More Inflation Data Due This Week

More Inflation Data Due This Week

- Treasury yields are drifting a bit higher this morning as investors await Treasury supply today and tomorrow (more on that below). The data calendar also picks up this week, and Fed speak will be plentiful, although comments are likely to sound familiar to last week’s patient pause messaging. Presently, the 10yr Treasury is yielding 4.26%, down 3/32nds in price while the 2yr Treasury is yielding 4.70%, down 1/32nd in price.

- A slow week of data is usually followed by a busy one and that is the case this week, with a host of first tier releases, Treasury auctions, and ongoing Fed speak all vying for investor attention this week.

- The headline release will be Thursday’s Personal Income and Spending Report for January with the Fed’s preferred PCE inflation series garnering most of the focus. Expectations are that core PCE will increase 0.4% which would be an uptick from December’s 0.2% and the highest since last January. With last January’s big 0.5% MoM print rolling off it allows the expected YoY to tick lower from 2.9% to 2.8%. Overall PCE is expected to increase 0.3% MoM with the YoY dipping to 2.4% from 2.6%. Stickiness in core service prices will get most of the attention by the Fed as they’ve identified that as the key to navigating the last mile from 3% to 2%. The PCE series is more comprehensive than CPI, so we’ll see how that broader series is measuring cost pressures on the services-side of the economy.

- Treasury supply will populate this week as well with $63 billion in 2yr notes and $64 billion in 5yr notes on offer today, and $42 billion in 7yr notes tomorrow. That’s $169 billion in coupon supply which is why we expect the short to intermediate part of the curve to trade a bit heavy until we’re past the auctions, and investor appetite for the debt can be assessed.

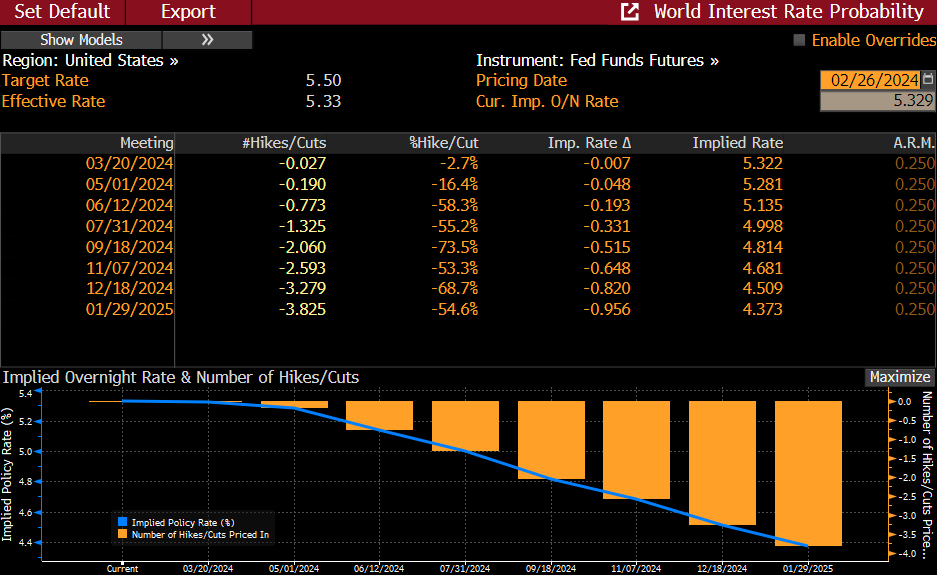

- At least ten Fed speakers will offer up their opinions on the economy, inflation, and Fed policy this week, with Kansas City Fed President Jeff Schmid (non-voter, moderately hawkish) the first to go this evening at an event in Oklahoma City. Frankly, we expect to hear more of what we heard last week and that is summed up Fed Governor Waller’s speech last week entitled, What’s the Hurry? With a somewhat steamy core PCE expected on Thursday, we don’t see the tone changing this week which should keep odds of mid-year rate cuts under pressure.

- Finally, the government is poised to partially shutdown on March 2nd, with a second wave of closures on March 8th if a spending plan is not agreed to by then. As we’ve been through these rodeos a few times already, essential services like Treasury auctions, maturity and interest ayments, and social security checks, etc., won’t be affected. The biggest risk to markets is possible delays in economic reports. The February CPI due on March 12, and PPI/Retail Sales on March 14th lead the list of reports that could be delayed if a shutdown continues past those dates.

Market’s 2024 Rate-Cutting Expectations Drifting Towards Fed’s 75bps Outlook

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.