October Jobs Report Misses, but with Plenty of Noise

- October nonfarm payrolls rose only 12 thousand vs. 101 thousand expected and 223 thousand in September (revised down from an initial 254 thousand). August was also revised down by 81 thousand jobs to 78 thousand, and after last month’s upward revisions this month returns to the year-long trend of downward revisions. Meanwhile, private sector jobs decreased 28 thousand vs. a 70 thousand expected increase and 192 thousand in September (revised down from an initial 223 thousand). Recall, ADP reported 233 thousand private sector jobs earlier this week vs. an expectation of 111 thousand and 159 thousand in September. So, do we laugh at ADP or realize this BLS number is awfully noisy given the impact from hurricanes and strikes?

- In that regard, the BLS noted the impact of the hurricanes kept over 500 thousand away from jobs due to weather, (which is obviously high but similar to other extreme weather events), and it also lowered response rates in the Establishment Survey. What’s more, they noted the average period to respond is typically between 10 and 16 days, and this month it was at the lower extreme of 10 days which also adversely affected the response rate. The Household Survey, however, is not impacted by weather and/or strikes as those involved in such are still included as working which is not the case in the Establishment Survey which is another reason to treat this report with a healthy dose of caution.

- Regardless of hurricanes and/or strikes the Household Survey (which generates the unemployment rate, labor force participation, etc.) reported a decrease of 368 thousand jobs and an increase of 150 thousand in the ranks of the unemployed. It also reported a 220 thousand drop in the labor force. The unemployment rate, however, remained unchanged at 4.1% (4.145% unrounded) which was the expectation. While the Household Survey uses a smaller sample size, and thus is subject to more volatility when extrapolated to the entire population, it is interesting that compared to a year ago, the number of employed persons increased by only 216 thousand compared to the Establishment Survey’s average monthly gain of 194 thousand over the past 12 months. Something doesn’t add up.

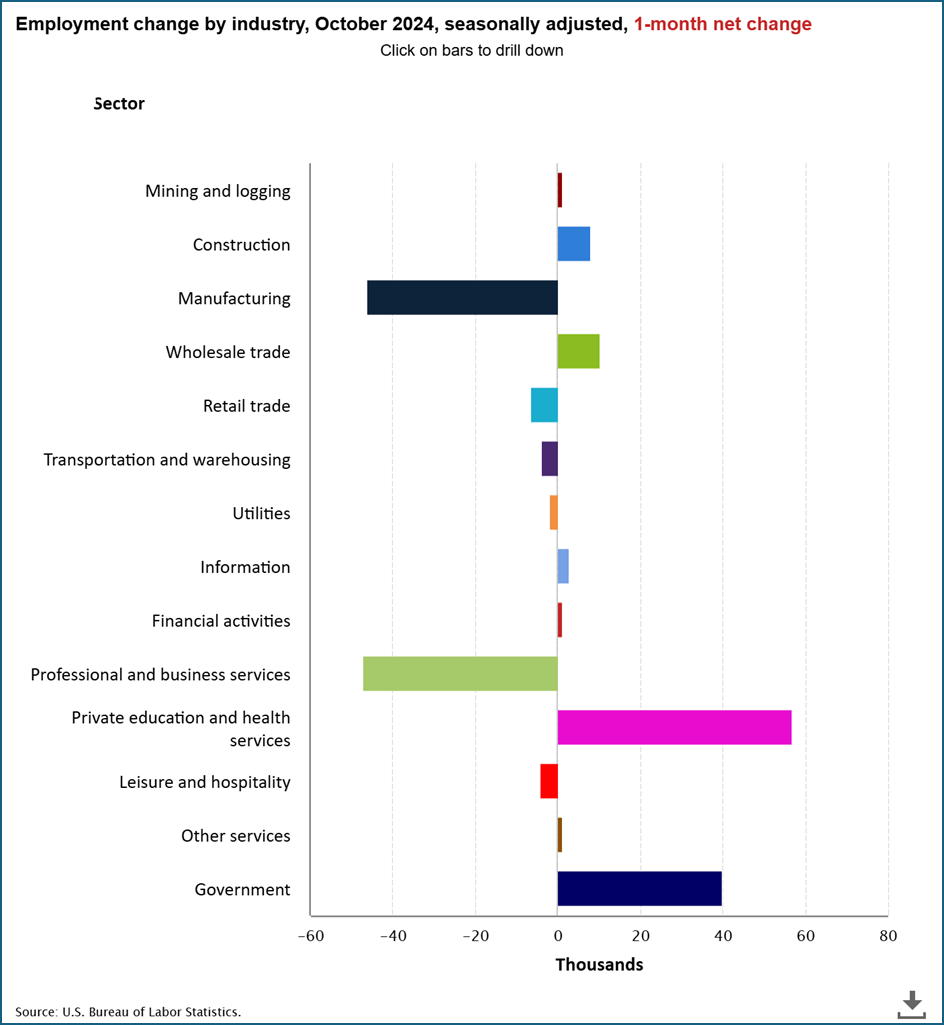

- Job gains were strongest in healthcare/social assistance (51k), and government (40k). Job losses occurred in manufacturing (-46k), and for a seventh straight month temporary help services shed jobs, this time 49 thousand. The job loss categories highlight the continuing weakness in the manufacturing side vs. the services side of the economy which in total added 9 thousand jobs in October.

