October PPI Confirms CPI With a Softer Read on Wholesale Inflation

October PPI Confirms CPI With a Softer Read on Wholesale Inflation

- Treasuries are giving back some of the outsized gains from yesterday, despite more good news on inflation. Prices were drifting lower into the PPI and retail sales releases and that picked up as retail sales, while easing in October, were revised higher in September as the consumer finished the third quarter even stronger than previously thought (more on that below). Presently, the 10yr Treasury is yielding 4.52 down 19/32nds in price while the 2yr Treasury is yielding 4.90%, down 3/32nd in price.

- October PPI confirmed what we saw in yesterday’s CPI numbers with a softer read on wholesale inflation and that adds to the “Fed is done” thinking by many investors. Overall PPI declined -0.5%, the largest monthly drop since April 2020, and well below the 0.1% expectation. The decline was mostly due to energy decreasing -6.5% for the month. On a YoY basis, the overall pace was up 1.3%, the lowest since the start of 2021. Excluding food and energy the index was unchanged vs. 0.3% expected. The YoY pace slowed from 2.7% to 2.4%.

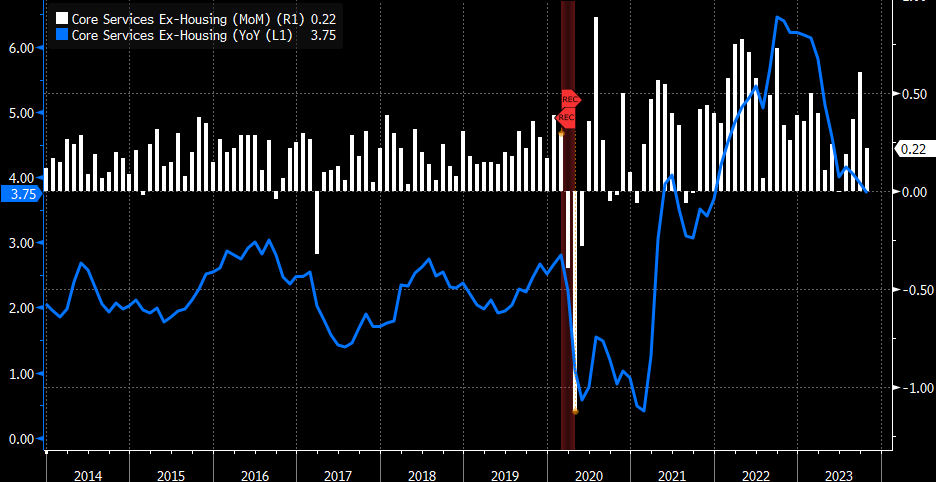

- On another positive note, service costs were flat after rising for six straight months. The Fed has been focused on the services-side as Powell noted in the FOMC press conference that they didn’t expect much more goods-side deflation, so the flattening in services-side costs is certainly welcomed. The slowing in service costs was also notable in the CPI release (see graph below). Yet another positive from this report is that several PCE categories derive from PPI so a softer PPI read implies the month-end PCE inflation series should also exhibit cooler price pressures, just like we’ve seen this week.

- The other big report today was October Retail Sales with sales coming in soft but better than expected. Overall sales were down -0.1% vs. -0.3% expected and well off the 0.9% upwardly revised pace in September. Sales ex autos were up just 0.1% which missed the 0.2% forecast and the strong 0.8% pace in September. The sales metric that directly feeds into GDP (the so-called Control Group) was up 0.2% which matched expectations but was off the 0.7% pace in September.

- It’s obvious the consumer took a breather in October after finishing the third quarter in a strong spending mood. As we’ve noted before, the question the market and the Fed will be asking is if the softer spending in October is a one-off or the start of the consumer retrenching. We saw this before in the second quarter only to have the consumer bounce back big in the summer. But with job and wage growth slowing, savings dwindling, and credit card balances increasing, the consumption slowdown in October does warrant additional scrutiny.

- Finally, just when we thought the budget battle in the House would go to the 11th hour, or later, they surprised with a bi-partisan vote to approve a continuing resolution with some spending passed into January and some into February. It was essentially a kick-the-can bill that we expected, and it now goes to the Senate where it’s expected to pass. With the President’s signature a government shutdown will be averted. While disfunction in the federal budget process remains front and center, the CR does remove one economic headwind that could keep the Santa Claus rally in place. We’ll worry about next year next year. Right?

CPI Core Services Ex-Housing – Nice Dip in October Feeds into the “Fed is Done” Narrative

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.