More Signs of a Hesitant Consumer

- Treasury yields are slightly higher this morning as equities try to mount a rebound after the heavy selling on Friday sparked by some dour outlooks on the economy (more on that below). The week’s headline report will be Friday’s Personal Income and Spending for January, along with the PCE inflation series, so until then expect trading to be dominated by DC headlines. Currently, the 10yr Treasury is yielding 4.50%, up 3bps on the day, while the 2yr is yielding 4.22%, also up 3bps on the day.

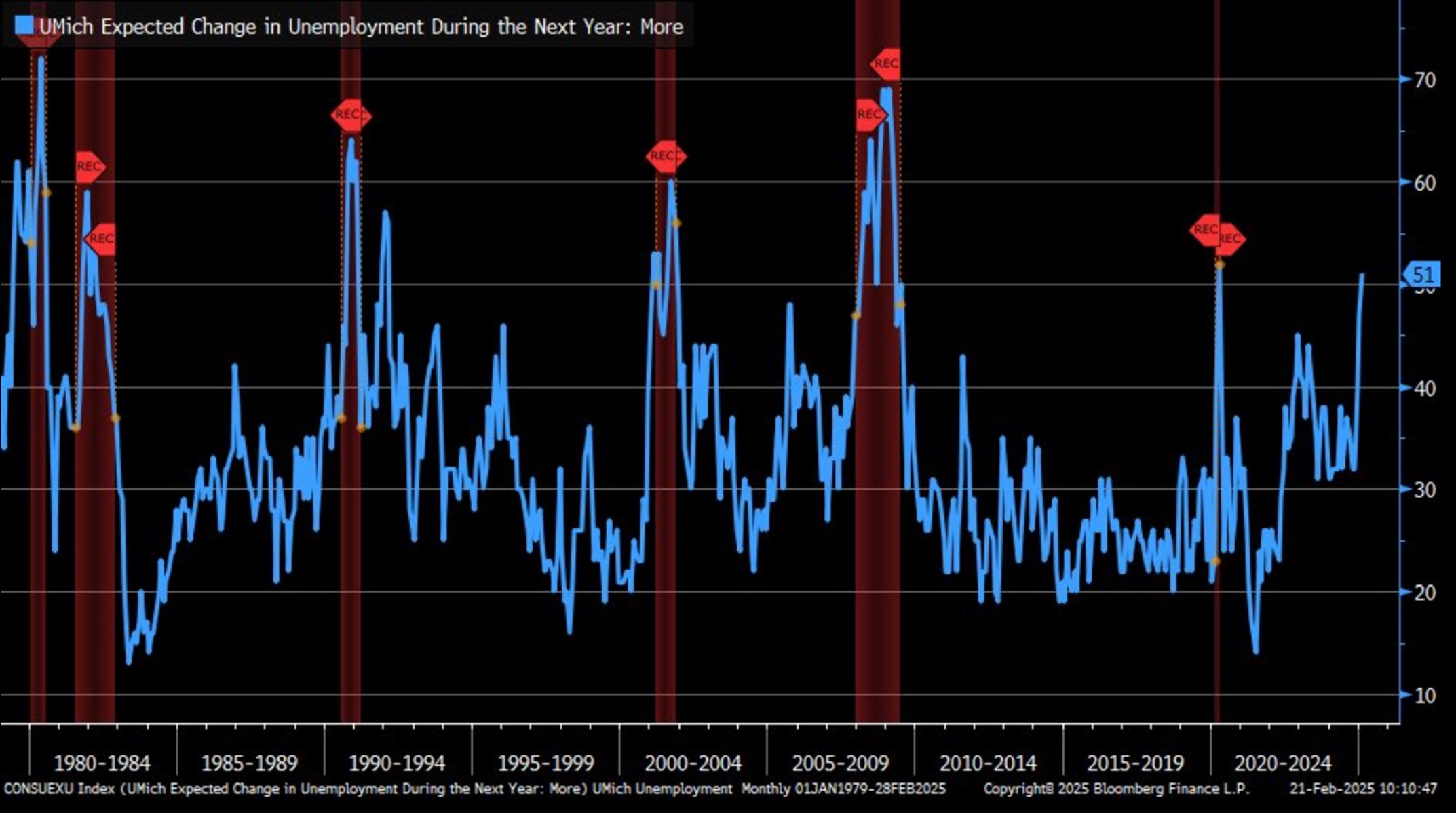

- We titled last Friday’s Market Update, Is the Consumer Showing More Distress Signs? and this was before any of the data hit on Friday. The mid-morning release of the S&P Global preliminary PMIs built on those signs as did the final read for February of the University of Michigan Sentiment Survey, specifically the increase in the 5-10yr inflation expectation to 4.4%, the highest since 1995. Admittedly, the increase was driven almost exclusively from self-identified Democrats, so it does give one pause as to how much to read into it, given the partisan angle. Chicago Fed President Austin Goolsbee mentioned over the weekend that one report is not enough but if they are followed by similar readings the Fed will notice, as they like to keep long-term inflation expectations “well anchored.”

