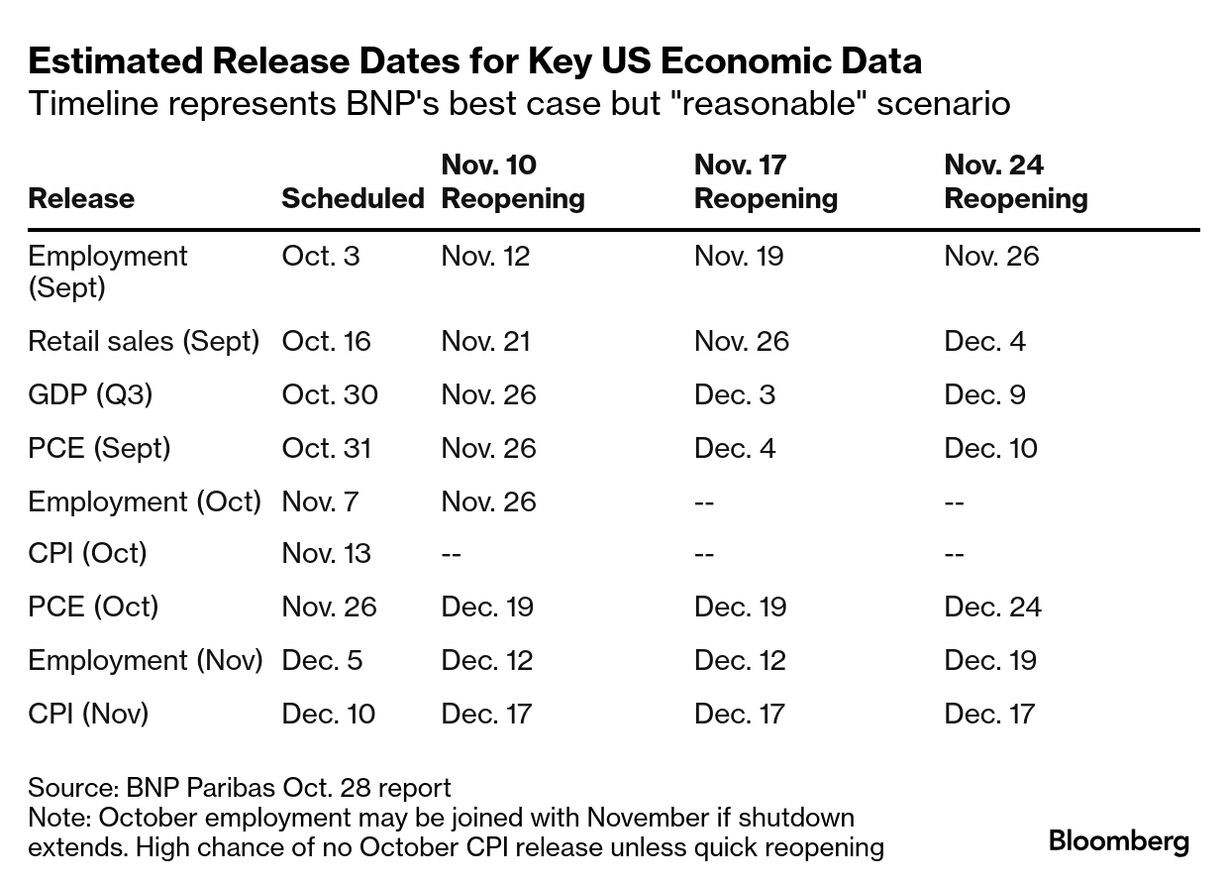

Receiving Delayed Reports Could be a Slow Process

- Restarting the government may happen very soon but receiving delayed reports could take some time. The table below offers possible report release dates given varying government reopening times. The House is expected to vote on the Senate bill today and presumably a passed bill to President Trump’s desk today or tomorrow. Given that legislative outlook it appears Nov. 17th is a possible restart date and that means a September jobs report on the 19th with the other delayed reports following. That quick turnaround on September jobs implies the data is mostly in hand. It’s October, when many workers were furloughed the entire month, that could be trouble. In any event, when you look at the likely release dates we’ll be dealing with delayed data well into December. The other big issue is whether the delayed reports will be as robust as we’re used to? Currently, the 10yr Treasury is yielding 4.08%, down 3bps on the day, while the 2yr note yields 3.56%, also down 3bps in early trading.

