Now We Wait for the Missing Data

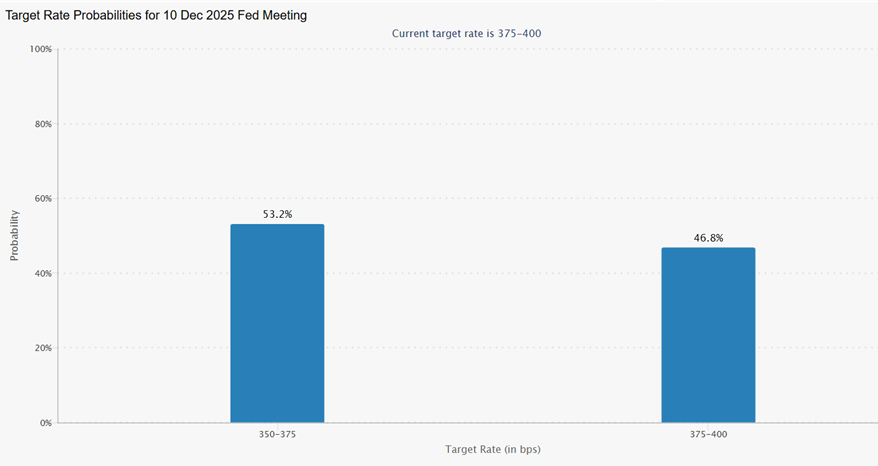

- With several Fed officials recently voicing more concern over inflation and less about the economy/jobs, odds for a rate cut in December have plummeted from a 96% probability a month ago to a toss-up at this point (see graph below). That shift contributed to the tech-heavy selling yesterday in stocks, which coincidentally has been the sector fueling the wealth effect for well-to-do consumers flush with stock portfolios near all-time highs. Oh, and futures are pointing to more selling of tech today. Just this week, we are up to four Fed regional presidents with an FOMC vote not pushing the case in recent speeches for a cut next month. Perhaps the lack of data has contributed to a steady-as-she-goes view of the economy? Here’s hoping the eventual release of the missing data doesn’t reveal a different story. Currently, the 10yr Treasury is yielding 4.07%, down 4bps on the day, while the 2yr note yields 3.55%, down 5bps in early trading.

- With the government shutdown at an end, the question turns to when we might see some of the missing data from the last six weeks. The September jobs report is likely to be the first, possibly early next week, but the reaction is likely to be somewhat asymmetric. That is, if it’s strong, the strength will likely be shrugged off as dated, but a weak report will feed into the view that the labor market was losing momentum before the shutdown which did nothing to help that trend.

