No Great Revelations in Early Data Releases

-

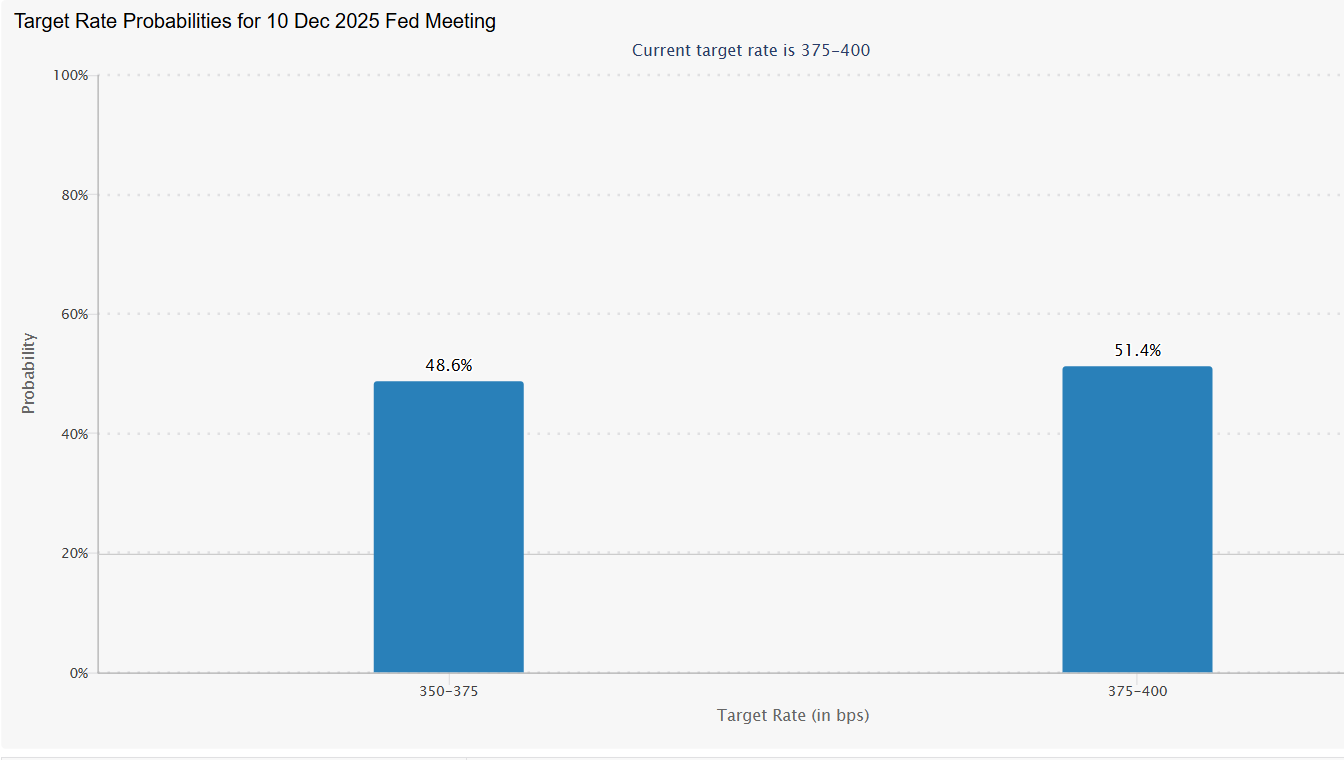

- The dam of delayed data is beginning to break. The initial releases, from August and second tier in importance, seem to pick up where we left them in the summer. That is, no great break from recent trends. That may change tomorrow when the BLS releases the September jobs report, however, expectations are for a decent report (53k headline jobs expected with unemployment unchanged at 4.3%). If expectations are met it won’t improve odds of a December rate cut, which are about 50-50 at the moment. The BLS did add September PPI to the release schedule for next Tuesday but still no date for September CPI. Hmmm. Currently, the 10yr Treasury is yielding 4.11%, down 1bp on the day, while the 2yr note yields 3.57%, also down 1bp in early trading.

- As we wait on tomorrow’s September jobs report, the Census Bureau released August Factor Orders which matched estimates rising 1.4%. Orders in July were down -1.3%. Orders ex transportation rose 0.1% in August vs. 0.5% in July, and shy of the 0.3% estimate. Meanwhile, Durable Goods Orders for August rose 2.9%, matching estimates and above the drop of -2.8% in July. Capital goods orders non-defense ex-air (a proxy for business investment) were up 0.4% vs. 0.7% in July. Given the stale nature of the data the market essentially ticked it off the list without much reaction.