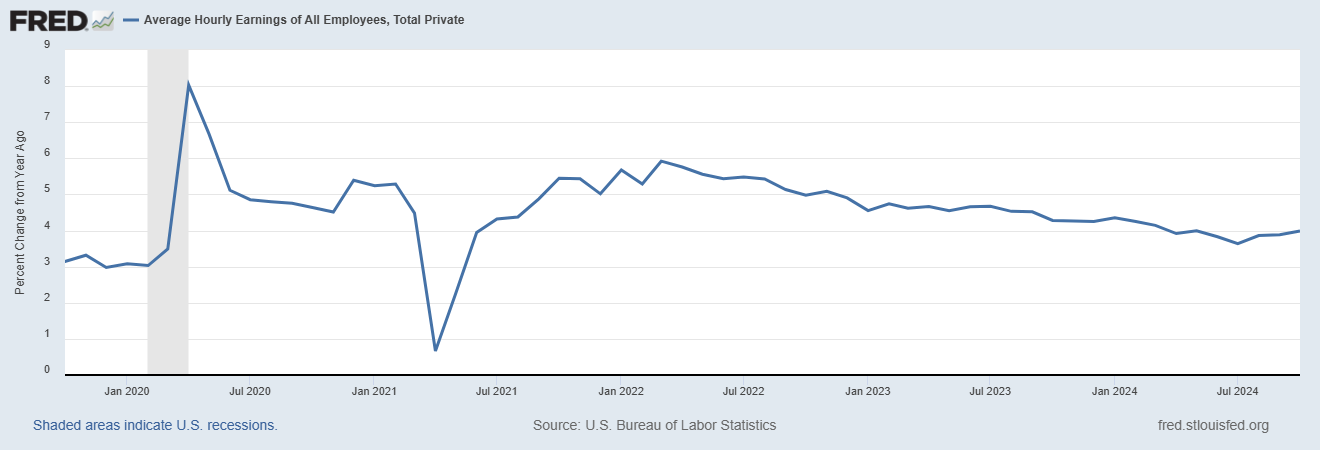

- Average Hourly Earnings rose 0.4% MoM, beating the 0.3% expectation and up from the 0.3% September gain that was downwardly revised from 0.4% originally. The year-over-year pace remained unchanged at 4.0%, matching expectations, but up from September’s 3.9% rate (also downwardly revised from 4.0%). Average weekly hours ticked up to 34.3, beating the 34.2 expectation and matching September’s 34.3 hours. Weekly hours peaked at 35.0 a year ago and seem to be settling in the low 34-hour range, which is another sign of moderating labor demand.

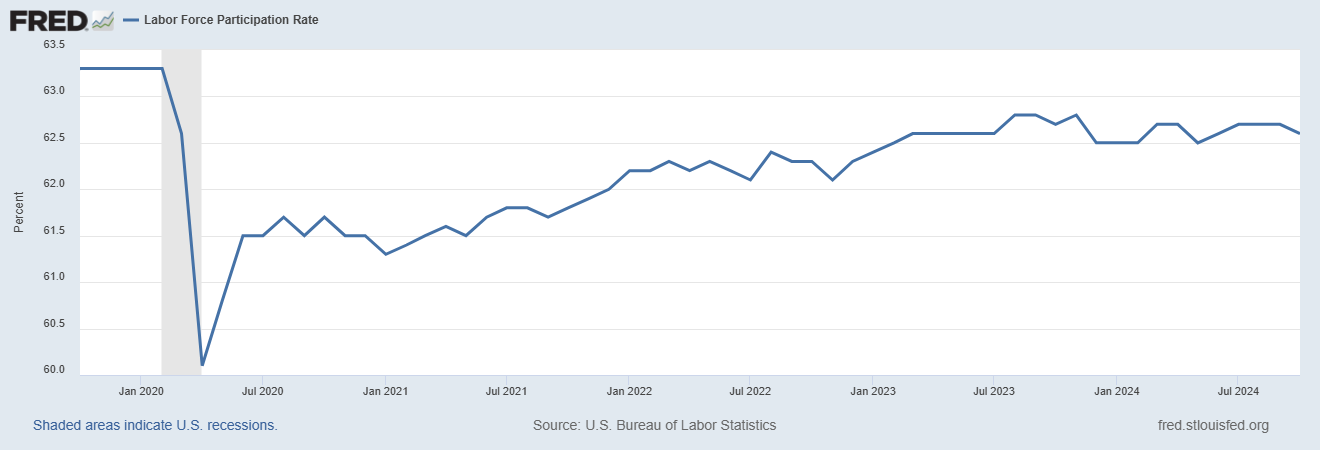

- With the decrease in the labor force, the Labor Force Participation Rate ticked a tenth lower to 62.6% after three straight months at 62.7%. The participation rate a decade prior to the pandemic ranged between 62.5% and 63.0% while the average over the past year has been 62.6%.

- Despite all its noise, October’s jobs report revives talk of a slowing in the labor market and will keep a 25bps rate cut firmly on the table for next week. The lack of year-over-year job growth in the Household Survey is another concern that is at odds with the much stronger Establishment Survey. Given that, and the current restrictive state of Fed policy, it seems the prudent course of action is for the Fed to continue to stay in normalization mode as long as inflation doesn’t flare up, but the first quarter is fast approaching with its usual hot inflation seasonality, so better to get those cuts in now before year end.

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.