PCE Inflation and Personal Consumption Cool in April

- Markets are wading through the latest personal income, spending, and inflation numbers for April with most at or near expectations. The inflation and spending numbers were cool, as expected, but a pop in personal incomes (0.8% vs. 0.3% expected) provided a brief uptick in yields. On closer inspection the income gain was due to a one-time Social Security Fairness Act payment, but excluding that incomes rose 0.5% for the third straight month. That income gain over spending will provide some dry powder for the consumer at some point in the near future. Currently, the 10yr is yielding 4.42%, unchanged on the day, while the 2yr is yielding 3.94%, also unchanged in early trading.

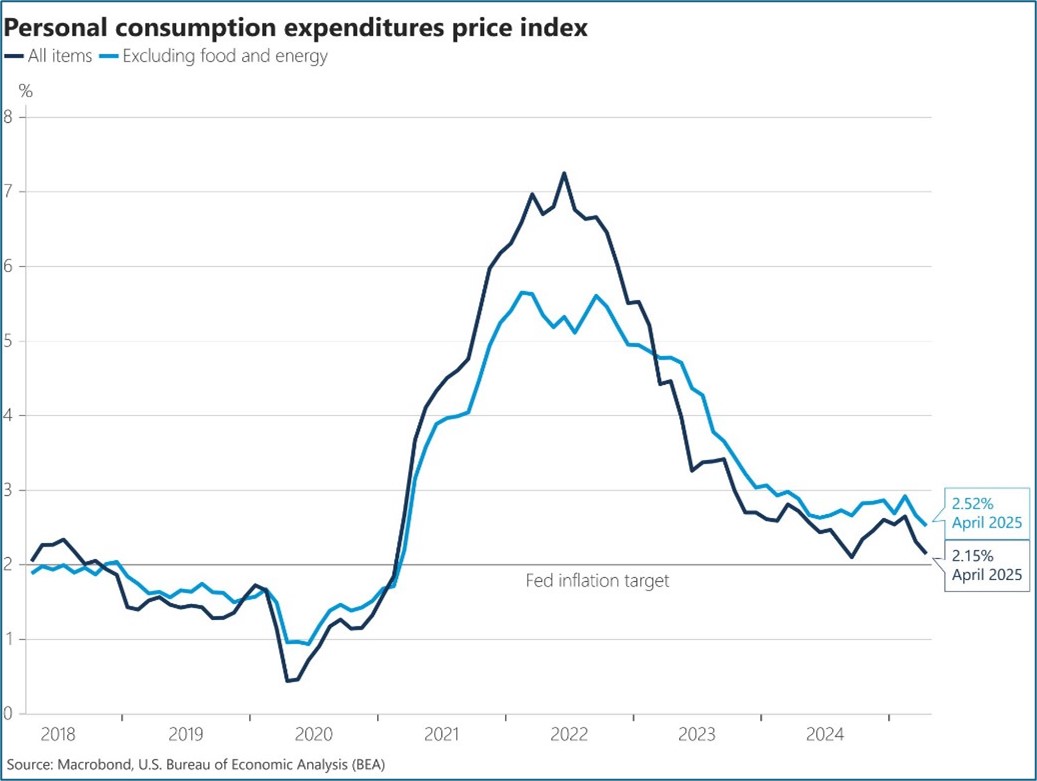

- The last of the April inflation numbers are out and they are the Fed’s preferred measure. April PCE was up 0.1% (0.10% unrounded) vs. 0.1% expected and an unchanged reading in March. That dropped the YoY rate two-tenths to 2.1% vs. 2.2% expected and 2.3% the prior month. Meanwhile, core PCE (ex-food and energy) was also up 0.1% (0.12% unrounded) for the month, matching expectations, and March’s revised level. That dropped the YoY rate to 2.5% from 2.6% in March. That’s the lowest YoY rate since February 2021 when the inflation surge was beginning. While this completes the uniformly cool inflation readings for April the Fed and investors expect a tariff-inspired uptick, so don’t contemplate any change in near-term monetary policy which the futures market still sees September as the earliest chance for a rate cut.

