Powell Not Keen on a July Cut

- Treasuries open the trading day mixed as the geo-political temperature continues to ratchet down and that has a quiet, slightly risk-on morning developing. President Trump is in Europe meeting with NATO allies and what could have been a contentious gathering appears to be a much more congenial affair. Meanwhile, Fed Chair Powell will be back on Capitol Hill, this time testifying to the Senate Banking Committee. He pushed back on a July cut yesterday in his House testimony and we expect the same today. Currently, the 10yr Treasury is yielding 4.32%, up 2bps on the day, while the 2yr is yielding 3.80%, also up 2bps.

- Fed Chair Powell ventured to the House side of Capitol Hill yesterday and testified to the House Financial Services Committee that while other members may be looking at July as a possible cut date, he wasn’t in that group. The money quote from the two-hour hearing was probably this, “we should start to see [tariff inflation] over the summer, in the June number and the July number… if we don’t, we are perfectly open to the idea that the pass-through [to consumers] will be less than we think, and if we do that will matter for policy. He added, “I don’t think we need to be in any rush because the economy is still strong.”

- He also pushed back on the notion advanced by several committee members that higher rates were contributing to a housing shortage. He admitted that housing shortages exist but would not concede that the fed funds rate was the driving factor to the supply issue. He maintained that there are many factors affecting demand and supply in housing, but he did admit that the interest rate sensitive sector hasn’t been helped by monetary policy, but it’s “the one tool we have to address macroeconomic imbalances.”

