Powell Admits the Obvious

Powell Admits the Obvious

- Treasury yields are finally retreating a bit, perhaps taking a breather from the recent run higher. It could also be that with Fed Chair Powell admitting the obvious, that inflation trends haven’t been what they were hoping for this year, traders are taking some profits with that admission and awaiting the next bit of inflation data, which won’t come until April 26th and the March PCE numbers. Currently, the 10yr is yielding 4.62%, up 12/32nds in price, while the 2yr is yielding 4.95%, up 2/32nds in price.

- Fed Chair Powell, in an afternoon address yesterday, admitted what the market and most observers have been observing this year and that is that the increased confidence in returning inflation to the 2% target that the Fed was hoping to achieve has not happened so far in 2024. The essence of his message was that higher-for-longer is gong to be just that, higher-for-longer.

- Not that the Fed Chair needs to take direction from a regional Fed president, it does seem Powell is coming to embrace the view offered for a few weeks now by Atlanta Fed President Raphael Bostic that he’s on board with one cut this year and that occurring late in the year. We suspect we’ll begin to hear that view repeated by most Fed officials. In that regard, the Fed speak today will be sparse, with it occurring after the close when Cleveland Fed President Mester speaks, and Fed Governor Bowman participates in a “chat” later in the evening. There will be a few more speakers this week then the Fed will go dark before the May 1st FOMC meeting.

- The market has gotten the Fed’s message loud and clear and continues to price rate cuts down in number and further out in time. The latest bet is that a full rate cut is not priced in until the November 7th meeting (one day after the election). Looker further afield, futures now see the funds rate at 4.50% at year-end 2025. That implies just three cuts between now and then. That’s certainly a sea change from the more optimistic rate-cutting scenarios from just a few months ago, and it adds credence to the moves we’ve seen in Treasuries, especially on the short-end.

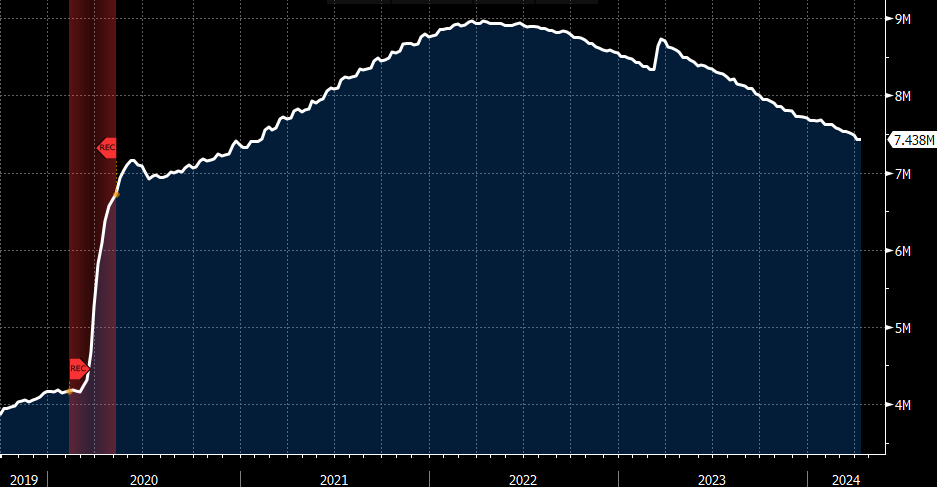

- While the May 1st FOMC meeting won’t provide a refreshed dot plot or economic forecast (those will come at the June meeting), it’s likely the meeting will provide us with details on tapering the QT program. One of the Fed’s reserve facilities (Reverse Repurchase Program) has traded down to $327.1 billion, from much loftier amounts and the lowest balance in nearly three years, so it does seem appropriate that the May meeting will lay out a slower pace of balance sheet reduction in order to maintain an “ample reserve regime.” That’s Fed speak for keeping adequate liquidity available to avoid market volatility. It’s anticipated that the current $60 billion per month in Treasury run-off will be slowed to $30 billion with MBS run-off remaining at the previous $35 billion level (if achieved as prepayments obviously are slow).

- Finally, this afternoon brings us the Fed’s Beige Book. It will be part of the information package officials take into the May FOMC meeting, so it will be interesting to see how the on-the-ground anecdotes fit with the impressive performance of the consumer so far in 2024, and whether any cracks are appearing. We haven’t seen any.

Fed’s Balance Sheet: From $9 Trillion to $7.4 Trillion – Expect Some Tapering Soon

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.