Powell Addresses Jackson Hole with a Fed Feeling Under Siege

- Fed Chair Powell will deliver the keynote address at Jackson Hole this morning, and while the market wishes for clarity akin to the mountain water surrounding the venue, we’re not likely to get that sparkling insight on future policy (more on that below). In fact, a good bit of the speech is likely to revisit the framework principles that were unveiled in 2020 when inflation struggled for a decade to get to 2.0%, and one of the principles unveiled at that time involved the concept of inflation averaging. Remember that? Well, we’re most definitely not in that world anymore so that work will be revised, and while important it’s not necessarily what the market wants most to hear today. That is, when will we get rate cuts and how many? That specificity is likely to be missing today. Prior to the proceedings in Jackson Hole, the 10yr note is yielding 4.32%, down 1bp on the day, while the 2yr yields 3.80%, unchanged in early trading.

- Fed Chair Powell’s keynote address at Jackson Hole is later this morning but we’re of a mind that he will leave markets disappointed that he didn’t offer a clearer view on future rate policy. This is something we expected. While the July jobs report was certainly weak, the Fed rarely acts off one report. Critics could say yes but there are other labor-related reports showing slowing momentum. We believe those second-tier and soft survey reports will leave the Fed wanting more before committing to a wholesale shift to rate-cutting.

- The near-term inflation trend is still uncertain and the uptick in core services inflation in recent months must be unsettling to Powell and others on the FOMC. It’s not hard to see why committing to a series of rate cuts now is a bridge too far given the uncertain inflation outlook and continued resilience of the economy. In addition, the recent expansion of the 50% steel and aluminum tariff to more than 400 additional product categories vastly increase the reach and impact of this tariff.

- Speaking of resilience, S&P Global reported yesterday that US business activity in August grew at the fastest rate recorded so far this year, according to early ‘flash’ PMI data, adding to signs of a strong third quarter. Growth was seen across both manufacturing and service sectors of the economy. Hiring also picked up. Job creation reached one of the highest rates seen over the past three years as companies reported the largest build-up in uncompleted work since May 2022.

- The headline S&P Global US PMI Composite Output Index rose to an eight-month high in August, edging up from 55.1 in July to 55.4, according to the ‘flash’ reading (based on about 85% of usual survey responses). Output has now grown continually for 31 months, with the latest two months seeing the strongest back-to-back expansions since the spring of 2022. A sustained robust expansion was reported in the services economy, albeit with business activity growth dipping slightly from July’s year-to-date high. Sales growth in the sector nevertheless gathered pace to register the steepest improvement in demand for services since last December, assisted by a modest return to growth of services exports. Companies reported improved confidence from customers and new product offerings.

- Not surprisingly, tariffs were reported as the key driver of further cost increases in August. Companies across both manufacturing and service sectors collectively reported the steepest rise in input prices since May and the second-largest increase since January 2023. Rates of increase accelerated in both sectors. While the manufacturing cost rise was especially large, being the second steepest since August 2022, the service sector increase was the second highest since June 2023. Average prices charged for goods and services rose at the sharpest rate since August 2022 as firms passed higher costs on to customers. Although goods price inflation cooled slightly for a second month in a row, it remained among the highest seen over the past three years. Service sector price inflation meanwhile was the sharpest since August 2022.

- Employment rose for a sixth successive month, with the pace of job creation hitting the highest since January (and one of the strongest rates seen for over three years). Service providers took on staff at the fastest pace for seven months while factory job gains reached the highest since March 2022

- Business confidence in the outlook meanwhile improved but remained much weaker than seen at the start of the year as companies reported ongoing concerns over the impact of government policies, especially in relation to tariffs. Tariffs were again widely cited as the principal cause of sharply higher costs, which in turn fed through to the steepest rise in average selling prices recorded over the past three years.

