Plenty of Fed Speak This Week After Soft Jobs Report

Plenty of Fed Speak This Week After Soft Jobs Report

- The return of geopolitical risk is adding to the rally in Treasuries that started after Friday’s softer employment report and that has yields dipping farther in response. Israel has told civilians to leave the Rafah area of Gaza as an attack in the area seems likely. Long-end Treasury supply this week may keep rallies somewhat in check, but for now it’s green on the screen. Currently, the 10yr note is yielding 4.50%, down 1bp on the day, and the 2yr is yielding 4.81%, also down 1bp on the day.

- This week is devoid of first-tier economic releases so markets will trade on the after-effects of the softish jobs report and the dovish-lite FOMC meeting/press conference. When Powell said any rate hikes are “unlikely” that view was further buttressed by Friday’s payroll numbers, especially the dip in average hourly earnings to less than 4% YoY. That has contributed to the dip in yields.

- From the Fed’s perspective the jobs report was almost Goldilocks-like with job gains that may have missed expectations but still represent solid gains, especially when viewed from a pre-pandemic world. The softer JOLTs reading and the ISMs coming in soft also lend some credence to a bit of labor market easing, but nothing yet to indicate that financial conditions are too tight, and/or material labor market weakness, and that means a period of waiting and watching.

- Fed speak will fill some of the void created by the lack of economic releases as I count a total of 12 speakers sprinkled across the week, but Powell is not one of them. At least a few of the dozen speakers will surely offer their opinions on the latest jobs report and what that means for policy. I expect we’ll hear that the modest softening is what they are wanting but will be alert for any additional weakness developing.

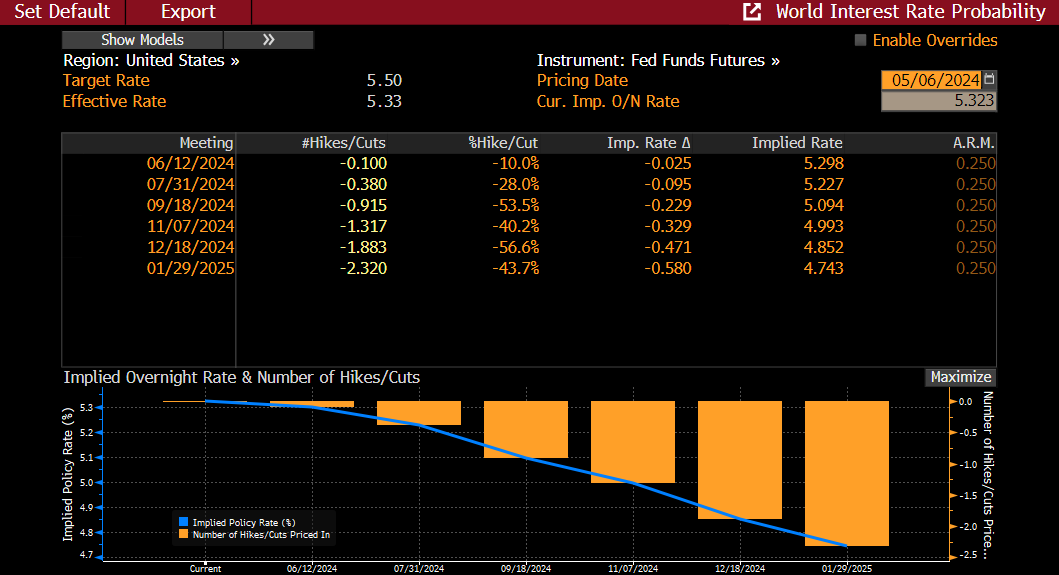

- For now, while the jobs report may have quashed any thoughts of rate hikes, it’s still premature to think it moves rate cuts back into active consideration. The April CPI Report due on May 15 will be a key consideration for the Fed’s June meeting. Any thoughts of cuts moving forward from the current fourth quarter expectation would require a read that returns to the pre-2024 hotter-than-expected trend. In that regard, core CPI is expected to increase 0.3% vs. 0.4% in March bringing the YoY pace to 3.7% vs. 3.8%. If that comes to pass, it won’t be enough to shift the higher-for-longer mantra in any great degree. For now, the market is still pricing in a rate cut at the November meeting with increasing odds that it’s followed by a second cut in December, that’s been the biggest change in odds since the FOMC meeting and jobs report. (see table below).

- As mentioned above, the Treasury will be selling $42 billion in 10yr notes this week along with $25 billion in 30yr bonds. The recent dip in yields adds an interesting element to the auctions as investors recall higher yields just a week ago. We suspect that keeps any rallies this week limited until the supply is put away. The good news is the auction sizes are in line with recent supply and the Treasury anticipates future auction sized will remain fixed for a few more quarters. Also aiding the supply cause, recall the Fed cut the QT tapering from $60 billion per month to $25 billion beginning next month. That will have the Fed as a bigger buyer in future months, and let’s not forget Treasury commencing it’s $10 billion/month buyback program which will also help to put supply away.

- One data point we will get today is the Senior Loan Officers Opinion Survey with expectation that lending standards are starting to loosen again as banks seek to add to loan portfolios after a year of building liquidity in the wake of Silicon Valley Bank, etc.. The report will be released at 2pm ET.

- Housekeeping Note: We’ll be traveling and speaking on Wednesday in Kentucky so the next Market Update will be on Friday. See you then.

Fed Funds Futures Increase Odds of November Cut After Jobs Report and Add to Odds of a December Cut

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.