PCE Inflation So-So, While Personal Spending Slows in May

- Investors are wading through the latest personal income, spending, and inflation numbers for May with the market mostly near levels prior to the release. The inflation numbers, particularly core, were a touch hotter-than-expected while the softer spending numbers evidenced payback for earlier tariff front-running. Incomes fell as a one-time Social Security Fairness Act payment in April boosted incomes. Wage and salary income rose 0.4% for the second straight month, so away from government transfer payments consumers continue to enjoy decent wage/salary gains. Currently, the 10yr is yielding 4.27%, up 2bps on the day, while the 2yr is yielding 3.75%, up 3bps in early trading.

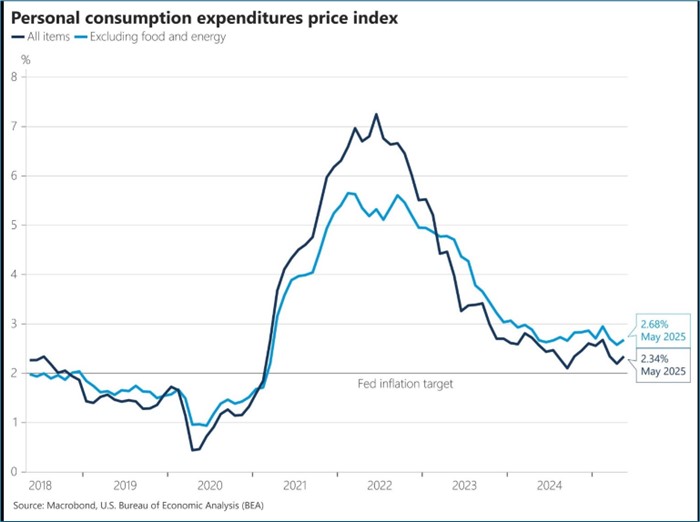

- The last of the May inflation numbers are out and they are the Fed’s preferred measure. May PCE was up 0.1% (0.14% unrounded) vs. 0.1% expected and 0.1% in April. Despite the cool monthly inflation print the YoY rate rose to 2.3% (2.34% unrounded) vs. 2.1%, matching expectations with the uptick due to an unchanged reading rolling off from last year. Meanwhile, core PCE (ex-food and energy) rose 0.2% (0.18% unrounded), a tenth hotter than expected, and April’s level. The YoY rate rose to 2.7% (2.68% unrounded) from an upwardly revised 2.6% in April. Goods contributed 0.1% to the increase in prices while services rose 0.2% vs. 0.1% in April. While this completes the inflation readings for May, the uptick in core PCE will quash any remaining thoughts of a July cut with the Fed’s expectation that tariff costs will flow more forcefully into higher goods prices in the months to come.

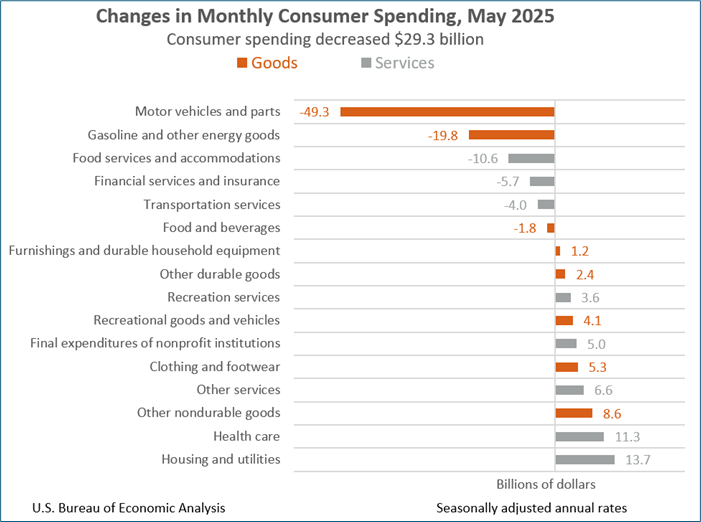

- Given the downshift in consumer consumption picked up in the third and final first quarter GDP estimate (more on that below), personal spending for May was nearly as eagerly awaited as the inflation numbers and they disappointed with personal spending decreasing -0.1% in May, down from April’s modest 0.2% gain. Real spending (net of inflation) was down -0.3%, well off the unchanged expectation and worse than the 0.1% increase in April. The impact of front-running purchases is evident as spending on goods was down -0.8% compared to up 1.1% in March. Service spending, however, was in line with recent trends with a 0.1% gain in May.

- The central question will be whether these lower levels of spending compared to last year mark a change in trend, or the more benign interpretation that it’s merely tariff-influenced changes in the timing of said spending. We’ve been reluctant to predict the demise of the American consumer, and the payback from front-loading is evident in this month’s spending. The concern we have is whether the so-called revenge spending over the last couple years will still be with us this year. The summer travel season is now firmly upon us, so it’s put up or shut up time for the America consumer.

