Quiet Data Week Puts Focus on Jackson Hole

- It’s a light week for data and that will put even more focus on the Jackson Hole central bank symposium convening later this week. Fed Chair Powell will deliver the keynote address on Friday, and the thinking is he’ll provide a bit more color regarding a possible rate cut at the September meeting, but probably not the clear message he left last year. Also, the Russia/Ukraine War will be centerstage today as Ukrainian President Zelensky and a gaggle of European leaders meet with President Trump. After Friday’s events in Alaska, it’s hard to envision a positive outcome for today’s meeting. Currently, the 10yr Treasury is yielding 4.29%, down 4bps on the day, while the 2yr note yields 3.75%, down 1bp in early trading.

- As mentioned above, this is an uninspiring week as far as data goes, so, we’ll be forced to read the tea leaves between now and Friday on whether Fed Chair Powell will signal a rate cut for the September FOMC meeting during his Friday address at Jackson Hole. Recall the disappointment after the July FOMC meeting when Powell was rather hawkish and didn’t hint at any cut for the September meeting, despite having two Fed governors’ dissent on the vote, a rare occurrence. That vote, however, came two days before the weak July jobs report which shifted odds back in the favor of rate cuts. That said, while we expect Powell to begin laying the groundwork for a September cut, we don’t expect the clarity that he offered last year at Jackson Hole when he teed-up cuts with this, “the upside risks to inflation have diminished and the downside risks to employment have increased…the time for policy to adjust has come.”

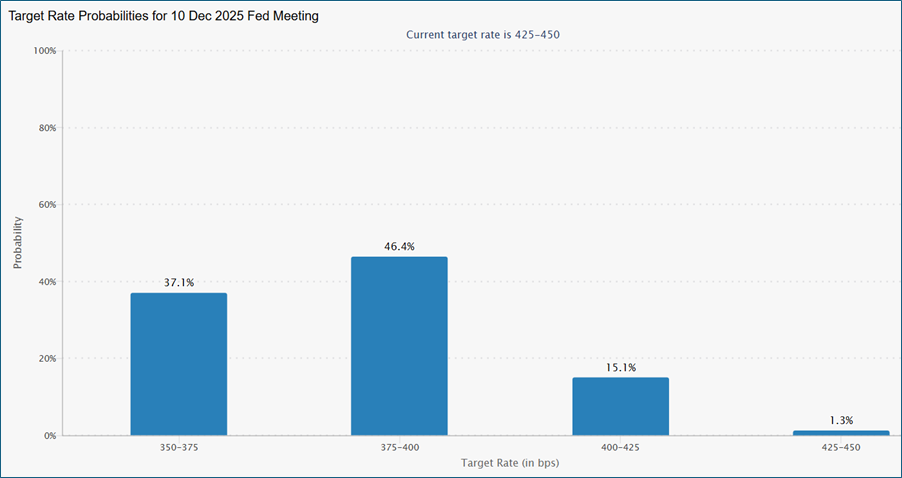

- Complicating such a clear message this time is the somewhat warm CPI report followed by a steamier PPI release which has reined in some of the more aggressive rate cutting expectations, which at one time were calling for a 50bps September cut and 75bps or more by year end. We are now back to expectations of a 25bps cut in September, with 50bps by year end with some still hopeful for more than that. We’ve been on board with 50bps in cuts this year and still think that’s what we’ll get when the year draws to a close.

- While we await news from Jackson Hole, we’ll have to be content with the likes of July housing starts and permits tomorrow, Fed minutes on Wednesday, initial jobless claims and the July Leading Index on Thursday, and existing home sales on Friday. Like I said, not a blockbuster week of data.