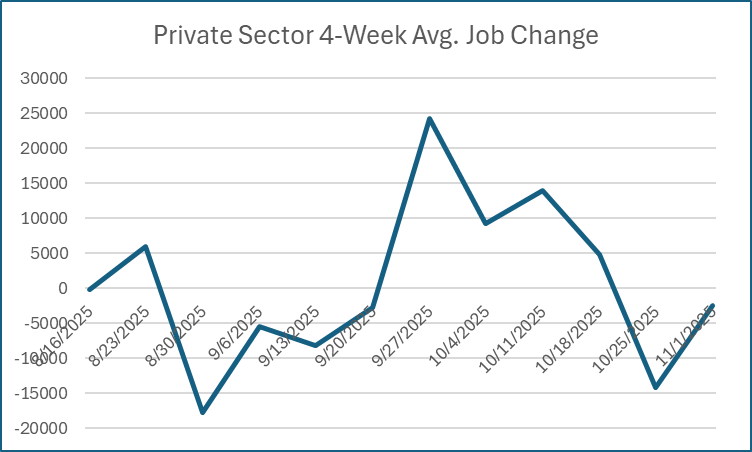

- Garnering a bit more attention was ADP’s preliminary weekly look at private sector hiring. For the four weeks ending Nov. 1, private employers shed an average of 2,500 jobs a week as employment losses slowed heading into November. Last week’s four-week average had private employers shedding 12,500 jobs per week for the four weeks ending Oct. 28th. So, improvement from the prior week but still little evidence that the labor market had a substantive rebound in October.

- Some interesting notes in the release: Hiring slowed from earlier in the year, so one would think that new hires—which they define as workers added to an employer payroll in the last three months—would be a shrinking share of the workforce. Instead, they’re on the upswing. What gives? In October, new hires accounted for 4.4% of all employees, up from 3.9% a year ago. This increasing share of new hires seems to run counter to the low-hire, low-fire labor market that we’ve been experiencing this year. That contradiction tells us a lot about today’s jobs market. New hires typically fluctuate with the business cycle, but the aging U.S. workforce means that demographics have begun playing a bigger role in hiring decisions. Employers are hiring to replace existing workers, not to increase headcount.

- In other labor news, notices of impending layoffs surged in October to among the highest levels on record, according to a tally by the Cleveland Federal Reserve Bank. In October, the Cleveland Fed researchers found 39,006 Americans were given advance notice as required under the Worker Adjustment and Retraining Notification Act (WARN Act). The WARN Act requires businesses with 100 or more full-time employees to provide 60-days advance notice to workers, and the Dept. of Labor, when planning to lay off 50 or more workers. In monthly data going back to 2006, the October figure has only ever been higher in 2008, 2009, 2020 and May 2025.

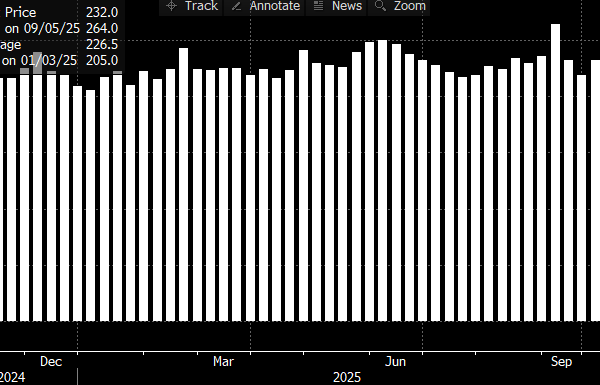

- We also received the October 18th initial jobless claims figures, but that addition seems to have been mistakenly posted to the website. Per the Department of Labor: Data on weekly applications for US unemployment insurance are due to be published as usual on Thursday. A technical issue caused the early posting of data for the week ended Oct. 18 on the Labor Department website. The complete series will be available by close of business on Thursday. Despite the surprise submission, the October 18th claims number was similar to what we’re seeing prior to the shutdown. Seasonally adjusted initial claims totaled 232 thousand and continuing claims 1.957 million.

- At 10am ET, Fed Governor Miran will speak on bank regulation and the Fed’s balance sheet. Miran is on record advocating for several more rate cuts, so we’re likely to hear the same today if he ventures into that discussion. I’m more interested, however, in his thoughts on the Fed’s balance sheet. As he clearly wants lower rates, then he may offer his thoughts on re-instituting QE with the Fed balance sheet to help influence longer term rates lower, particularly mortgage rates.

- Later today we’ll get the minutes from the October 29th FOMC meeting. That should give us a better sense of the divide within the committee over the inflation/jobs issue. Chair Powell’s comments in the post-meeting press conference in October mentioned that that there was not a clear consensus to cut in December, and that’s obvious given the Fed speak since then. However, the discussion in the minutes should provide additional color around the subject.

Futures Inch Towards 50-50 Odds for December Rate Cut

Source: CME Group

ADP Preliminary 4-Week Average of Weekly Job Growth Change – Still Weak but a Bounce from Last Week

Source: ADP

Initial Jobless Claims in October Looked Similar to Earlier Results

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.