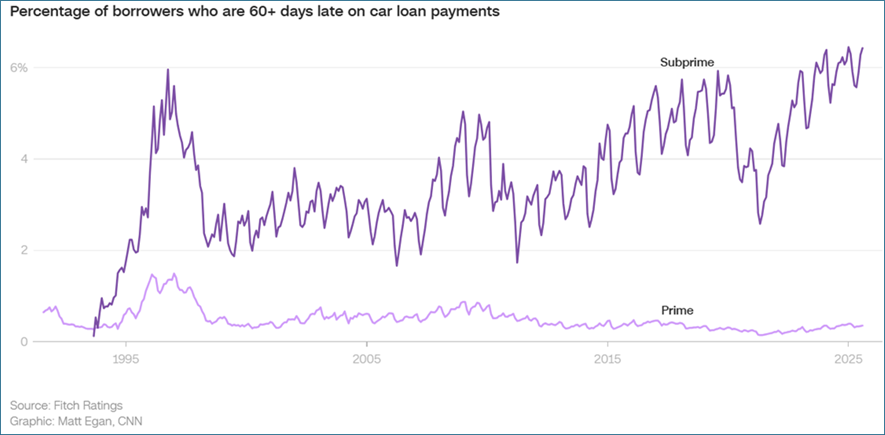

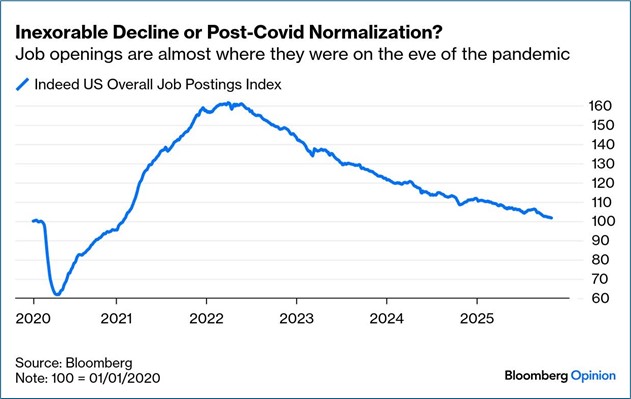

- The Trump administration has commented that an October jobs and inflation report may not come at all, or, if it does, with less than complete data. The issue here is that both reports use surveys and other data collecting methods that once missed are difficult if not impossible to replicate after-the-fact. We have privately issued reports, like ADP, Challenger Job Cuts, and Revelio Labs that posted October estimates of job growth and planned job cuts, and while not all similar, definitely pointed to slowing momentum. Job postings are also back to pre-pandemic levels which either speaks to a return to pre-covid trends, or yet another sign of slowing momentum. Which is it?

- The FOMC has definitely divided into two camps: those concerned most about inflation and those more concerned about jobs. A comprehensive look at October prices would be critical in developing a consensus to cut or not cut in December. It looks like, however, a robust inflation report for October is unlikely to happen and the November report will not be available until after the December 10th FOMC meeting. The market is getting the sense that in the absence of data, the better part of valor for the Fed is to stand pat and wait until January when the data backlog will have eased. That scenario, however, assumes the September jobs report is not woefully weak, which, if it is, could shift the discussion in favor of a December cut.

- One piece of information we will get on time next week is the minutes from the October 29th FOMC meeting on Wednesday. That should give us a better sense of the divide within the committee over the inflation/jobs issue. Given Chair Powell’s comments in the post-meeting press conference that there was not anything approaching a consensus to cut in December, the discussion in the minutes should provide additional color around the subject.

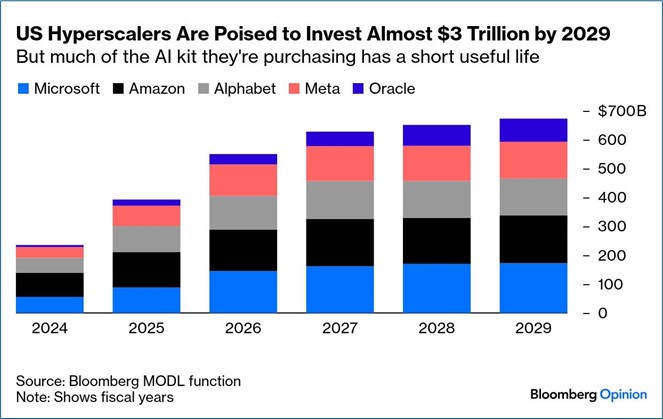

- It’s my sense that with the K-shaped economy in full effect, growth at this point seems overly reliant on the factors that have led to the recent run-up remaining in place. With the top 10% of consumers contributing close to 50% of consumption – which is being fueled in part by record-breaking stock prices – as long as a stock market correction doesn’t dent that wealth effect, consumption should hold up. It’s a bit like a high-wire act, however, with an ever-growing share of economic growth being fueled by AI spending which is, in turn, fueling wealth generation in stocks, thus aiding the upper cohort of consumers to spend with gusto. A sudden slowing in AI capex spending, and/or a stock market correction, could slow spending by that well-heeled consumer such that an economy that has become reliant on a handful of big spending players could be vulnerable. We’ll look to see if that concern is mentioned in the minutes.

Futures Now See December Rate Cut as a Toss-Up

Source: CME Group

Growth is Becoming Reliant on this AI Spending Continuing

Job Postings Returning to Pre-Covid Trend or Slowing Momentum Continuing?

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.