Powell’s Comments and Retail Sales Boost Treasury Yields

- Treasury yields are higher this morning as a hawkishly-received speech from Chair Powell yesterday mixes with decent retail sales numbers and hotter-than-expected import/export prices. It all has the market rethinking a December rate cut, although we still think it happens. Currently, the 10yr Treasury is yielding 4.48%, up 6bps on the day, while the 2yr is yielding 4.36%, up 6bps on the day.

- Chair Powell spoke yesterday and in Q&A session mentioned that “the economy is not sending any signals that we need to be in a hurry to lower rates. The strength we are currently seeing in the economy gives us the ability to approach our decisions carefully.” That wasn’t really a new take, but the market reacted negatively.

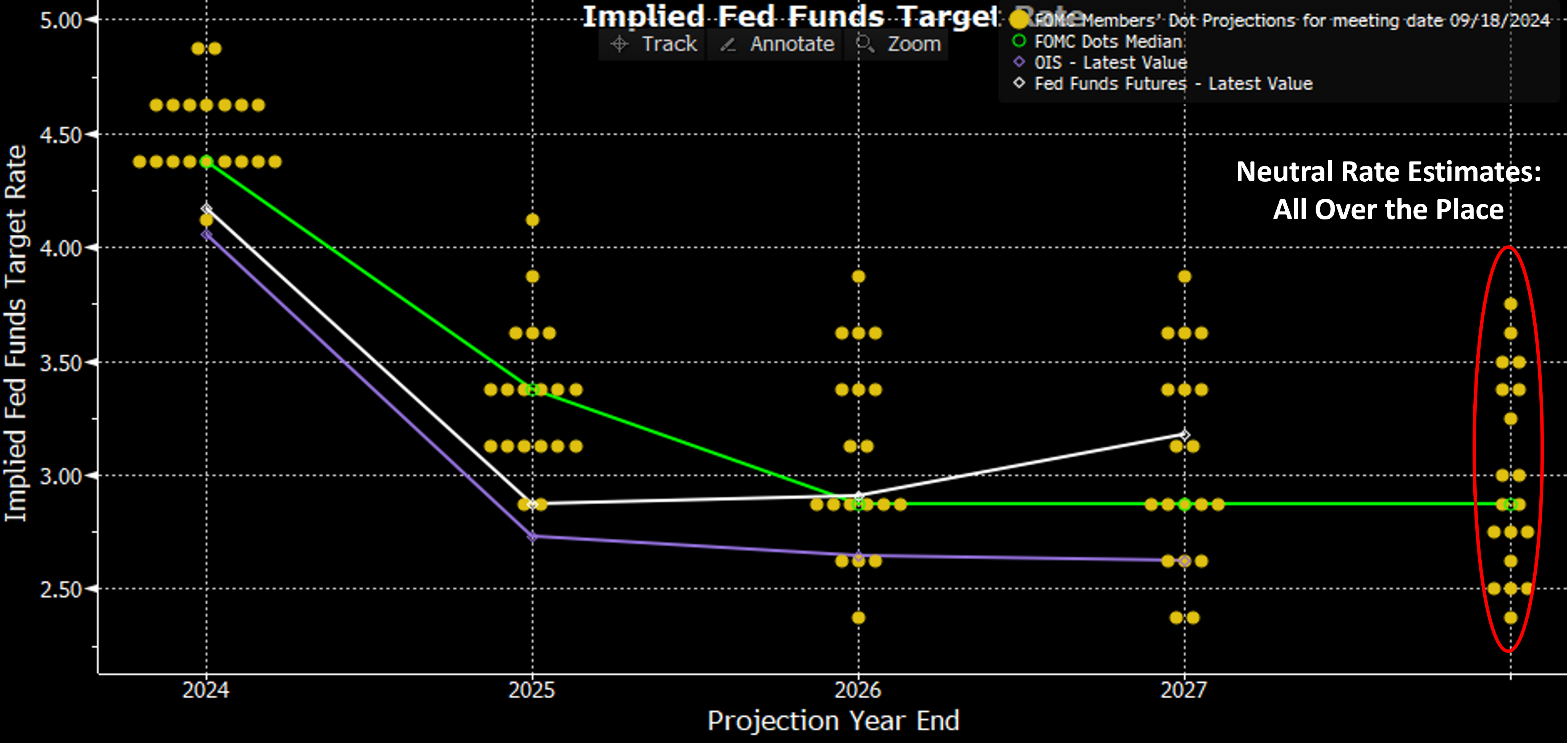

- Obviously, a disappointing October jobs report weighs on their minds as Powell said the two mandates are roughly in balance, but he mentioned too the noise from the report given the hurricanes and strikes is another reason to go slow. We still see a 25bps cut in December given the 4.50% – 4.75% funds range is well above even the highest estimate of neutral (3.75%) in the latest dot plot (see below). So, take the cut in December and pause in January while awaiting the new Administration and what those early days may bring as to actual policies vs. campaign pledges.

- Advance Retail Sales for October came in stronger than anticipated on the back of auto sales while sales ex-autos were slightly disappointing. Offsetting some of that disappointment, September’s numbers were revised significantly higher. That will probably boost third quarter GDP in the second estimate, but the October results put the start of the fourth quarter on the softer side. Overall sales rose 0.4% vs. 0.3% expected and the upwardly revised 0.8% in September (originally reported at 0.4%). The strength vanished ex-auto and ex-auto and gas with both up just 0.1% vs. 0.3% expected. The so-called Control Group fell -0.1% vs. 0.3% expected and well short of the upwardly revised 1.2% in September (originally reported at 0.7%).