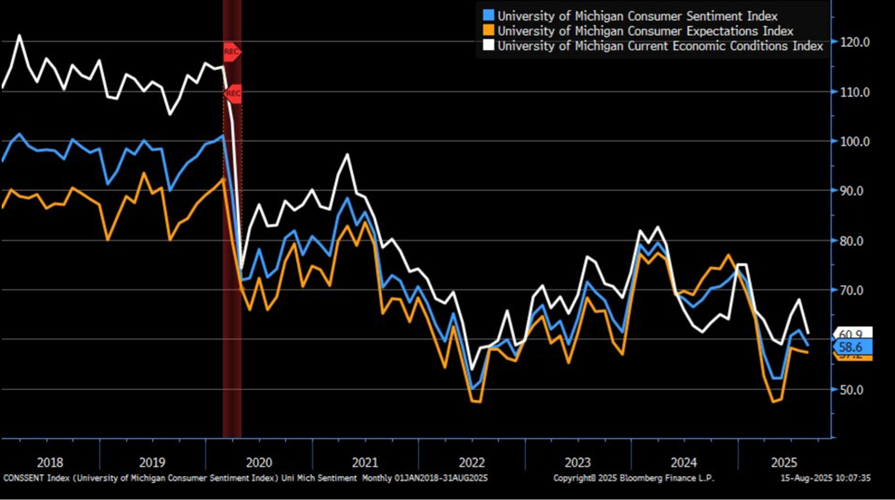

- In a late morning release on Friday, the preliminary August University of Michigan Sentiment Survey did surprise in its pessimism which contrasted with the solid retail sales numbers that were released just a couple hours earlier. That difference between soft survey data and better hard data once again reflects the murky waters investors and policymakers are swimming in at present. This is particularly so with issues pertaining to the consumer. We try to live by the motto “watch what the consumer does and not so much on what they say.”

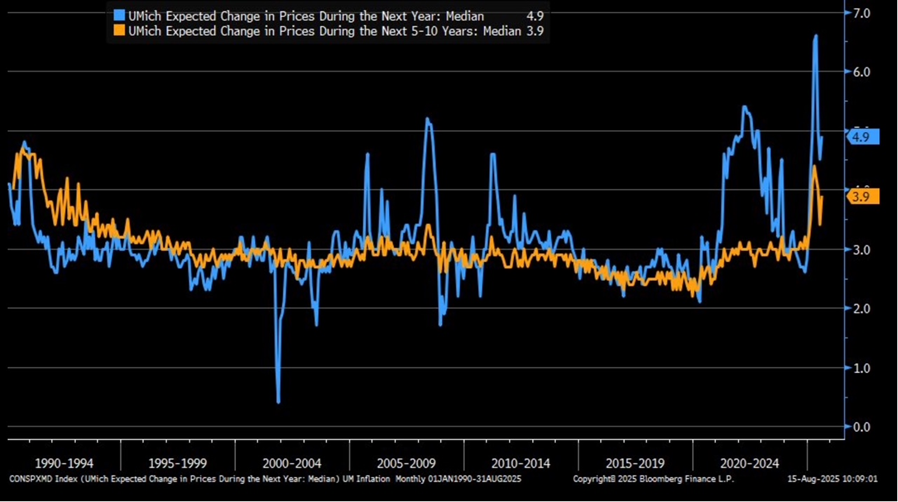

- In any event, the latest reading on consumer sentiment dipped from 61.7 to 58.6, well below the 62.0 expectation. Current Conditions took a steeper dive from 68.0 to 60.9, while Expectations slipped more mildly from 57.7 to 57.2. Most of the comments revolved around uncertainty about prices/tariffs and expectations for higher inflation as evidenced by the 1yr inflation outlook increasing from 4.5% to 4.9% and the 5-10yr expectation from 3.4% to 3.9%.

- While the increased pessimism is something of a concern, like we said, watch what they do more than what they say, and the consumer was quite active in July per the retail sales numbers. Although we will admit, the categories that did see declines, (electronics, restaurants and bars, building materials, and misc. retailers) gives hints of a more frugal consumer. That is, one more focus on essentials and less on discretionary purchases that characterized much of 2024. That is something we noted in May, less so in June, but it appears now to be a trend and not a one off. It’s not a severe shift at this point but it does imply the consumer will be more measured in their purchases than in 2024.

- The increase in inflation expectations, combined with the increased tariff fingerprints across the inflation reports last week, will provide plenty of fodder for inflation hawks on the FOMC. That’s not to say they won’t vote to cut 25bps, but I suspect there will be at least one dissent if not more and getting a second cut by year end remains a work-in-progress (see graph below).

Fed Funds Futures Leaning Towards 50bps in Cuts by Year End, but the 75bps Crowd is Still Hopeful

Source: CME Group

Univ. of Michigan Preliminary August Sentiment – Inflation Worries Send Sentiment Lower

Source: Bloomberg

Univ. of Michigan Preliminary August Inflation Expectations – Heading Higher Again

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.