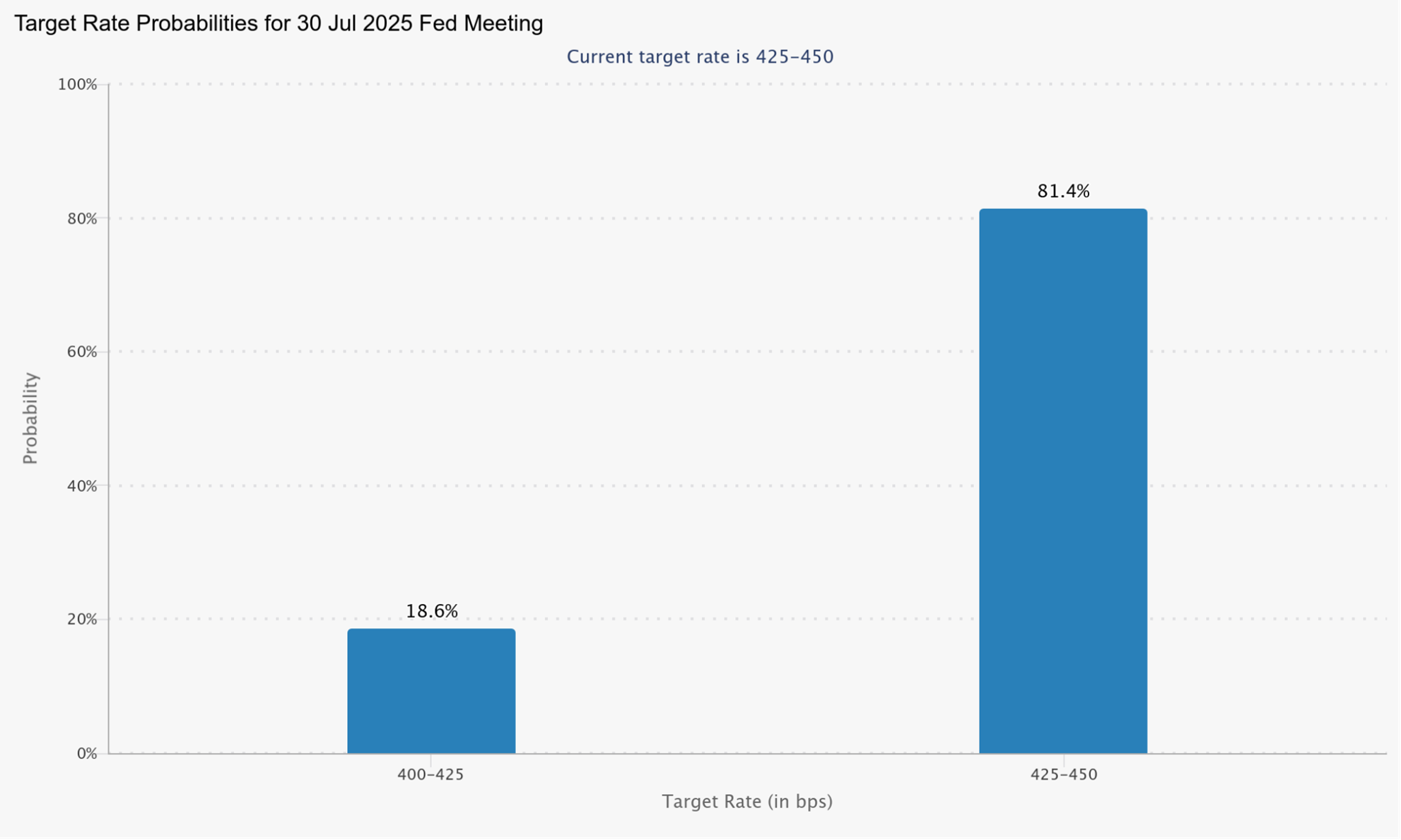

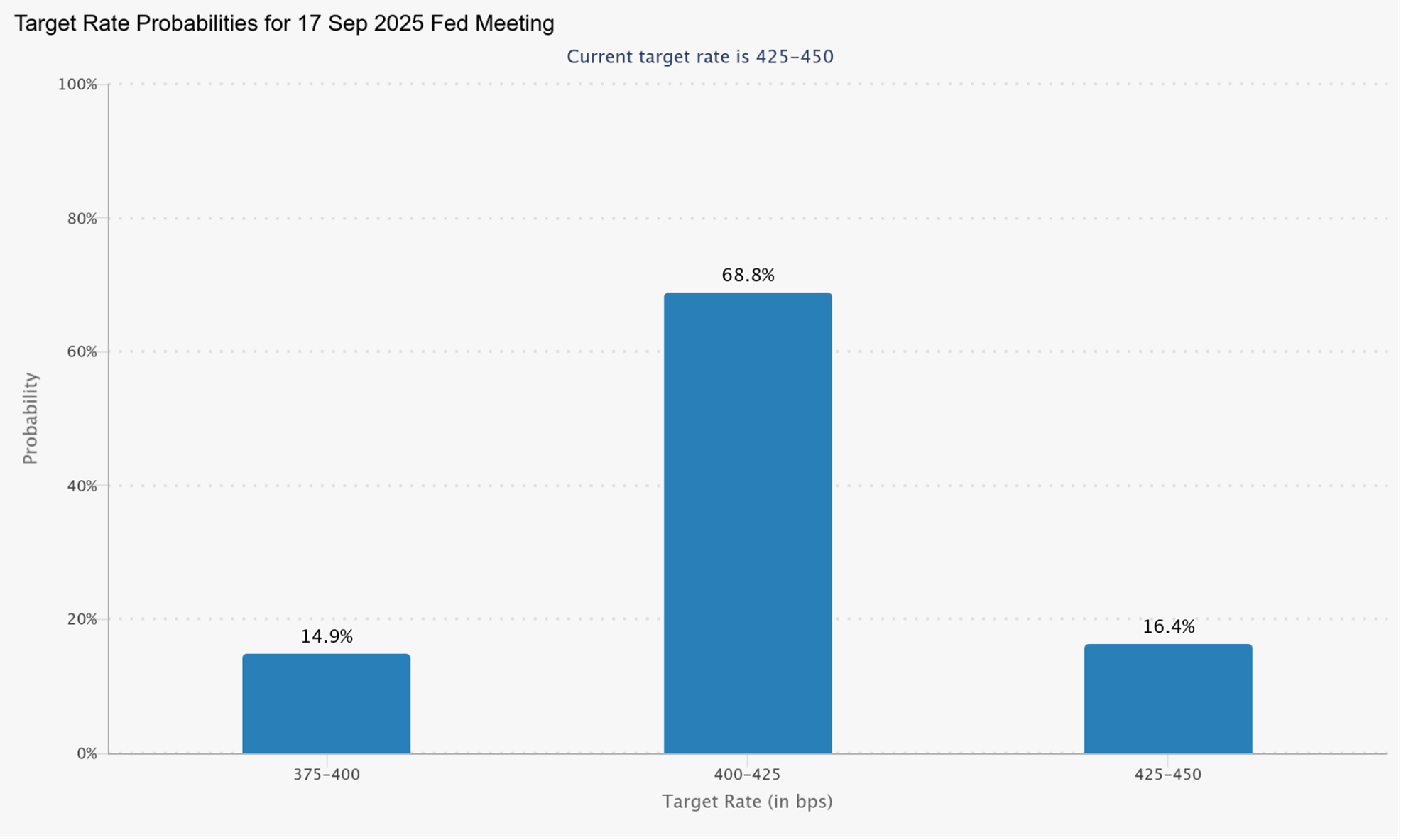

- In summary, odds for a September rate cut advanced, but remained at pre-testimony levels for July (see graphs below). He’ll reprise his opening statement this morning in front of the Senate Banking Committee where he may face more forceful pushback from senators echoing President Trump’s desire for rate cuts now. I suspect he’ll easily deflect such attempts. It’s September guys, at the earliest. See you then.

