Odds of a 50bp Cut Still Increasing

Odds of a 50bp Cut Still Increasing

- Treasury yields are waffling around unchanged this morning as the market awaits a Fed rate cut on Wednesday, the first since March 2020 (see graph below). The debate over 25 or 50 rages, but the 50 crowd is gathering some momentum and that is aiding Treasury bids in early trading. Currently, the 10yr is yielding 3.66% down unchanged on the day, while the 2yr is yielding 3.58%, down 1bp on the day. ·

- Fed Week arrives and it will be the most consequential meeting of the year. While a rate cut is assured, the case for a 50bp cut is gathering momentum. Recent op-ed pieces from ex-Fed officials and WSJ reporter, and noted Fed Whisperer, Nick Timiraos has said internal discussions between 25 and 50 as being a virtual jump ball. The oft-cited reason for not going 50bp is that it might signal the Fed knows something we don’t which may spook the market. But what could that be? We see virtually the same key data that they do. Plus, they could easily condition a 50bp cut as a one-off due to the creeping tightening that has taken place as inflation rates have dropped over the past year while the funds rate remained fixed at 5.25% -5.50% ·

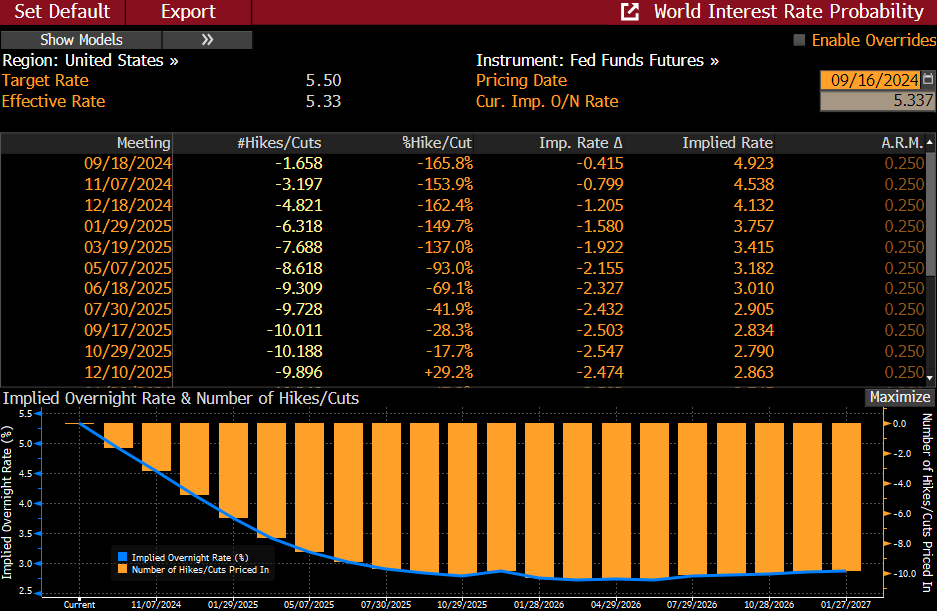

- With gathering odds of a 50bp cut now over 60% (see table below), something less would be greeted now as a disappointment by the market, with comments like “they are falling behind the curve.” We had been in the 25bp camp, and the slightly hotter inflation data last week probably gave Fed members pause, but again recent comments that 50bp is being considered is keeping the hopes of that crowd alive. We still lean slightly to a 25bp cut, but a 50bp cut would not surprise, and it would probably be greeted better than a smaller rate cut. This Fed, however, doesn’t want to surprise the market so the recent spate of articles on 50 vs. 25 being considered does seem to be an effort to gauge market reaction, and so far, the reaction seems to be more positive than negative.

- Also adding to the 50bp case is with CPI and PPI in hand analysts are estimating core PCE to come next week somewhere around 0.14% – 0.18% MoM. That rounds to either a “high” 0.1% or “low” 0.2%. In either case it would be cooler than core CPI, perhaps alleviating some concerns from the inflation hawks at the Fed.

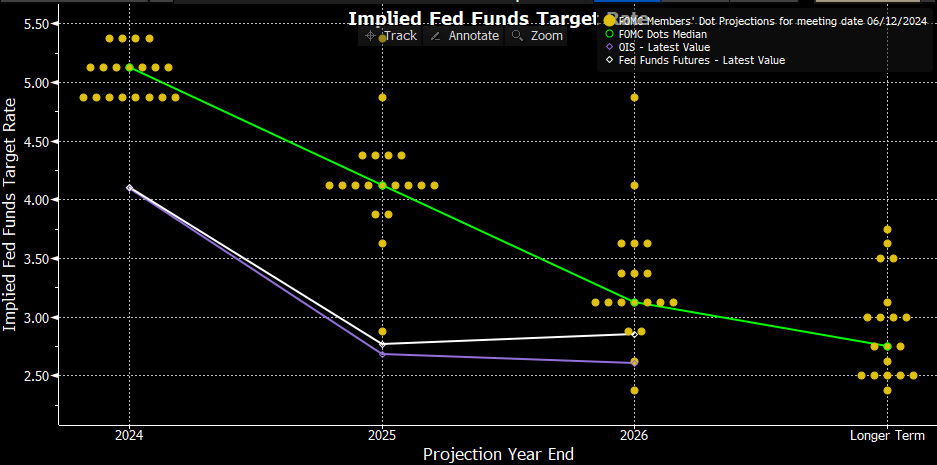

- Being a quarter-end meeting we’ll get an updated dot plot along with a refreshed Summary of Economic Projections (SEP). Recall the June dot plot had one 25 bp cut planned by year-end with the median funds rate at 5.125%. The futures market has that at 4.135%, certainly more aggressive. While we expect the updated dot plot to reflect a lower year-end rate, it seems unlikely they’ll move all the way to the futures 120bp in cuts by year-end. The June forecast also had 100bps in cuts in 2025 ending the year with the median rate at 4.125%. The futures market is again more aggressive with a year end funds rate at 2.862%. So, the dot plots will easily dominate the early information coming from the meeting, until Powell’s press conference where he’ll try to get people not to focus on it too much. Good luck with that.

- Away from the Fed, the week also provides the latest in consumer spending with Advance Retail Sales for August due tomorrow. Overall sales are expected to be down -0.2% vs. 1.0% in July but sales ex auto and gas are expected better at 0.3% vs. 0.4% in July. The Control Group – a direct feed into GDP – is expected to match July’s 0.3%. So, generally decent sales are expected, outside of softer car activity. Once again, the caveat to this report is that it’s more goods based and not inflation adjusted and with the consumer spending more on the services side this year, a modest to soft report should be taken with a grain of salt until the more comprehensive Personal Income and Spending report that comes late next week.

- The latest Atlanta Fed GDPNow forecast for third quarter is 2.47% which was last updated a week ago. It will be updated tomorrow following the retail sales numbers.

- Some other reports of note this week will be Industrial Production and Housing Starts/Permits, due tomorrow, and Wednesday, respectively. Generally speaking, both are expected to be slightly better than July results which again plays well with the 25bp crowd, but then again those reports come so close to the FOMC rate decision they might not be a factor.

Fed Funds Futures See Increasing Odds (>60%) of a 50bp Cut on Wednesday

Source: Bloomberg

June Dot Plot Had Only One 25bp Cut By Year-end – That Will Get Adjusted Wednesday But Not Likely Matching Futures Market

Fed Funds Rate – First Rate Cut Since March 2020 Expected This Week

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.