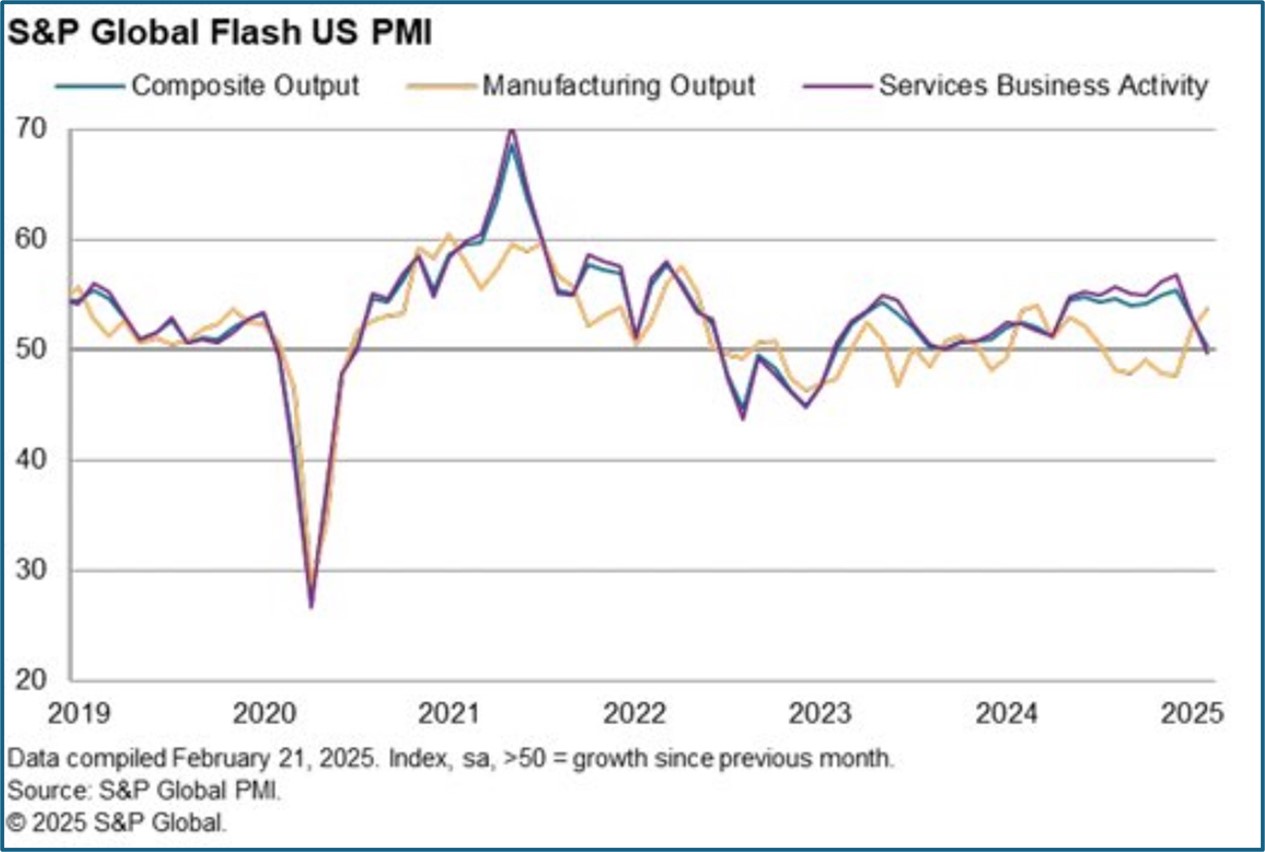

- The real mover on Friday, however, was the S&P Global preliminary PMI series for February. The Composite PMI fell to 50.4 in February, the slowest pace of activity since September 2023. Most concerning was the sharp drop in the services index, which came in at 49.7, the first sub-50 print in over 2 years; offsetting the improvement in the manufacturing gauge to an 8-month high of 51.6. S&P Global Chief Business Economist Chris Williamson said, “Companies report widespread concerns about the impact of federal government policies, ranging from spending cuts to tariffs and geopolitical developments. Sales are reportedly being hit by the uncertainty caused by the changing political landscape, and prices are rising amid tariff-related price hikes from suppliers.” We don’t need to remind readers that the services-side of the economy has been the real driver of activity for over a year and if that starts to falter, there’s no amount of manufacturing pick-up that will offset that decline.

- So, now we have a soft Retail Series report to deal with, a sales warning from Wal-Mart, combined with a decidedly lower outlook on the services side of the economy, along with higher inflation expectations. It’s not surprising then to see the equity and fixed income reaction on Friday. The question is are these just anomalies and not trend changes? The sentiment surveys this cycle have been of questionable value, at best, so there is that. The Retail Sales Report is more goods-sided and taking a breather in January after the holiday season is not unheard of. If we’ve said it once we said it a hundred times not to be quick to predict the demise of the consumer. It does warrant a healthy dose of attention, however, as we start to get the first-tier reports for February in the next two weeks.