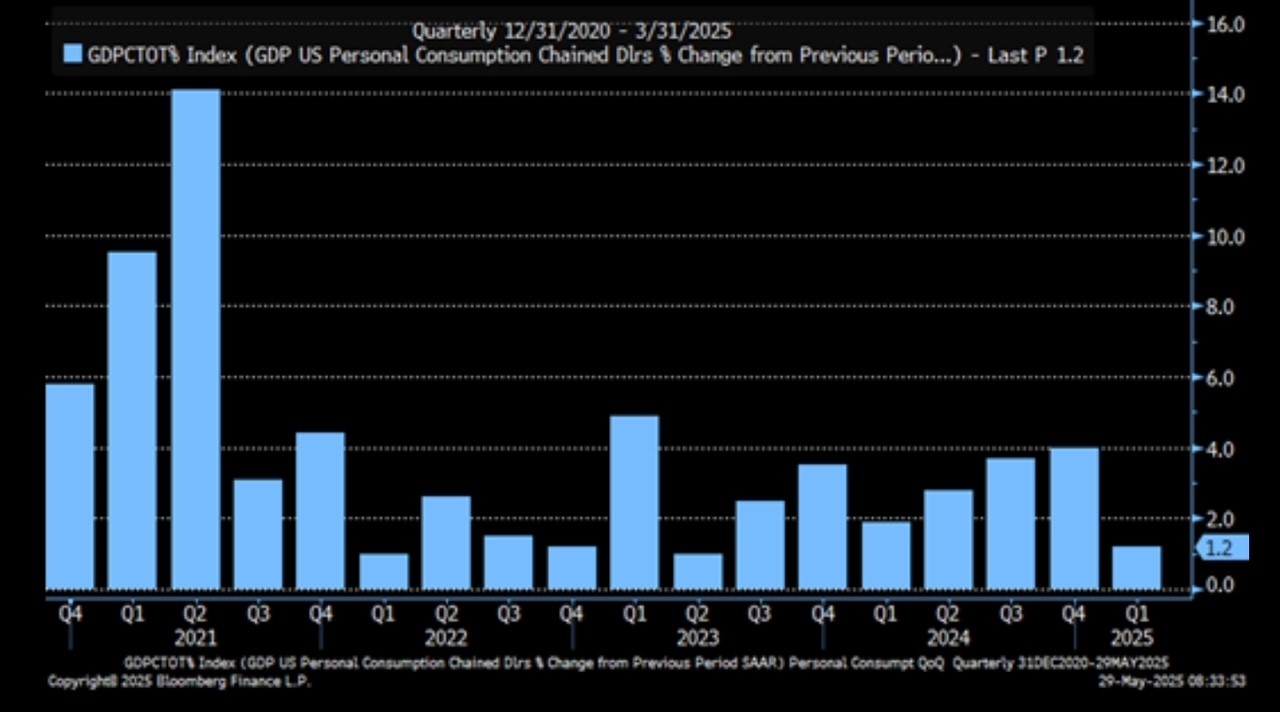

- Given the downshift in consumer consumption picked up in the latest first quarter GDP estimate (more on that below), personal spending for April was as eagerly awaited as the inflation numbers. As expected, personal spending rose 0.2% in April but that’s a dip from March’s 0.7% pop which no doubt had some purchases pulled forward to avoid tariff price hikes. Real spending (spending net of inflation) was up 0.1%, slightly better than the unchanged expectation but well off the 0.7% pace of spending in the prior month. While a step back from the March pop was a reasonable expectation, the ongoing question will be whether there is a bounce in May and/or June or does this mark a change in trend? We’re reluctant to predict the demise of the American consumer as that has been a losing bet for some time, but we do stand on alert for the possibility of a more discerning consumer going forward.

- The US Court of International Trade ruled late Wednesday that the administration’s reciprocal tariffs issued under the Economic Emergency Act were unconstitutional setting the stage for more uncertainty and countermoves by the Trump White House. The administration is expected to appeal the decision and depending upon that outcome could be followed by a Supreme Court review. Also, the administration can look to the 1974 US Trade Act where several sections in that Act seem to provide an avenue to reinstate tariffs at a maximum 15% for up to 150 days before they are subject to congressional approval. Thus, this episode only increases the level of uncertainty, but the administration has legal options to continue the tariffs in some form and that seems to be the path they will take.

- The second of three estimates of first quarter GDP was released yesterday, and while GDP improved slightly from -0.3% in the first estimate to -0.2%, a drop in consumer consumption heightened nervousness heading into today’s April spending update. Personal consumption, which is 2/3rds of GDP, dipped from 1.8% in the first estimate to 1.2% in the second, the lowest spending growth in nearly two years. The downshift in consumer spending was more than offset by an increase in inventories and business investment which led to the slight GDP improvement. Recall that fourth quarter consumption was a solid 4.0% and 2.8% for all of 2024, so the first quarter slowdown heightens concerns over whether this is the beginning of the consumer taking a step back from last year, or just a pause that refreshes. We shall see.

