Moody’s Finally Joins the Rest in US Debt Downgrade

- The Friday afternoon downgrade of US Government debt by Moody’s (Aa1 from Aaa) has Treasury yields higher and a risk-off tone in equities to start the week. Moody’s (a lagging indicator per Treasury Secretary Bessent) becomes the last major rating agency to make the downgrade, and it comes as the House struggles to get past the early steps to begin voting on President Trump’s “Big Beautiful Budget Bill.” The week is light on new economic releases so the price action itself, and DC headlines, will be the driving force this week. Currently, the 10yr is yielding 4.55%, up 11bps on the day, while the 2yr is yielding 4.03%, up 5bps on the day.

- As mentioned above, Moody’s became the last of the major rating agencies to downgrade US Government debt on Friday afternoon citing an inability to address the widening budget deficit problem. That’s not a new story for sure, so the impact is less than when S&P and Fitch years earlier downgraded US debt over the same concerns. Perhaps the latest proposed budget, which is struggling to make it to the House floor for a vote, and offers no hint that the deficit situation will be seriously addressed, became the proverbial straw that broke the camel’s back for Moody’s. In any event, it has Treasuries on the back foot, particularly longer-dated issues with the 10yr solidly over 4.50% and the 30yr over 5.00%.

- We mentioned the economic calendar is sparse, but Fed Speak will not. It will be a full slate of speakers. Atlanta Fed President Bostic (non-voter) gives welcome remarks at the Atlanta Fed conference. Fed Governor Jefferson (voter) also delivers keynote remarks at the Atlanta Fed conference. NY Fed President Williams (voter) speaks in a moderated conversation. Dallas Fed President Logan (non-voter) gives remarks and will moderate a panel at the Atlanta Fed conference. Minneapolis Fed President Kashkari (non-voter) takes part in a moderated Q&A. Bostic returns later for a Bloomberg interview. Given that “uncertainty” is the latest Fed watchword, and with little certainty had of late, we don’t expect to hear much beyond the recent mantra of patience in the face of the uncertainty.

- The limited calendar opens today at 10am ET with the latest Leading Index for April. The Leading Indicators series has been signaling an imminent recession for over a year, which has diminished its credibility, but today’s report will be viewed on whether that recession signal is increasing. Unsurprisingly, expectations are that the index slips a bit lower into negative territory from March (-1.0% from -0.7%).

- Truth be told, probably the highlight of the releases this week will be the weekly jobless claims on Thursday, and that report has been rather boring of late. As investors, and the Fed, look for signs of labor market slowing and layoffs increasing, jobless claims have been quiet. Expectations for this week are the same with claims expected to inch up from 229 thousand to 230 thousand.

- The preliminary S&P Global US Manufacturing PMI for May will also be released on Thursday with a drop back into contractionary territory expected for the manufacturing sector in May (49.8 vs. 50.2). With no releases due on Friday and a holiday weekend in the offing, we think attention will be modest for the last of the data points in what should be a slow week.

- Away from the limited new economic news, Treasury coupon supply returns this week with $16 billion in a 20-year refunding auction on Wednesday and $18 billion 10-year TIPS reopening on Thursday. So far in May, coupon auctions have been met with elevated demand despite the uncertainty around the economic outlook and fears of flagging foreign demand. This has, at least for the time being, helped alleviate concerns around global investors willingness to continue underwriting the US deficit. In that regard, Thursday afternoon will see the release of the investor class data for the coupon auctions that settled on May 15th (3s, 10s, and 30s). The details for the 10-year auction will garner the most attention. Recall that auction stopped-through by 1.2 bp with end-users taking their largest share of a new-issue in over two years (91.1%). From anecdotal information gleaned from other auction stats, we don’t expect the foreign allocation numbers to challenge the narrative of consistent foreign buying. We’ll see if the actual numbers back up that case.

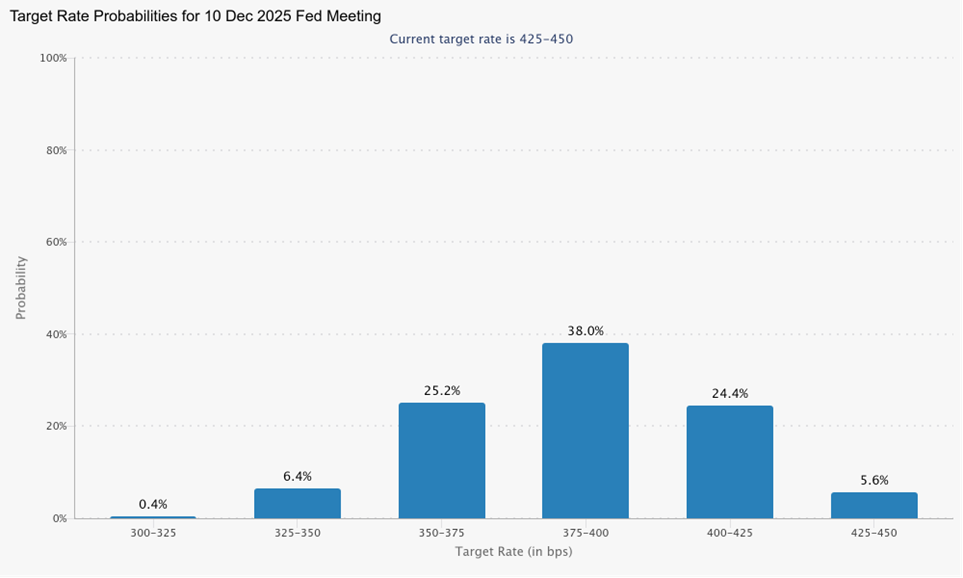

Futures Market after Moody’s Downgrade: Still Seeing Two 25bps Rate Cuts this Year

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.