More Housing Numbers and Treasury Supply This Week

More Housing Numbers and Treasury Supply This Week

- Treasuries are sharply unchanged as the week opens which includes another dose of supply. 2yr ($69bn), 5yr ($70bn), and 7yr ($44bn) note auctions will take place this week which should keep any rally attempts on a short leash. Last week’s longer duration auctions were generally well received, so the shorter maturities should be put away without difficulty, but some concession should be expected. Currently, the 10yr note is yielding 4.26%, unchanged on the day, and the 2yr is yielding 4.74%, up 1bp on the day.

- The data this week will be focused on housing, but the highlight of the week will be May PCE on Friday. That report is expected to show core PCE at 0.1% MoM with the yearly rate dipping to 2.6% from 2.8% which would play well with the odds for a September rate cut. With CPI and PPI in hand, the ability to forecast PCE is much better than CPI estimates, so the market may already be pricing in much of the potential “good” inflation news.

- Given the weakness in the Retail Sales report for a second straight month, personal spending will get plenty of attention after the PCE numbers are absorbed. Expectations are for spending to increase 0.3% vs. 0.2% in April. The Personal Spending series incorporates more service-side items which has been where the consumer has been focused for some time; thus, a bit better spending level vs. Retail Sales is the forecast which will keep the debate over the health of the consumer continuing into July.

- The housing data last week (starts/permits and existing sales) disappointed but we’ll get more housing numbers this week to provide a little more color on the health of this sector. The first will be tomorrow’s S&P CoreLogic CS 20-City Home Price Appreciation numbers for April. Expectations are for yearly appreciation in the 20-city series to dip from 7.38% to 7.00%. Coming off a peak appreciation rate of 21.3% in April 2022, just as the Fed was embarking on their rate hiking campaign, appreciation rates gradually slowed with four straight months in the first and second quarter of 2023 going negative. That brief depreciation has since reversed with appreciation rates rebounding to 7.38% in March. This rebound in appreciation will eventually lead to upward pressure on OER but given the long lag time that will be a next year issue for inflation.

- New Home Sales follow on Wednesday with 640k annualized sales expected vs. 634k in April. That level of activity has been the norm for the past year. One advantage to this report over some other housing numbers is that it’s based on contract signings and not closings so it’s a more current look at housing than existing sales, but it remains a small 10% part of the overall housing market. Recent sales activity does show that buyers aren’t flooding to the new home market even though builders can generally buydown mortgage rates, making affordability a little easier.

- The third and final update to first quarter GDP arrives on Thursday with a slight uptick from 1.3% to 1.4% expected. Personal consumption (2.0), and core inflation (3.6% annualized) are expected to be unchanged from the second estimate. The Atlanta Fed’s GDPNow model is calling for second quarter GDP to rebound to 3.0% while Bloomberg’s consensus forecast is a bit lighter, but still healthy, at 2.4%.

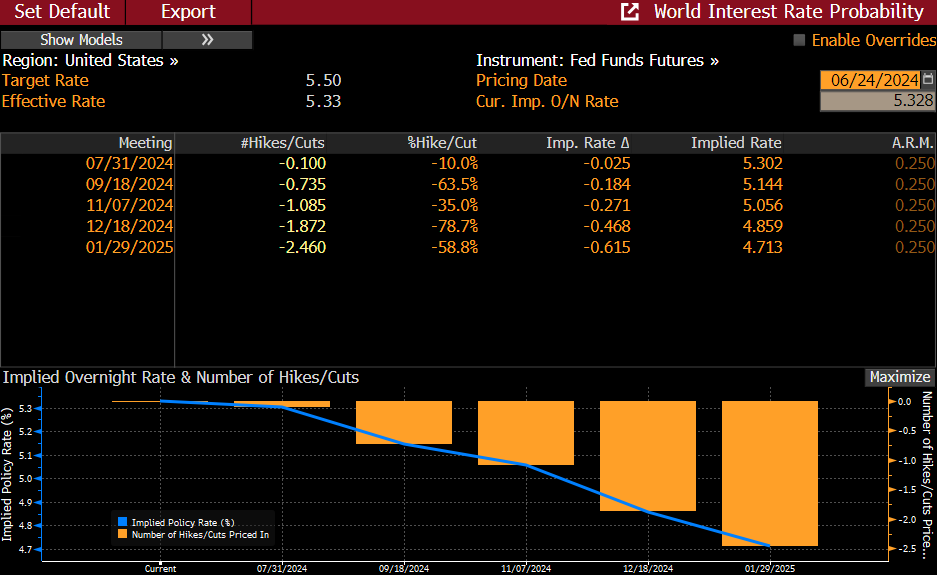

- Last Friday’s S&P Global preliminary PMI series for June came in better than expected with both manufacturing and services above expectations and well into expansion territory (i.e., >50). Thus, we continue to confront survey data that at times conflicts with “hard” data. This time, the hard data indicates a softening in the consumer, but was the weaker-than-expected April and May retail sales numbers simply a pause that refreshes, or a permanent downturn in consumption? Friday’s personal spending numbers will help to add color to that question, but the more critical report will come on July 5 with the June employment report. Expectations are for a slight downshift from 272k to 185k in job gains with the unemployment rate unchanged at 4.0% and average hourly earnings slowing slightly from 0.4% MoM to 0.3%. If those numbers come as expected it will continue to give the Fed comfort that they have time to remain higher-for-longer while waiting for inflation to move closer to the 2% target. All that said, the futures market still sees good odds (63.5%) of a September rate cut (see table below).

Futures Market Still Sees Good Odds (63.5%) for a September Rate Cut

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.