New Supply Keeping Treasuries Under Pressure

New Supply Keeping Treasuries Under Pressure

- Treasuries are still feeling some pressure this morning after the so-so 2yr and 3yr auctions from yesterday, boosted along with the standard hawkish Fed Speak. Today offers more new supply in the form of 7yr notes so the mood may not improve until we’re past that event. Currently, the 10yr note is yielding 4.57%, up 3bps on the day while the 2yr is yielding 4.95%, essentially unchanged from yesterday’s close.

- Today offers little in the way of new trading catalysts with only a couple regional Fed activity indices and the Fed’s Beige Book of economic conditions coming this afternoon. Investors will have to mark more time until Friday’s PCE numbers, and with expectations evenly divided between a 0.2% to 0.3% MoM core reading it’s not likely to provide any grand departure from recent trading patterns.

- After the unenthusiastic reception to the 2yr and 3yr auctions yesterday, today does provide more supply in the form of 7yr notes. However, since it sits at a less pivotal spot on the curve any disappointment in auction results is not likely to spur the type of negative reaction that followed the 2yr and 3yr auctions.

- Also helping the negative action yesterday were comments from Minneapolis Fed President Neel Kashkari that while rate hike odds are quite low, he thinks restrictive policy levels could be held ‘indefinitely’, and that no FOMC members have taken hikes ‘off the table’, while the short-term neutral rate may have risen. Those are all thoughts we have heard for some time. Plus, Kashkari has staked out one of the more hawkish positions for many months now, and the fact he is not a voter, shouldn’t have caused such a market reaction but coming on the heels of the so-so auctions, and an “upgraded” consumer confidence reading, it added fuel to the fire.

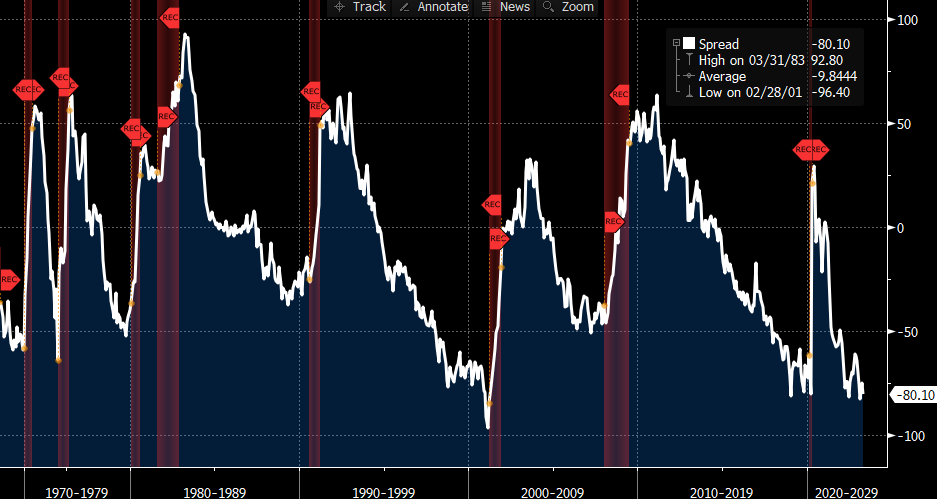

- As alluded to above, the latest Conference Board’s Consumer Confidence reading surprised to the upside. After declining for three straight months the headline confidence reading rose from 97.5 to 102.0. The present situation index improved as did the expectations index, but it remains below 80 for the fourth straight month which often was a recession signal in pre-pandemic times (see graph below). So, while it was taken as a positive report by the market, it could be argued it wasn’t all that great.

- While the PCE numbers coming on Friday will offer the headline event this week, next Friday’s employment report will provide the big event next week. While another decent report is expected, Citigroup did offer up what it thought it would take from the labor market to get the Fed off its higher-for-longer mantra. That would be something below 150 thousand in headline job growth for a couple months along with an unemployment rate ticking over 4%. Keep that in mind when the numbers hit a week from Friday.

- Finally, we recently recorded a podcast with Joe Keating, who is now back in the SouthState fold as part of our Wealth Management Group, and we discussed his latest thoughts on the economy and where it and Fed policy are headed. It’s been a while since we had Joe on the show so go give it a listen. You can find the show link here.

Conference Board’s Expectations Index Minus Present Situation Index – At Previous Recession Levels

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.