November Jobs Report Beats Expectations

November Jobs Report Stronger Than Expected

- Nonfarm payroll gains came in better than expected with 199 thousand new jobs vs. 185 thousand expected. Private sector jobs increased by 150 thousand vs. 160 thousand expected. Revisions have been trending to the downside this year and that held true for this report with 35 thousand jobs cut from September. Also, after two straight months where the Household Survey reported much weaker jobs numbers it made up for that in November with 747 thousand new jobs and that obviously influenced the unemployment rate which dipped from 3.9% to 3.7%.

- It’s estimated that approximately 47 thousand of the new jobs were returning UAW and SAG workers. Job gains were notable in the healthcare sector (93k), government (49k), leisure and hospitality (40k), and durable goods (36k) read: returning auto workers. Job losses were notable in retail (-38k) and temporary help (-14k).

- Wage gains reversed their moderating trend that started in August with a MoM gain of 0.4%, above the 0.3% expectation. Despite the monthly beat, the year-over-year pace decreased to 4.0% vs. 4.1%. That’s the smallest YoY pace since June 2021. Average weekly hours increased from 34.3 hours to 34.4 hours. That stops a three month streak at 34.3 hours which represents the cycle low. Weekly hours peaked at 35.0 a year ago. The uptick in wage gains and increased weekly hours will certainly bolster the Fed’s higher-for-longer theme, so expect more of that next week. Ideally, the Fed wants that YoY number to drift to around 3.5% to reduce the wage-push inflation potential.

- As mentioned above, the unemployment rate dipped two-tenths to 3.7% as the Household Survey reported a decrease of 215 thousand in the ranks of the unemployed combined with a large increase of 532 thousand in the labor force (the denominator in the unemployment rate calculation). It seems the much smaller Household Survey may have been impacted by the returning strikers which when extrapolated across the entire population induced some of the volatility we are seeing in November’s numbers.

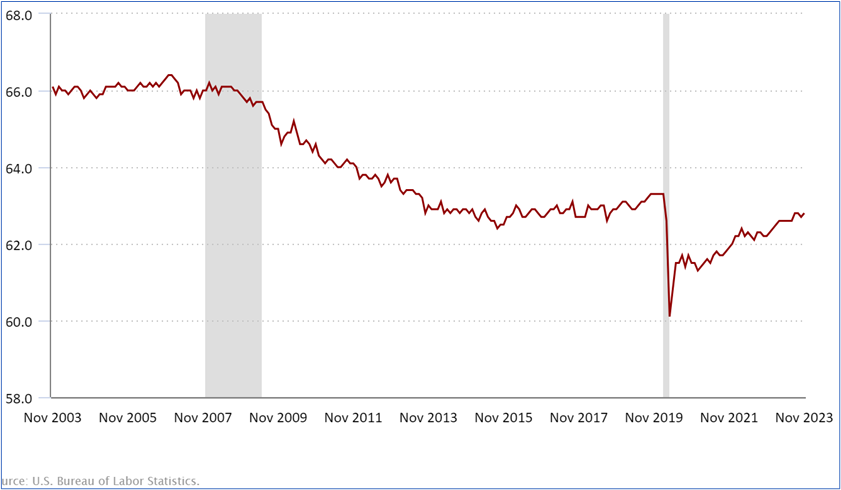

- The increase in the labor force led to the Labor Force Participation Rate increasing from 62.7% to 62.8%, which was the rate back in September. The participation rate a decade prior to the pandemic averaged 63.3% while the average over the past year has been 62.6% (see graph below). The increase in November reverses a similar dip in October and will be welcomed by the Fed, but they ideally want the rate to approach pre-pandemic levels, broadening the labor pool, and keeping a lid on excessive wage gains.

- All-in-all, the Fed will wring their hands over the uptick in wage gains and hours worked despite the sizable increase in the labor force. However, the impact of the returning strikers obviously influenced the numbers so the Fed won’t overreact to this report, as it does fly in the face of other recent labor market readings that were softer than expected like JOLTS, ADP, and increased continuing claims. They will, however, use it to advance their higher-for-longer theme at next week’s FOMC meeting. They will also probably throw water on the market’s timing and pace of rate-cutting expectations for next year.

Labor Force Participation Rate – Slowly Improving But Still Below Pre-Pandemic Levels

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.