Mid-Summer Inflation Week Arrives

- Treasuries are taking weekend developments in stride this morning which has been the tendency of late, but the question always lurks, for how much longer? Japanese long bond yields rose again, talk of 30% tariffs on Mexico, Canada, and possibly the EU, have been threatened and criticism against Powell over Fed HQ renovations only seems to be gaining members to the choir. Yet, Treasuries are handling it in stride. We’ll see how that transpires during the week as the inflation numbers start to roll in. Currently, the 10yr is yielding 4.43%, up less than a basis point on the day, while the 2yr is yielding 3.89%, down 2bps on the day.

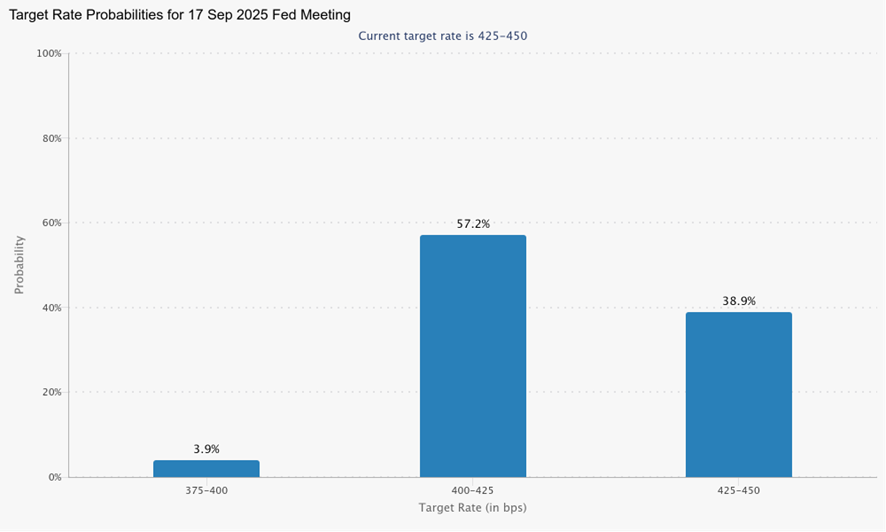

- While we’ve reached the mid-summer mark, Inflation Week arrives to remind us of whether this is the month tariff costs definitively show up in the data. We tend to think it’s still too early, but little tells here and there may still emerge from the data. While the last jobs report wasn’t great, it was good enough to dash thoughts of a rate cut later this month, or so we think. But even with stellar inflation reports, talk of more tariffs, namely hikes to Canada and Mexico and maybe the EU, will reduce the impact of decent reports on inflation. Still, with the market now eyeing September as a first possible rate cut date, as expected inflation readings will go a long way in buttressing those odds.

- Tomorrow’s June CPI read is expected to show overall inflation rose 0.3% for the month vs 0.1% in May, and the YoY rate ticking up from 2.4% to 2.7% as lower summer readings from last year roll off. Meanwhile, core CPI is expected to also increase 0.3% MoM vs. 0.1% the prior month, forcing the YoY up from 2.8% to 3.0%. For those couple holdouts on the Fed eyeing a July cut, good luck with those numbers if they come to be realized.

- As we’ve mentioned for a few months, with the hotter first quarter 2024 numbers out of the calculations, achieving further improvement in the YoY rate towards the Fed’s 2.0% goal will be exceedingly difficult, especially as the summer of 2024 produced a string of low readings, and adding to that headwind is the eventual tariff impact in some form. That’s part of the reason in their March and June forecasts, the Fed saw little if any improvement in inflation towards the 2% target this year, and that’s probably still a safe bet.

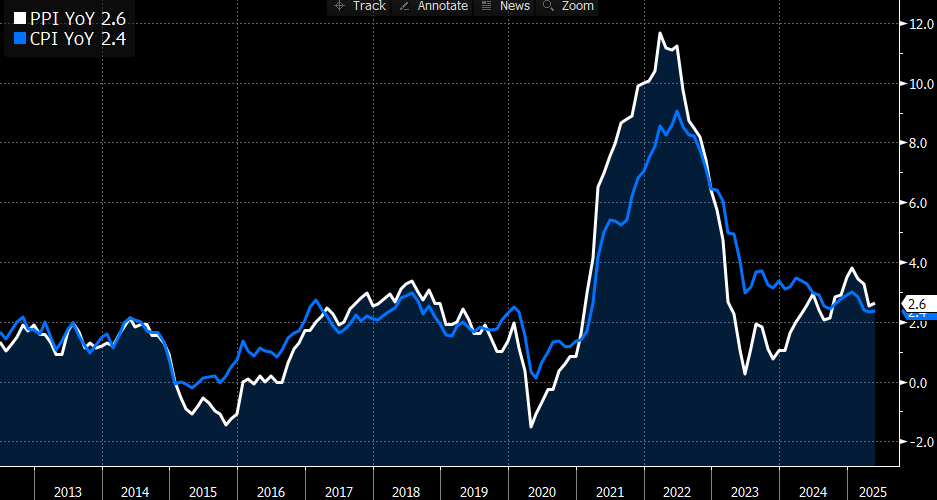

- The CPI report will be followed on Wednesday by a look at wholesale pricing pressure with June PPI. Recall, part of the reason behind the big drop in retail-level inflation (read: CPI) in 2022 and 2023 was deflation in wholesale prices that was partially passed on in lower retail prices. Wholesale prices are no longer falling and, while the climb earlier in the year has stalled, tariff costs seem likely to begin showing, at least in intermediate inputs, particularly steel and aluminum. That will also work against CPI from falling to the Fed’s 2% target.

- Taking a break from inflation, Thursday will bring us a fresh look at consumer spending habits in the form of June Retail Sales. Expectations are that overall sales rose +0.1%, representing something of a recovery from May’s -0.9% drop that was dented by slowing auto sales that came after a pre-tariff surge earlier in the year. Within the details of the release, investors will be focused on the Control Group-a direct feed into GDP- which is seen up +0.2% after May’s +0.4% and April’s -0.1%. This would put the second quarter average at 0.17% compared to the first quarter’s average of 0.27%. This rather lackluster rebound is not encouraging, especially after first quarter personal consumption was revised down to a quarterly-annualized pace of just +0.5%; the lowest since the second quarter of 2020. Right now, the Atlanta Fed has second quarter GDP at 2.6% so we’ll see how that gets adjusted following these latest sales numbers.

- Thursday also brings Initial Jobless Claims, and the preliminary look at the latest University of Michigan Sentiment Survey. Weekly jobless claims have moderated some of late but continuing claims continue to creep higher above 1.9 million. The low-fire, low-hire environment has been in place for some time, and we see that trend continuing in the June numbers as well.

- Meanwhile, consumer sentiment levels will get attention in the U Mich numbers, in addition to the inflation expectations. The prior inflation expectations retreated some from the spike in May, but with tariff talk swirling by the day, it will continue to be the most closely watched metric in the report.

- We have one more week of Fed Speak before they go into the Cone of Silence before the July 29-30 FOMC Meeting, so expect some feedback from members as the inflation data rolls in, not to mention the verbal bombs directed at Fed Chair Powell from the White House and supporters as they question his interior design choices. Perhaps this could be a new series on HGTV?

Futures Focus on September Meeting as Next Rate Cut Date Source: CME

Source: CME

PPI Deflation Had Helped Lower CPI but that Tailwind Seems Over – Especially When Steel and Aluminum Tariffs Hit

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.