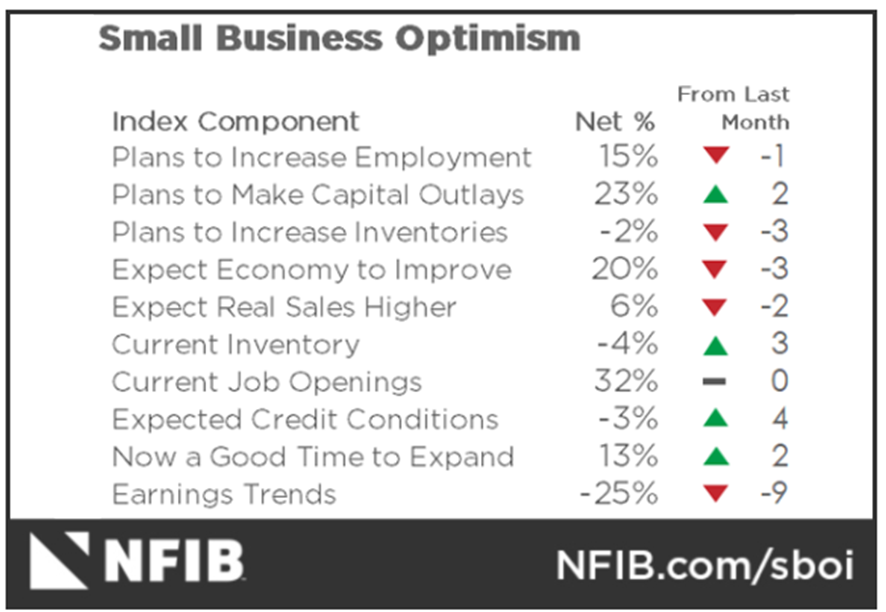

- Yesterday we received yet another private sentiment survey. This time it was the NFIB Small Business Optimism Index which declined 0.6 points in October to 98.2 but remained above its 52-year average of 98, so I guess that’s something. The percentage of owners expecting better business conditions fell 3 points from September to a net 20% (seasonally adjusted), the lowest level since April (see graph below).

- Other findings include 32% reported job openings they could not fill in October, unchanged for the second consecutive month. Before August, the last time unfilled job openings hit 32% was in December 2020. Of the 56% of owners hiring or trying to hire in October, 88% reported few or no qualified applicants for the positions they were trying to fill. A seasonally adjusted 15% of owners plan to create new jobs in the next three months, down 1 point from September. This marks the first decline since hiring plans started to increase in May 2025.

- In October, both actual and planned price increases fell from the previous month. The net percent of owners raising average selling prices fell 3 points from September to a net 21% (seasonally adjusted). Despite the decline, price increases remain above the monthly average of a net 13%, suggesting continued inflationary pressure. Looking forward, a net 30% (seasonally adjusted) plan to increase prices (down 1 point from September) over the next three months. 27% of small business owners reported labor quality as their single most important problem, up 9 points from September and ranking as the top problem. However, the percent of small business owners reporting labor costs as their single most important problem fell 3 points to 8%.

- Meanwhile, the Mortgage Bankers Association reported this morning that applications for the week ending Nov. 7th increased a slight 0.6% from the previous week, trimming the 1.9% pullback on the earlier period. The slight increase took place despite a 3bps uptick in mortgage rates. Applications for a purchase mortgage jumped 6%, their strongest showing since September. However, applications for a contract to refinance a mortgage, which are more sensitive to short-term changes in interest rates, fell by 3%.

- Later this afternoon, the Treasury will auction $ 42 billion in 10yr notes and $25 billion in 30yr bonds tomorrow. The Monday 3yr auction was well received, but the 10yr remains the true tell on investor sentiment so we’ll see how that goes with modest yields greeting duration buyers.

- As far as Fed speakers today it will be Fed Governor Waller at 10:30am ET and Governor Miran at 12:30pm ET. Both have been prolific on the speaking circuit so we’re not expecting much new from their recent advocacy for more rate cuts, Miran still with his outsized 50bp hopes. Waller speaks at another payments conference so it may not be focused on Fed policy while Miran is speaking at a fireside chat in London, so he’ll have a better chance to expand on his recent statements, although he’s made it clear he’s all in for rapid and large rate cuts.

Not Surprisingly Small Business Optimism Dips in October

Small Business Economic and Earnings Outlook take a Hit in October

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.