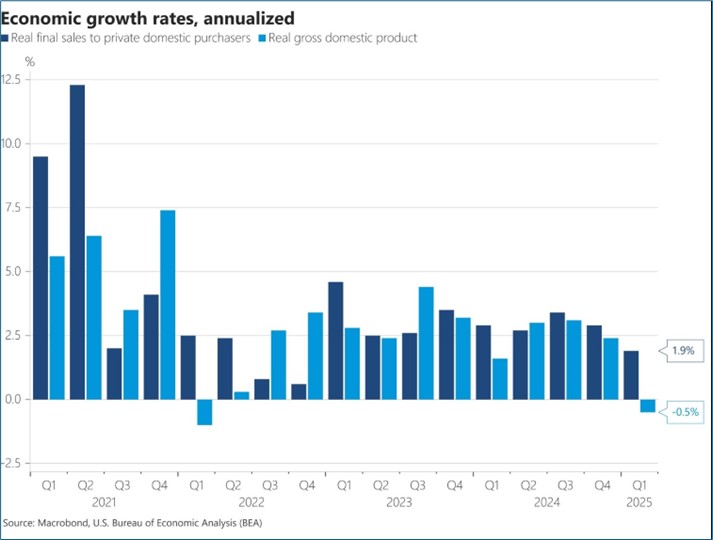

- The third of three estimates of first quarter GDP was released yesterday, and GDP worsened from -0.2% in the second estimate to -0.5%, as a drop in consumer consumption heightened the attention heading into today’s May spending update. Personal consumption, which is 2/3rds of GDP, dipped from 1.2% in the second estimate to 0.5%, the lowest spending growth since 2022. Recall that fourth quarter personal consumption was a solid 4.0% and 2.8% for all of 2024, so the first quarter slowdown heightens concerns over whether this is the beginning of the consumer taking a big step back from last year, or just a pause that refreshes. The summer will be the tell.

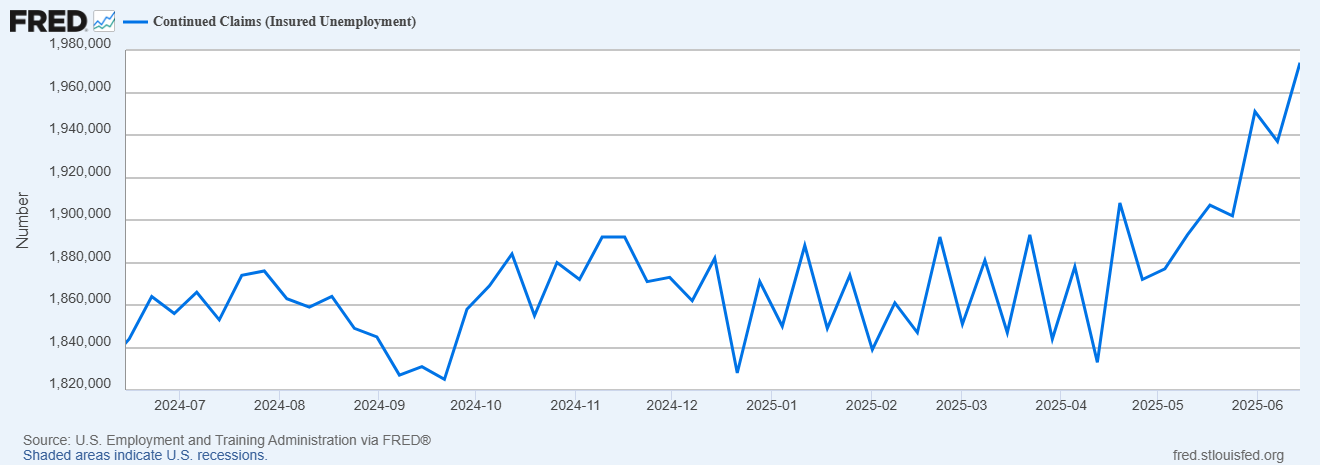

- Initial Jobless Claims for the week ending June 21 were 236,000, a decrease of 10,000 from the previous week’s revised 246,000. Continuing Claims for the week ending June 14 were 1,974,000, an increase of 37,000 from the previous week’s level and the highest since November 6, 2021. This continues the slow uptick in continuing claims as workers are increasingly finding it difficult to secure new employment. So, while employers remain reluctant to lay off trained and experienced workers, they are definitely cutting back on new hiring. It should be noted as well that this release of the continuing claims figure coincides with the survey week for June’s upcoming nonfarm payrolls which will be released next Thursday due to the July 4th holiday on the traditional Friday release date.

- While trade and tariffs are top of mind these days we received the latest numbers on the goods trade deficit for May. The deficit increased from -$87.0 billion in April to -$96.6 billion last month larger than the expected -$88.4 billion. With the 90-day deferral of higher tariff rates set to expire in July we may see another surge in imports in June as tariff front running returns. Thus, it looks like we’re in store for these self-induced crosscurrents to continue through the summer months, keeping the economic picture difficult to discern accurately.

Fed’s Preferred Inflation Gauge Ticks Unexpectedly Higher in May

Pretty Obvious Where the Reduced Spending in May Came From

Continuing Unemployment Claims Increases to Highest Since Nov. 2021

Real Final Sales to Private Domestic Purchasers in 1Q25 – Lowest Since 4Q22

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.