Prepare for a Boatload of First-Tier Data and Events this Week

Prepare for a Boatload of First-Tier Data and Events this Week

- Treasury yields are lower again this morning, but with plenty of first-tier data on tap this week, not to mention several central bank meetings, including the FOMC on Wednesday, there will be plenty of catalysts to spur trading reactions, so strap in for a potentially volatile week. Cooler inflation readings and expectations of a gently softening labor market are prompting the early bullish bids at present. Currently, the 10yr note is yielding 4.16%, down 4bp on the day while the 2yr is yielding 4.38%, unchanged on the day.

- The summer doldrums collide this week with a boatload of first-tier data and other events that will keep investors and analysts busy handicapping everything from Fed rate cuts, future Treasury auction sizes, other central bank actions, and let us not forget a jobs report to end the week in grand fashion.

- Besides the Fed’s rate decision on Wednesday, the Bank of Japan could offer up a rate hike earlier that day in defense of the yen. The Fed’s rate decision will be followed on Thursday by the Bank of England. The betting there is for a first rate cut in their cycle, but it will be a close call. We’ve mentioned before the central banks that have already cut (Bank of Canada, ECB, the Swiss and Sweden central banks) and the BoE could add to that list this week.

- As for the Fed, despite pleadings from former NY Fed President Bill Dudley and former Fed member Alan Blinder to cut on Wednesday, Powell is not likely to oblige. The Fed speak hasn’t indicated any inclination to go that route so we suspect the meeting and press conference will offer a more optimistic tone for future rate cuts, with signals pointing to September. Recall, the Fed still has the August Jackson Hole central bank symposium to offer a grand stage to clearly pivot to an easing stance, if the July inflation report doesn’t rain on the potential pivoting parade.

- The Fed has had the confidence of a solid labor market to backstop their patient stance in getting to the 2% inflation target. While there has been a general slowing in labor market momentum, it hasn’t fallen out of bed yet. But the Sahm Recession Rule – 50bps higher in the unemployment rate on a three-month average over the 12-month low- is in danger of being met with a weak July jobs report. It’s currently at 43bps, but with expectations for an unchanged 4.1% unemployed rate for July perhaps this becomes an August story, but any miss with Friday’s report will dent the Fed’s confidence and add more evidence for a September rate cut that could exceed 25bps if the feeling of getting behind the labor market curve becomes evident.

- As for the July jobs report, expectations are for the headline to reflect 175 thousand new jobs vs. 206 thousand in June. Private payrolls are expected a little lower at 150 thousand vs. 136 thousand in the prior month. As mentioned, the unemployment rate is expected to be unchanged at 4.1% and average hourly earnings are expected to match June’s 0.3% increase. That would drop the YoY wage gains to 3.7% vs 3.9% in June and that would play well with the softening trend we’ve been seeing which would continue to ease concerns of a wage-push spiral in prices. All-in-all, a decent to solid jobs report is expected.

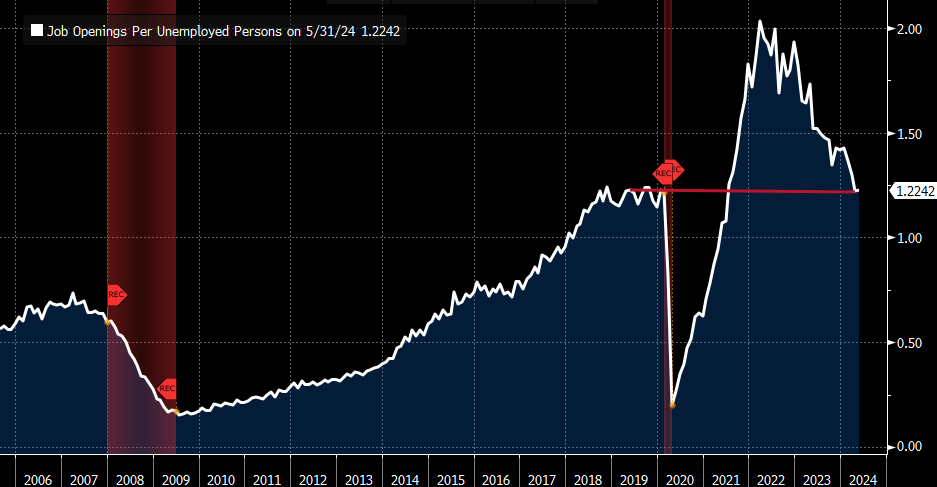

- Tomorrow brings the June Job Openings and Labor Turnover Survey (JOLTS) with another dip in job openings from 8.140 million to 8.055 million expected. The drop in job openings has been an ongoing trend since hitting a 2022 high of 12 million. The Fed has often mentioned this along with the number of unemployed to show how strong the labor market had been when openings were running at 2 for every unemployed person. Now that level has returned to a pre-pandemic levels of around 1.2 openings for each unemployed person indicating a more balanced supply/demand picture for the job market (see graph below). An as expected report will add impetus to get on with rate cuts in September.

Job Openings to Unemployed Persons back to Pre-Pandemic Levels – Labor Market in Better Balance

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.