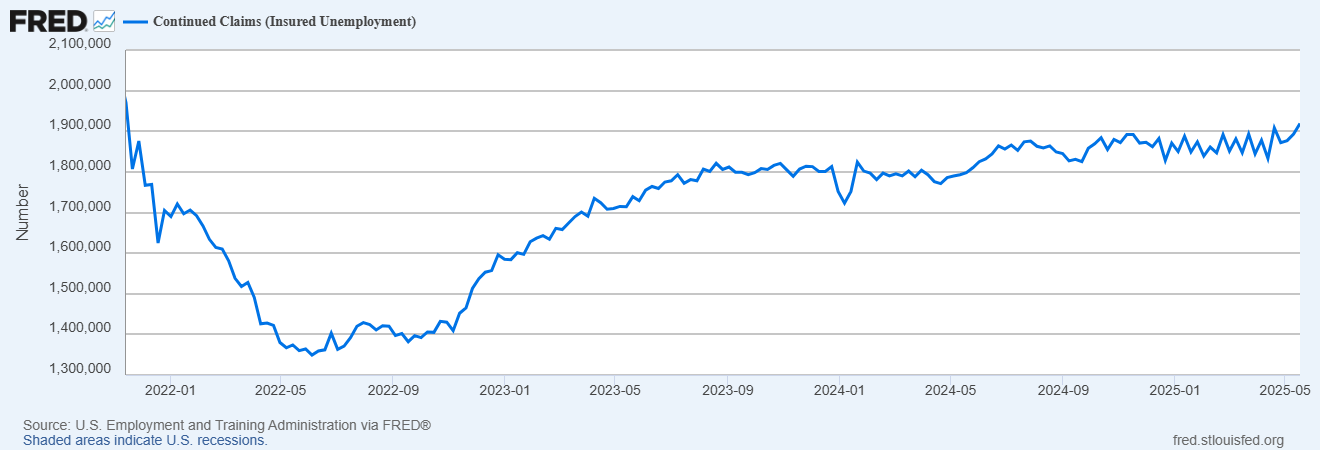

- Initial Jobless Claims for the week ending May 24 were 240,000, an increase of 14,000 from the previous week’s 226,000. Continuing Claims for the week ending May 17 were 1,919,000, an increase of 26,000 from the previous week’s level and the highest level since November 1 , 2021. This continues the slow uptick in continuing claims indicating more workers are finding it difficult to secure new employment. So, while employers continue to remain reluctant to lay off trained and experienced workers, they are definitely cutting back on new hiring.

- While trade and tariffs are top of mind these days we received the latest numbers on the goods trade deficit for April. The deficit shrank from the record -$163.2 billion in March to -$87.6 billion last month vs. an expected -$140.0 billion. Once again, the impact of tariff front-running and the stepping back from that is apparent in the results. If you thought that tariff issue was a one-time catalyst expect the same as we get closer to the August expiration of the China tariffs that sit at 30% for most goods, down from the outsized 145% rate briefly in place. Thus, it looks like we’re in store for these self-induced crosscurrents to continue through the summer months, keeping the economic picture difficult to discern accurately.

- Finally, with the numerous crosscurrents impacting the economy, I sat down with Joe Keating from our Wealth Department this week for a chat on the economy. Follow the link to listen to our 30-minute conversation on some of the issues confronting the economy, and Joe’s outlook for the balance of 2025. Listen here.

Fed’s Preferred Inflation Gauge Approaching the 2% Target but Tariff Costs Loom on the Horizon

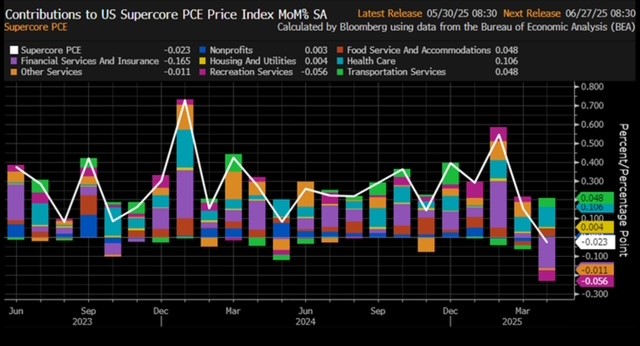

Another Inflation Measure (Core Services Ex-Housing) Watched Closely by the Fed Trended Lower in April

Continuing Unemployment Claims Increases to Highest Since Nov. 2021

First Quarter Personal Consumption Revised from 1.8% to 1.2%, Lowest Since Second Quarter 2023

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.