Regional Bank Angst Returns

Regional Bank Angst Returns

- Treasury prices are higher this morning as fears once again erupt over the state of banks and their exposure to office building loans. New York Community Bank is the latest to draw fire, but with the well-documented travails of office building vacancies in the WFH era, short-sellers suspect there are many more potential problems (more on that below). Presently, the 10yr Treasury is yielding 4.08%, up 5/32nds in price while the 2yr Treasury is yielding 4.37% up 2/32nd in price.

- The slow data week continues with the headline today being the $42 billion 10yr Treasury auction this afternoon. This is the largest 10yr auction in history, so the odds of a tail are high. Also, 10yr notes have tailed in the last 11 auctions, so we’ll see if that string is broken today. The positive spin is that the Treasury has signaled auction sizes going forward will be stable which has limited the potential downside in pricing this week’s increased auction sizes. Results will be released just after 1pm ET so look for some volatility to follow.

- The newest battleground in the regional banking story is focused on New York Community Bank which suffered a 22% loss in its common stock yesterday hitting a fresh 27-year low. Moody’s downgraded the debt to junk status this morning so concerns naturally turn to liquidity and potential runs. The bank did announce the appointment of a new executive chairman who indicated that deposits had increased since year-end. That temporarily boosted the pre-open stock price but it’s moving lower once again in early trading. The troubles for NYCB appear to stem from troubled office loans and with the uncertain status of many other office building loans short-sellers are circling the sector once again looking for other potential problem banks.

- Meanwhile, the Fed chorus on holding and waiting for more confidence on inflation continued this morning. Minneapolis Fed President Neel Kashkari added his voice to that refrain in a CNBC interview. He did manage to mention that he sees two to three rate cuts this year but refused to offer up a starting date. We’re still on board for a May or June cut depending on how the data evolves over the next few months.

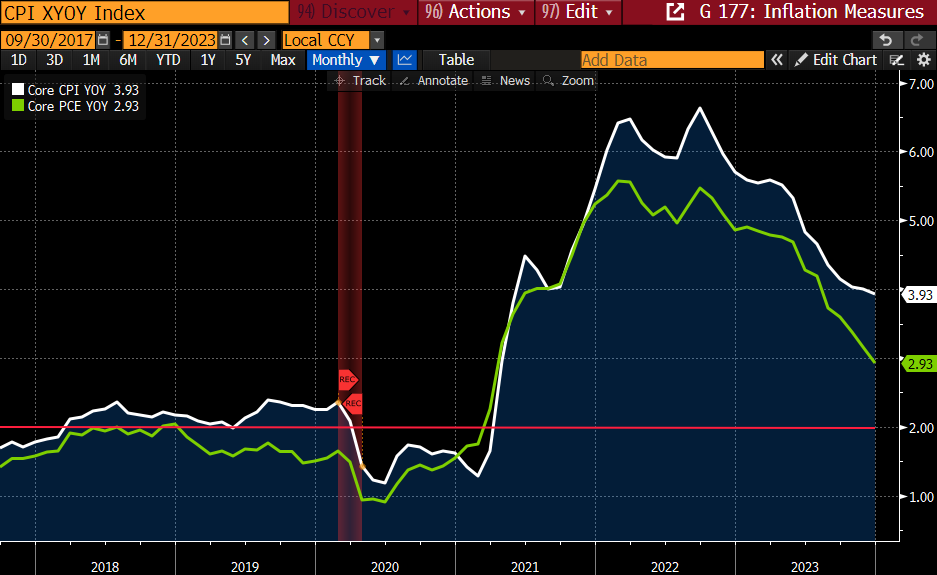

- Speaking of data, the next first-tier release will be January CPI due next Tuesday. Expectations are the headline number will dip from 0.3% MoM to 0.2% with the YoY rate falling to 2.9% vs. 3.4%. That would be the lowest YoY rate since March 2021. The core rate is expected to increase 0.3% MoM for the third straight month, while the YoY rate dips to 3.7% vs. 3.9% in December. That would be the lowest YoY rate since April 2021, but still a long way from the 2% target. Positive base effects for the next several months should put the YoY pace in decent shape for a May or June rate cut.

Core CPI and PCE – Fed Patiently Waiting on 2%

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.