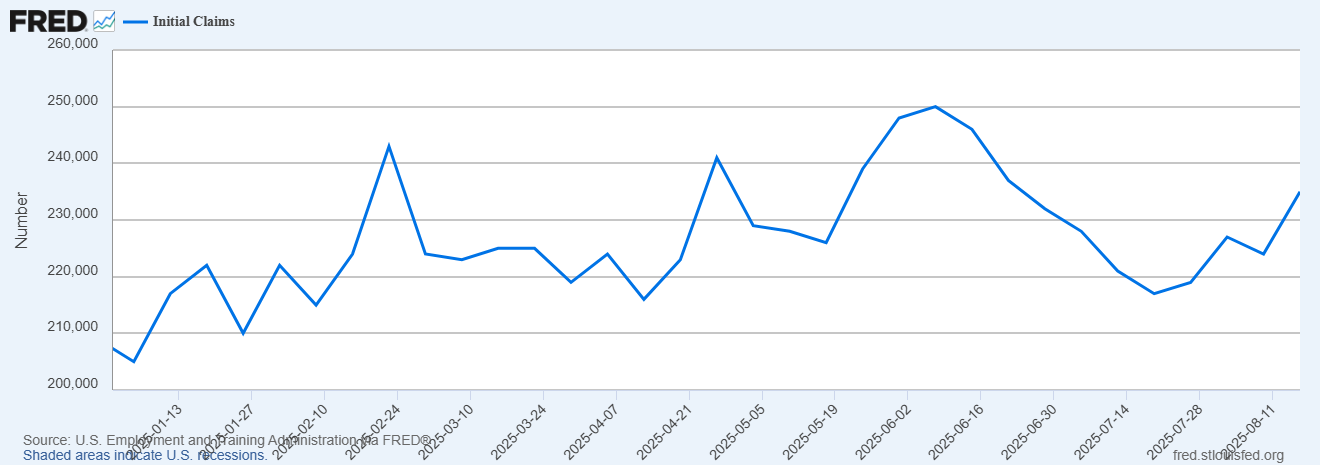

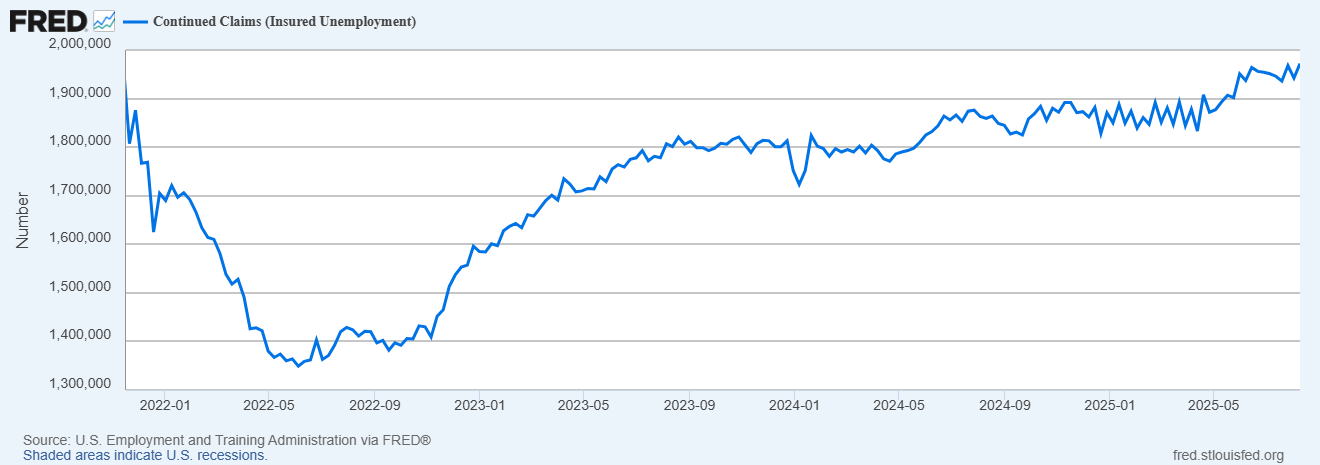

- Finally, the latest iteration of weekly jobless claims data has kept to the 2025 script with little change in new claims while continuing claims continue to edge higher, reflecting the low-fire, low-hire mood of businesses. In the week ending August 16, initial claims were 235,000, an increase of 11,000 from the previous week’s unrevised level of 224,000. The 4-week moving average was 226,250, an increase of 4,500 from the previous week’s unrevised average of 221,750. Meanwhile, continuing claims for the week ending August 9 were 1,972,000, an increase of 30,000 from the previous week’s revised level. This is the highest level for insured unemployment since November 6, 2021, when it was 2,041,000. The previous week’s level was revised down by 11,000 from 1,953,000 to 1,942,000.

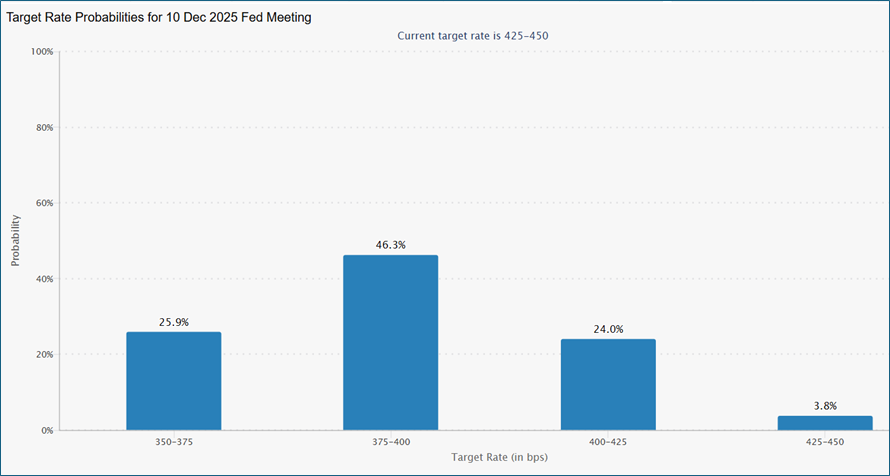

Futures Leaning More Towards 50bps in Cuts by Year End as More Fed Members Voice Inflation Worries

Source: CME Group

Initial Jobless Claims Under 240,000 Since June Indicating the Low-Fire Environment Continues

Source: Bloomberg

Who Will Give the Jackson Hole Address Next Year?

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.