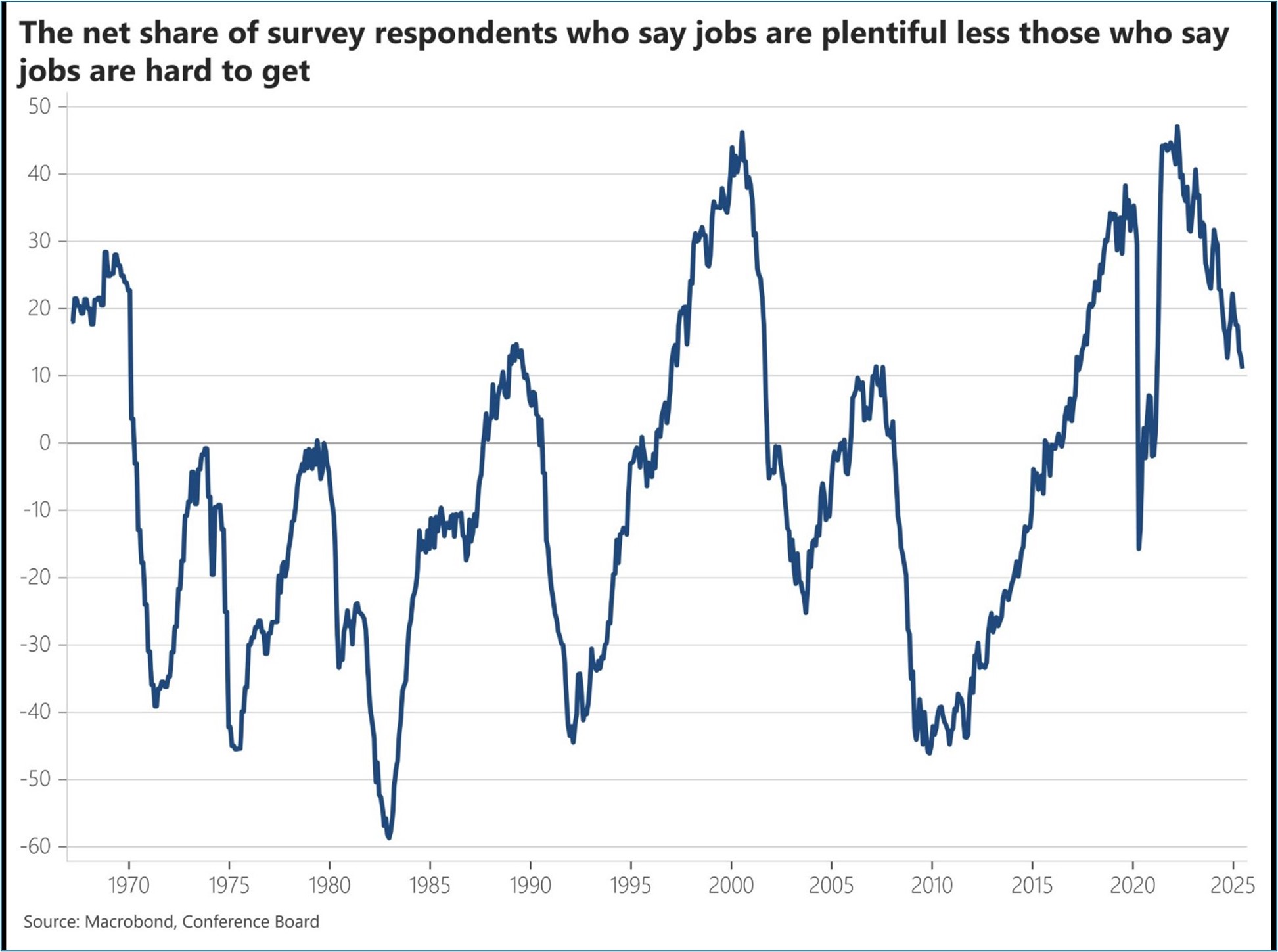

- Meanwhile, the Conference Board’s latest Consumer Confidence Reading for June deteriorated by 5.4 points to 93.0 (1985=100) from 98.4 in May. Expectations were for improvement to 99.5. The Present Situation Index—based on consumers’ assessment of current business and labor market conditions—fell 6.4 points to 129.1. The Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions—fell 4.6 points to 69.0, substantially below the threshold of 80 that typically signals a recession ahead.

- Consumers views of current job availability (jobs plentiful minus jobs hard to get) weakened for the sixth consecutive month but remained in positive territory, which speaks to the weakening in labor market momentum from robust levels a year or more ago to more pedestrian pace today. With fast-moving news from Washington, it’s hard to tell how much of this survey (cut off was June 18th) is already stale but expectations were for continued improvement in sentiment and that did not happen as consumers continue to voice concerns about tariffs and the impact to future prices.

- Fed speak was in full force yesterday with several other officials joining. Here’s a sampling:

- NY Fed President John Williams (voter), “Maintaining this modestly restrictive stance of monetary policy is entirely appropriate to achieve our maximum employment and price stability goals. We need to be vigilant in analyzing the totality of the data to see how conditions evolve.”

- Cleveland Fed President Beth Hammack (non-voter) said, “It may well be the case that policy remains on hold for quite some time before the committee initiates very modest cuts to return policy to a neutral setting.”

- Minneapolis Fed President Neel Kashkari (non-voter) said, “The last two or three months the inflation data we’ve been getting has been quite positive, it suggests that the disinflationary path I described has been on track” … “But it isn’t obvious that we’ve seen the full effects of the tariffs yet, so we’ve been taking our time to try to get a sense of what’s really going on before we made any dramatic changes in our policy outlook.”

- Atlanta Fed President Raphael Bostic (non-voter) remained in cautious mode saying, “I would see the last quarter of the year is sort of when I would expect we would know enough to move.”

- Today, it’s only Powell on Capitol Hill so less Fed speak to keep track of.

- After an uneventful 2-year auction, the Treasury will be back selling $70 billion in 5-year notes this afternoon. Sponsorship for 5-year notes has been solid recently, with six of the last seven auctions stopping through (an indication of solid demand). However, we suspect a concession will be forthcoming. First, the 5-year sector has been a strong performer and with When Issued 5-year rates already trading below 3.90%, the auction should post the lowest yield since September 2024.

- One recent talking point was refuted with Tuesday afternoon’s release of investor class allotment data for the early-June 3-, 10-, and 30-year auctions. The allotment showed broad-based investor demand for US debt with no evidence of flagging foreign sponsorship for Treasuries. Overseas investors were awarded a typical 13.6% of the 10-year reopening on June 11th, consistent with the 13.2% norm. Foreign buyers took 11.4% of the 30-year reopening on June 12th, in line with the 11.1% norm. And lastly, overseas investors took 10.9% of the 3-year auction on June 10th, their largest share since February.

- Despite lingering fears of global hesitancy to underwrite the immovable US deficit, Treasury auctions remain well-sponsored both domestically and internationally since Liberation Day. In fact, foreign investors have shown a tendency to pay-up at auctions. This news should allay concerns that future Treasury auctions, particularly longer duration bonds, may require increasingly higher yields to entice buyers. To date, that doesn’t seem to be the case.

Fed Funds Futures for July – A Cut Remains a Long Shot After Powell Testimony

Source: CME

But Odds for a September Cut Hit a New High After Powell Testimony

Meanwhile, the Conference Board’s June Consumer Confidence Unexpectedly Dips

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.