- One of those will be tomorrow’s Conference Board Consumer Confidence Survey for February. Yes, another survey report, but while the confidence reading is expected to dip slightly from 104.1 to 102.7, we’ll be paying more attention to the Labor Differential reading (Jobs Plentiful – Jobs Hard to Get). Recall, that it ticked lower last month, resuming a second half 2024 slide that was interrupted by a three-month uptick into year-end. Given the government job-cutting, and hesitancy expressed in hiring in the PMI survey, it won’t be a shock to see the differential tick lower again in February.

- All of this concern over the consumer will bring even more attention to the headline report of the week which is Friday’s Personal Income and Spending for January. While the PCE inflation series will get top billing, and a decent outcome is expected there, attention will now be paid to the personal spending side of that report, given the retail sales weakness reported earlier. Remember that this series is more comprehensive than retail sales and covers a bigger swath of the services side so if it notes weakening too, it will most likely provide another round of Treasury buying and equity selling.

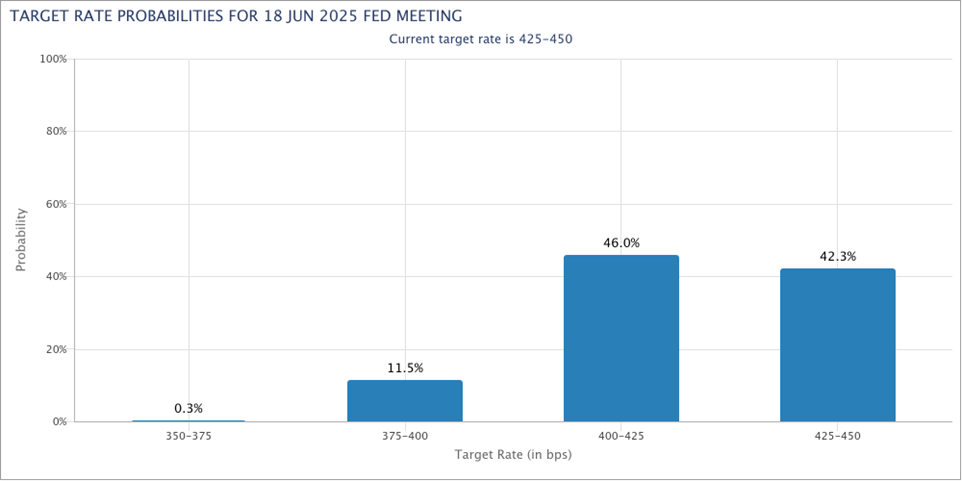

- And all of this is too early for the Fed to abandon its oft-expressed confidence in the US economy that they believe will allow them to comfortably sit on their hands waiting on 2% inflation. While it may be too early for the Fed to start squirming, at least publicly, the futures market is already adjusting its outlook with increasing odds of a mid-year rate cut to 57%.

After Weak Consumer Readings Odds Increase for June Rate Cut Source: CME

Source: CME

Services Activity Dips Into Contraction Territory for First Time in Two Years

UMich Survey – Jump in Unemployment Expectations to Highest in Five Years

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.