More Cool Inflation Numbers Match the Dovish Pivot

Inflation Numbers Continue to Improve in November

- This morning’s PCE inflation numbers should have been friendly for Treasuries as they came in cooler than expectations but a large pick-up in durable goods orders, led by aircraft, tempered the PCE-inspired bids. Durable goods orders for November rose 5.4%, easily beating the 2.5% forecast and that offset a decrease of -5.1% in October. Ex-transportation orders were up 0.5% vs. 0.1% expected and a -0.3% decrease in October. Before this morning’s releases, the 10yr note was yielding 3.85% and is now at 3.86% while the 2yr was 4.32% and is now at 4.34%.

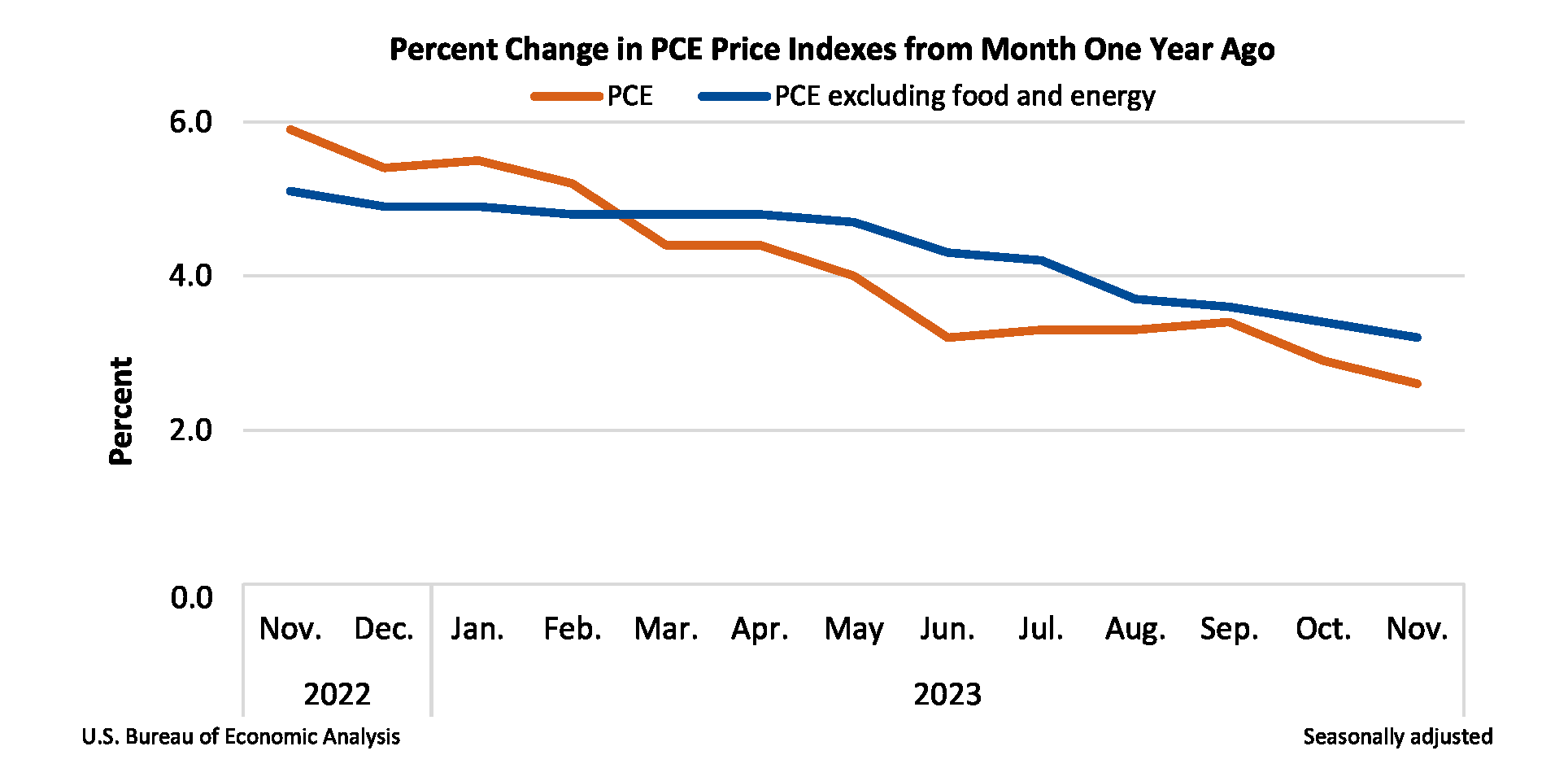

- Meanwhile, the much anticipated inflation numbers are in and they are mostly conducive to the recent bond rally. Overall PCE came in a tenth lower than expected decreasing -0.1% vs. 0.0% expected and unchanged in October. The YoY print moved three-tenths lower to 2.6% vs. a downwardly revised 2.9% rate in October. The YoY rate bested the 2.8% pre-release expectation and is the lowest since February 2021. It’s also below the Fed’s 2.8% year-end forecast. On a six month annualized basis the rate is 2.0%.

- The all-important core PCE also came in better than expected increasing 0.1% (0.058% unrounded) vs. 0.2% expected and the downwardly revised 0.1% gain n October. The YoY core rate dipped to 3.2% from a downwardly revised 3.5% in October and beating the 3.3% expectation. The core YoY pace is the lowest since March 2021 and on a six-month annualized basis is down to 1.87%. The 3.2% YoY rate matches the Fed’s latest year-end forecast with one month remaining to perhaps dip below it. While the Fed won’t declare victory off these numbers it does match with the dovish pivot last week and will certainly keep the market’s aggressive rate cutting expectations in place.

- Also, the report saw personal spending increase 0.2% vs 0.1% in October, missing the 0.3% expectation. Real personal spending, adjusted for inflation, rose 0.3% from 0.1% in October. So, spending growth, both nominal and real, rose in November from a lull in October. One thing that caught our eye was the spending was led by a 0.5% gain in goods and 0.2% in services. Goods spending was led by recreational items and cars. The services-side gain was led by food services and accommodations. So, the consumer continues to spend and the goods-side increase is interesting as that had been softening earlier in the year.

- On the income side, personal income grew at 0.4% matching expectations and beating the 0.2% increase in October. So, even with an increase in MoM spending, the bigger increase in income is allowing the consumer to replenish savings to a certain degree. That had been an area analysts were spying as a possible catalyst to expect the consumer to slow spending as they had been increasingly dipping into their savings to finance consumption. The personal savings rate increased 4.1% vs. 4.0% in October and is the highest since August.

- Another factor that may keep the consumer standing for longer than anticipated are some large fiscal stimulus programs that remain. The Inflation Reduction Act, CHIPs Act, and the Infrastructure Act will be dosing shots of adrenaline into the economy via outright dollar investments and tax credits to spur private investment. These programs are expected to hit their stride in 2024, so while plenty of pandemic-era programs have expired there remains some fiscal stimulus still to come.

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.