PPI Yields Few Surprises

- Treasury yields are again trading around unchanged this morning as the PPI report for September came in without too much surprise and that leaves traders looking for a quiet day before a long three-day weekend. Currently, the 10yr Treasury is yielding 4.10%, up 1bp on the day, while the 2yr is yielding 3.97%, down 3bp on the day.

- PPI for September was released this morning and came in at or cooler than expectations on the monthly prints, but the YoY was a touch higher given those tough base effects from the second half of 2024. Final Demand PPI was unchanged vs. 0.1% expected and 0.2% in August. PPI ex-food and energy was up 0.2% matching expectations and down from 0.3% in August. The YoY rate rose from 2.4% to 2.8%, just above the 2.6% expectations. PPI ex-food, energy and trade rose 0.1% vs. 0.2% expected and 0.2% in August. The YoY rate was 3.2% vs. 3.3% the prior month.

- This data today, especially the cooler monthly prints, should lead to some friendly estimates for a core PCE print that we’ll see on October 31. It’s likely then that the decision to move or not in November will be made. We’re hesitant to put too much stock in the October jobs report as it’s likely to be rather noisy with all the issues surrounding the twin hurricanes and their related impact on jobs, etc..

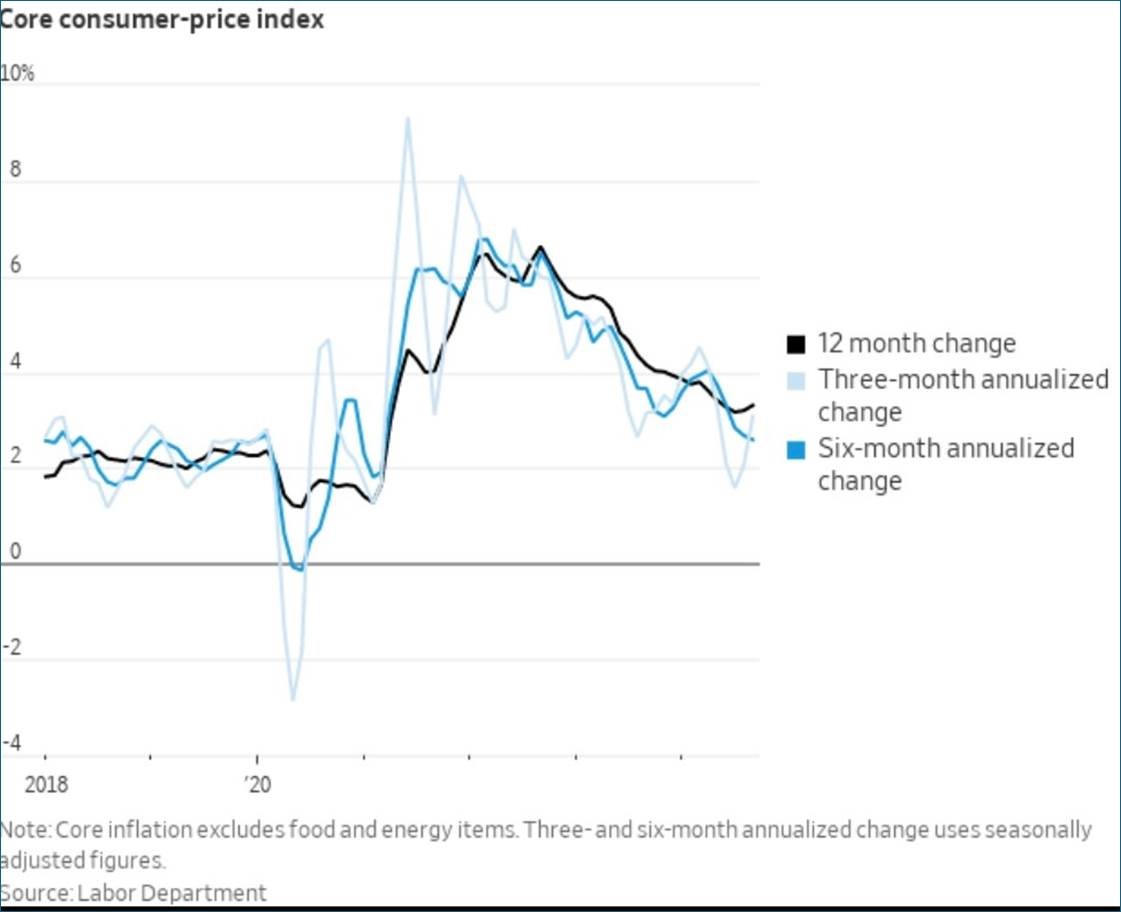

- Meanwhile, the CPI numbers yesterday were slightly hotter than expected with core CPI rate rising 0.3% (0.312% unrounded), so a solid print for sure. The interesting thing is we did see improvement in Owners Equivalent Rent (OER), which dipped from 0.5% to 0.3%, which is approaching the 0.2% to 0.3% range it was in prior to the pandemic. So, while we saw improvement in OER (the largest component of CPI), items like food and insurance surprised to the upside, offsetting some of the improvement in OER. The graph below shows how certain categories increased (or decreased for the month).

- On the Fed speak front, most of the commentators were willing to look past a single CPI report, but the headlines were garnered by Atlanta Fed President Raphael Bostic who said that he would be willing to look skip November depending on the data between now and the meeting. He’s been more of a moderate so it’s not that surprising that he would talk about a skipped meeting.

- Yesterday, Initial Jobless Claims rose by 33k to 258k. This was well above the 230k consensus and the highest since August 2023. The surge was partially attributable to sharp increases in the states impacted by Hurricane Helene, labor strikes, and industry layoffs. The surge in jobless claims didn’t occur during NFP survey week, but we’re likely to see another spike next week as Hurricane Milton makes his impact known. So, expect some noisy employment-related metrics in the wake of these storms.

The Spike Arrives in Jobless Claims as Storm Effects are Felt

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.