October Jobs Report – Weaker Than Expected

October Jobs Report – Weaker Than Expected

- Nonfarm payroll gains came in weaker than expected with 150 thousand new jobs vs. 180 thousand expected, plus the prior two months were revised lower by 101 thousand jobs. Revisions had been trending to the downside this year until September, but that appears to be the anomaly as the downward revision trend returned. For the second month in a row, the Household Survey reported much weaker jobs numbers with a loss of 348 thousand while the labor force decreased by 201 thousand, and that had the unemployment rate ticking up to 3.9%. So, a weaker take on jobs in that survey vs. the Establishment’s headline numbers. However, there is likely some larger impact from the UAW strikes in that survey which could reverse in November with the strikes having largely been settled. Job gains occurred in healthcare (77k), and government (51k). Due to the UAW strikes, job cuts were heaviest in manufacturing (-35k) and transportation (-12k).

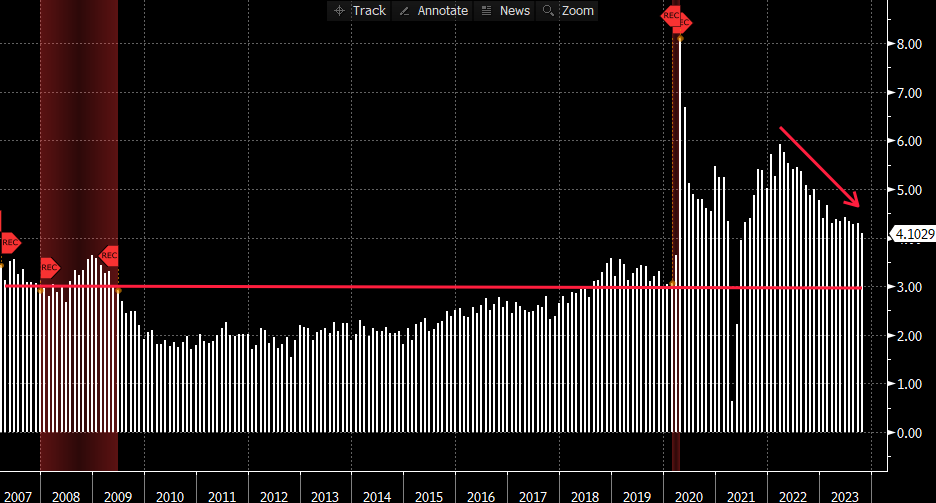

- Wage gains continued their moderating trend started in August with a MoM gain of 0.2% below the 0.3% expectation and lower than the upwardly revised 0.3% September print (up from 0.2%). The year-over-year pace decreased to 4.1% vs. 4.3% the prior month but above the 4.0% expected. That’s the smallest YoY pace since June 2021. Average weekly hours decreased from 34.4 hours in September and expected to 34.3 hours. That’s the third month this year at 34.3 hours and represents the cycle low. Weekly hours peaked at 35.0 a year ago. The continued moderation in wage gains and softening in weekly hours worked will be welcomed by the Fed, but they will want that YoY number to continue under 4% to further reduce the wage-push inflation potential.

- As mentioned above, the unemployment rate rose a tenth to 3.9% as the Household Survey reported an increase of 146 thousand in the ranks of the unemployed with a modest decrease of 201 thousand in the labor force. Once again, the disparity between the Establishment and Household Surveys provides a somewhat mixed picture as to exactly how much softening is occurring in the labor market. The Household Survey is a smaller sample size vs. the Establishment Survey so it gets less weighting when these discrepancies occur, and it could be more impacted by the UAW strikes, but it will be food for thought until the November report.

- The modest decrease in the labor force led to a dip in the Labor Force Participation Rate to 62.7%, from 62.8% in September which was also the pre-release expectation. The participation rate a decade prior to the pandemic averaged 63.3% while the average over the past year has been 62.6%. The slight dip in October won’t be welcomed by the Fed as they ideally want the rate to approach pre-pandemic levels, broadening the labor pool, and keeping a lid on excessive wage gains.

- The Fed will be cautiously optimistic that they are getting the soft landing with this report. The modest increase in headline jobs, with moderating wage gains, will be welcome news that job gains can continue without inducing more inflationary pressure. The weaker jobs picture in the Household Survey, and the softening in Establishment Survey job growth, certainly argues for a December pause, but plenty of data remains to be seen between now and that meeting.

- Presently, the odds of a December hike are only 5% vs. 22% before the report. The market is still calling for around 80bps of rate cuts by year-end 2024. Recall, the Fed had only 50bps in 2024 rate cuts in their September forecast. Those Fed forecasts will be updated at the December 13 FOMC meeting.

Average Hourly Earnings (YoY) – Trending Lower but Fed Wants it Closer to 3%

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.