Plenty of First-String Economic Releases Due This Week

- Treasury yields are higher this morning as the light volume rally from Friday is partially reversed as more traders return to their posts. Plenty of first-tier data is on tap this week and Fed speak gets started with Fed Governor Waller and NY Fed President Williams both on tap later this afternoon. They are some of the more consequential Fed members so any thoughts on the December meeting will be closely watched. Currently, the 10yr Treasury is yielding 4.23%, up 6bps on the day, while the 2yr is yielding 4.23%, up 7bps from Friday’s close.

- After a holiday-shortened week that had most economic releases shoehorned into Wednesday, while Thanksgiving distractions abounded, the new month brings the usual first week of heavy hitters headlined by the November jobs report on Friday. Before then, however, plenty of other first-tier data will distract us from the political headlines that have driven trading since the November 5th elections. A return to more typical data reviews will be a welcome reprieve from the feeble attempts at political analysis, if only for this week!

- First up will be today’s November ISM Manufacturing Index which is expected to remain in contractionary territory but with slight improvement from 46.5 to 47.5. Given the concern over sticky inflation, the prices paid component will get its share of attention too with expectations at 55.2 vs, 54.8, so a slight uptick expected there. The New Orders index (48.0 expected v 47.1 prior month) and Employment index (47.0 expected v 44.4 prior month) will influence trading as well.

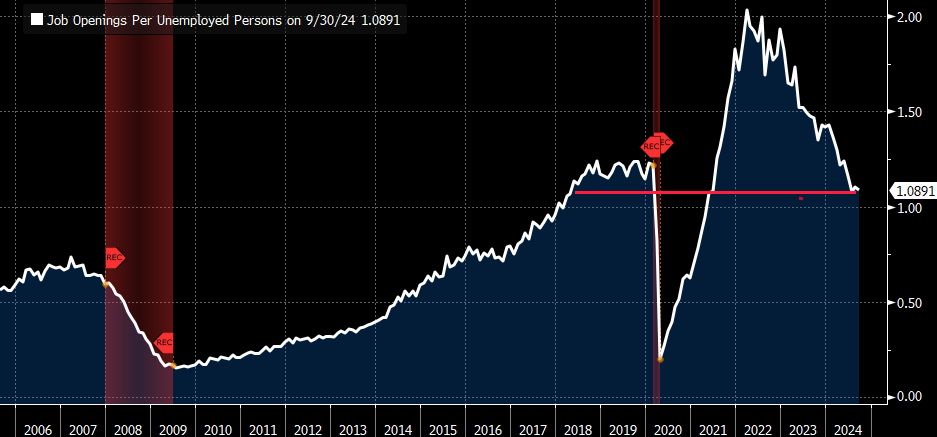

- Tomorrow brings the October Job Openings and Labor Turnover Survey (JOLTS) with openings expected to be slightly higher at 7.495 million v. 7.443 million the prior month. Openings seem to be stabilizing around this level which is about where they resided pre-pandemic. The Quits Rate (% of all workers voluntarily leaving a position) sank to 1.9% in September which is below the 2.3% pre-pandemic rate. That seems to indicate more hesitancy on the part of workers to leave a position in search of greener pastures. That aligns with the slow increase in Continuing Claims which is another indication that hiring seems to be slowing, or at least getting more selective. This is a report that the Fed references quite a bit, so it does have market moving potential.

- The ADP Employment Change report arrives on Wednesday, for what it’s worth, with 158 thousand new private sector jobs expected vs. 233 thousand in October. Keep in mind the BLS found a loss of 28 thousand private sector jobs, so treat the ADP report with caution when trying to glean an early edge for Friday’s numbers.