- Digging through the 13 categories, eight saw monthly gains indicating it was moderately broad-based, but almost all categories were short of the gains seen in September. Recall, there was no doubt heavier buying in September in preparation for the hurricanes which helped to goose that month’s numbers, so perhaps some spending being pulled from October into September. And my usual caveat, this series is more goods-based with a smattering of service spending included. The more comprehensive personal spending numbers for October that comes along with the PCE inflation series will provide a more fulsome tell on consumer spending. That report is due on Black Friday.

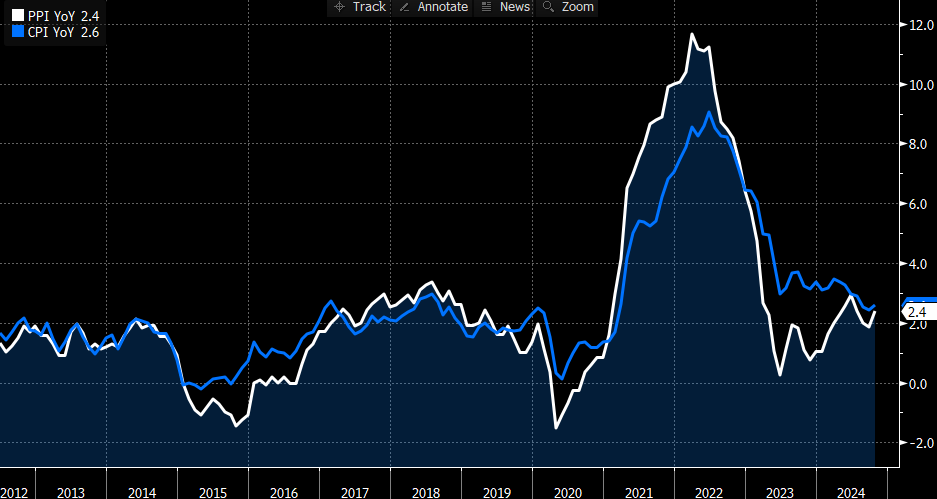

- Yesterday’s PPI report for October was a bit perplexing. The monthly prints came in under expectations while the YoY totals ran a tenth hotter than expected. Probably those rounding issues again. In any event, the important take away is that the deflationary run in wholesale prices that we saw in 2022 and into 2023 that provided a tailwind to lower CPI prints is over. That will add another challenge in seeing improvement in CPI (see graphed comparison below).

- Also, this morning we received the October Import/Export Price Indices with both sides running hotter-than-expected. With CPI and PPI in hand, the early estimate had core PCE for October in the “high” 0.2% to “low” 0.3% range. The addition of the import/export prices to the calculus is likely to shift it closer to the 0.3% range, unfortunately.

Neutral Rate Estimates – All Over the Place

PPI’s Deflationary Run in 2022 and 2023 is Over – Spells Another Challenge for CPI to Improve

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.