More Fed Speak and an Early February Inflation Number

More Fed Speak and an Early February Inflation Number

- Treasuries are hovering around unchanged levels this morning as a final slate of five Fed speakers go at it today, and we get our first look at February inflation pressure, or lack thereof, in the ISM Manufacturing Survey later this morning, (more on that below). Presently, the 10yr Treasury is yielding 4.29%, while the 2yr Treasury is yielding 4.64%.

- The rally yesterday off the January PCE numbers wasn’t so much about them being good, rather, it was a case that they weren’t worse. That shows the power of expectations vs. what the report told us. Core PCE rose the expected 0.4% (0.416 unrounded), and was the highest since January 2023 when it also printed 0.4%. Given favorable base effects the YoY rate managed to tick down to 2.8% vs. 2.9%. That also matched expectations. Those favorable base effects continue into June, so making progress on the YoY rate should continue through mid-year, then those base effects get more challenging.

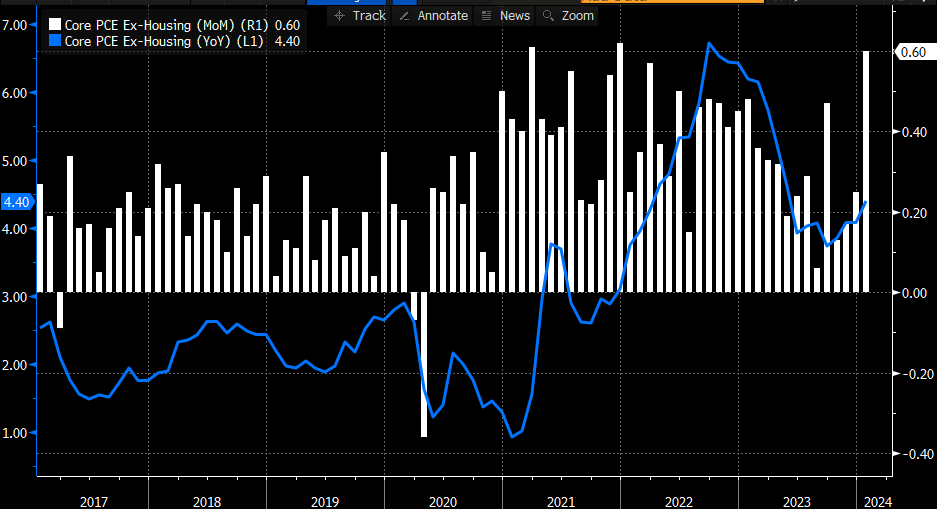

- One obvious fly in the ointment was the jump in core services with prices rising 0.6%, the highest in two years (see graph below). In addition, purchases during the month shifted more towards services vs. goods and that led to the 0.4% uptick in core PCE for the month. Goods prices actually deflated -0.2% during the month but as the consumer is shifting to services that goods deflation is having less of an impact on overall inflation levels. The Fed has made it clear they view the “stickiness” in core services as one of the key metrics they are watching. Those service prices will have to ease before the Fed will feel comfortable in proceeding with rate cuts.

- One more point is that January continues to be a confounding month for data. The monthly increase in core PCE this year matched the increase in January 2023. Also, the pick-up in core services prices was the highest since January 2022. That plays well with the crowd that wants to wave off the January reports as one-offs due to wonky seasonal adjustments and a couple other issues particular to January. It definitely puts more importance on the February inflation numbers with CPI due on March 12.

- Actually, we will get a look today at an early inflation read when the ISM Manufacturing Survey is released at 10am ET. While the headline gauge is expected to improve slightly but remain in contractionary territory (49.5 expected vs. 49.1 January), the prices paid component will get the most attention. Recall, it popped last month to 52.9, the highest in 18 months and is expected to edge higher to 53.2 in February. While manufacturing is a sliver of the overall economy, the prices paid metric does provide an early look at February pricing pressure, or lack thereof.

- The Fed speak has been nonstop this week, but the message has been mostly the same, and that is there no reason to hurry towards rate cuts, but rate cuts are likely “later this year.” We have five more speakers today led by probably the second most influential member in Governor Chris Waller. Since his appointment to the FOMC he has emerged as one of the thought leaders in the group, so the recent softening in his previously hawkish stance was noted by the market. We suspect, however, with the noisy January data, and plenty more to come from maybe “cleaner” February data, he’ll strike a similar tone to most of the Fed speakers that we’ve heard in the last week.

- The Treasury successfully auctioned off a huge $169 billion in coupon-bearing debt this week, and while there was some indigestion in taking down that size, it was managed without a huge backup in yields. The good news on the supply front is that it’s nearly two weeks before the next coupon auctions so a bit of reprieve, and one less thing to worry about for short while. The bond bears point to the increasing size of auctions as a recipe for higher yields, and that could still be the case, but for now enough investors are showing up with cash to buy and that is keeping the rate backups in check.

Core Services PCE Ex-Housing: Highest Monthly Increase in Two Years

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.