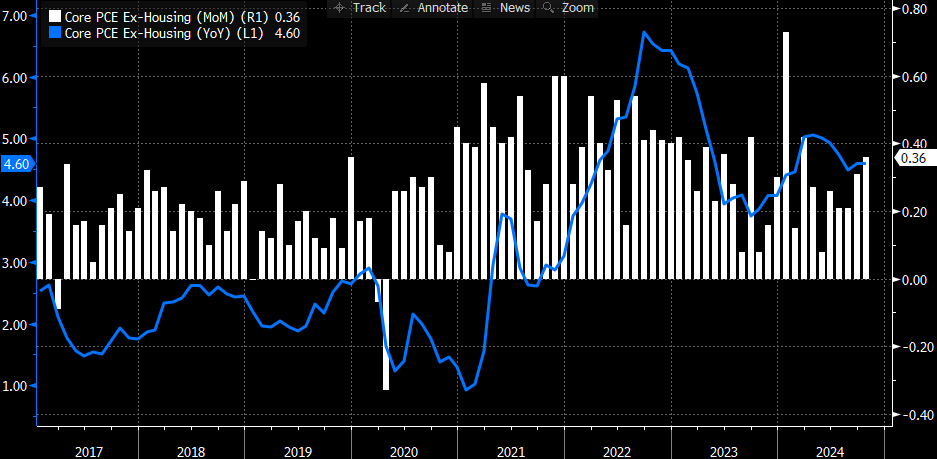

- On Thursday, the consequential ISM Services Index for November will be released. As we’ve noted for a while, the services-side has carried the economic ball with effectiveness and that is expected to continue with the Bloomberg consensus forecast at 55.6 vs. 56.0 the prior month and remaining well above the 50 dividing-line of expansion vs. contraction. Just as in the manufacturing index, the prices paid, employment and new orders metrics will be important in assessing inflationary pressures, future activity, and the jobs outlook in the services economy.

- The Initial and Continuing Claims reports arrive on Thursday and nothing is expected to move too much. Initial Claims are expected to be relatively unchanged at 215 thousand new claims vs. 213 thousand the prior week, while Continuing Claims are expected to tick immaterially lower to 1.904 million vs. 1.907 million. So, a fairly status quo week is expected: no uptick in layoffs and continuing claims reflecting a challenging rehiring environment.

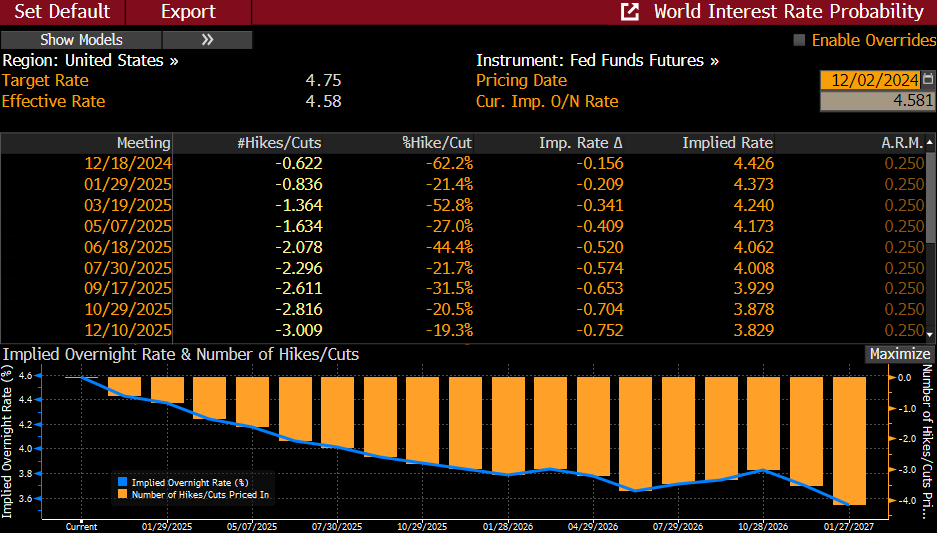

- Finally, Friday brings the November BLS Change in Nonfarm Payrolls report with a bounce to 200 thousand new jobs expected vs. 12 thousand jobs in October. The unemployment rate is expected to be unchanged at 4.1%. Hourly earnings are expected to slip from 0.4% MoM to 0.3% with the yearly rate dipping to 3.9% v. 4.0%. Speaking of the Fed and the report, it would take a large upsize surprise to materially reduce odds of a rate cut at the December meeting, and with the echo effect of the hurricanes it may be more prudent to look more at the rolling average of the last three months rather than the month-to-month swings brought on by the storm and the after-storm bounce.

Odds for a December Rate Cut at 62%, but only Three Cuts Total by Dec. 2025 Source: Bloomberg

Source: Bloomberg

Job Openings to Unemployed Persons Dipped Below Pre-Pandemic Levels Indicating Labor Market Equilibrium Source: Bloomberg

Source: Bloomberg

Sticky Services-Side Inflation Not Improving – Argues for a Pause in Rate Cuts AFTER December Source: Bloomberg

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.