Powell Likely to Signal Rate Cuts to Begin in September

Powell Likely to Signal Rate Cuts to Begin in September

- We’ve arrived at Friday with investors waiting on Powell’s Jackson Hole address at 10am ET. Not much else is on the docket today, so the stage is cleared for Powell and his comments (more on that below). Currently, the 10yr note is yielding 3.85%, down 1bp on the day while the 2yr is yielding 4.00%, also down 1bp on the day.

- Fed Chairman Powell delivers the keynote address at Jackson Hole this morning at 10am ET and he is expected to signal more clearly than ever that the September 18th FOMC will kick off the rate-cutting cycle. The question is will it be 25 or 50bps and will it be an every-meeting pace or every quarter? While we don’t expect that much transparency from Powell, especially with August jobs and inflation reports in the offing prior to the September FOMC meeting, investors will be hanging on every word for clues.

- The futures market has 100bps of cuts priced in by year-end, which is well above the Fed’s June forecast of just one 25bps cut. It does seem the market is leading the Fed towards a more rapid pace of cuts and/or larger cuts than 25bps. We believe the Fed would rather stick to 25bps cuts and go every meeting rather than dial in larger rate cuts per quarter. In any event, we’re not likely to get that clarity today, but Powell’s comments will dominate the trading action today.

- The BLS revised down estimated job growth in 2023 by 818 thousand from March 2023 to March 2024. Estimates had ranged from 300 thousand to over a million, so the actual revision was on the high side, and the highest in nearly 15 years. In the scope of a 150 million worker economy it’s not significant, but when 2023 monthly payroll gains initially averaged 225 thousand the revision cut that to 157 thousand.

- So, less robust job gains than initially believed which aligns more with the Household Survey which consistently reported less job growth than the Establishment Survey last year. The rumor is the birth/death model of business formation was consistently overestimating new business formation; perhaps, another weakness in trying to model in a post-pandemic economy. In any event, at nearly 150 thousand new jobs per month it does explain some of the unemployment increase as immigration surges add to the labor force, but with employment slowing it adds to the ranks of the unemployed.

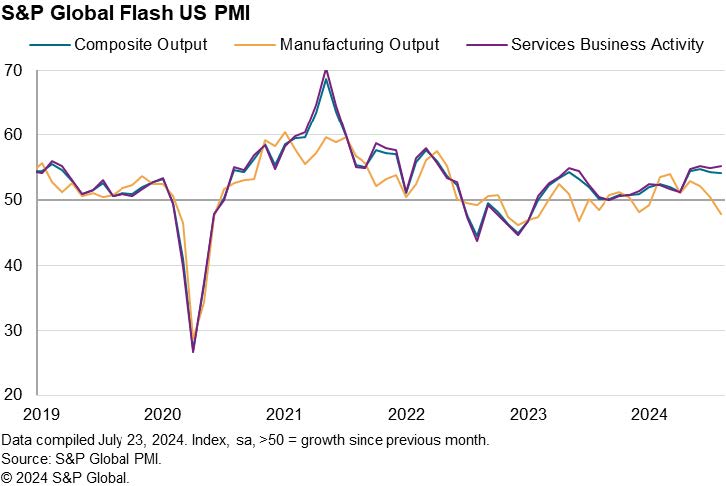

- US business activity remained solid in August, albeit more on the services-side, according to flash PMI survey data from S&P Global. Growth disparities widened further, however, with the service sector expanding at a solid rate while manufacturing output declined at the fastest rate in 14 months. Manufacturing dipped from 49.6 to 48.0, an eight-month low while the services sector increased from 55.0 to 55.2. Another indication that the service sector remains the primary engine of growth in the current economy.

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.