Maybe the Fed Would Like a Do-Over on its Latest Forecast?

Maybe the Fed Would Like a Do-Over on its Latest Forecast?

- The cool May CPI report on Wednesday was followed by a cool PPI report yesterday, which will most likely provide a favorable PCE read later this month, and that has Treasury yields continuing to drift lower. One last inflation report came this morning, and it too provided a favorable read on easing price pressure in May (more on that below). Currently, the 10yr note is yielding 4.22%, down 2bp in yield, and the 2yr is yielding 4.68%, down 1bp in yield. It’s the lowest yield since April 4th.

- The cool May CPI report was followed up yesterday by another cool read, this time at the wholesale level when the May PPI printed below expectations, and well below April levels. Final Demand PPI was down-0.2% for the month vs. 0.1% expected and 0.5% in April. On a YoY basis, it ticked down from 2.3% to 2.2% while the expectation was 2.5%. PPI ex-food and energy was unchanged vs. 0.3% expected and 0.5% in April. On a YoY basis it fell from 2.4% to 2.3%. Finally, PPI ex food, energy and trade was unchanged vs. 0.3% expected and 0.4% in April. On a YoY basis it remained at 3.2%.

- With the weaker-than-expected PPI, the updated forecasts for the Fed’s preferred inflation gauge, core PCE, is likely to print around 0.12% – 0.15%. Anything shy of 0.15% would round to 0.1% which would be a downtick from April’s 0.2% (.0245% unrounded) and drop the YoY to 2.6% from 2.8% in April. The Fed’s updated year-end forecast from Wednesday’s FOMC meeting was revised higher from 2.6% to 2.8%. The May PCE report is due June 28th.

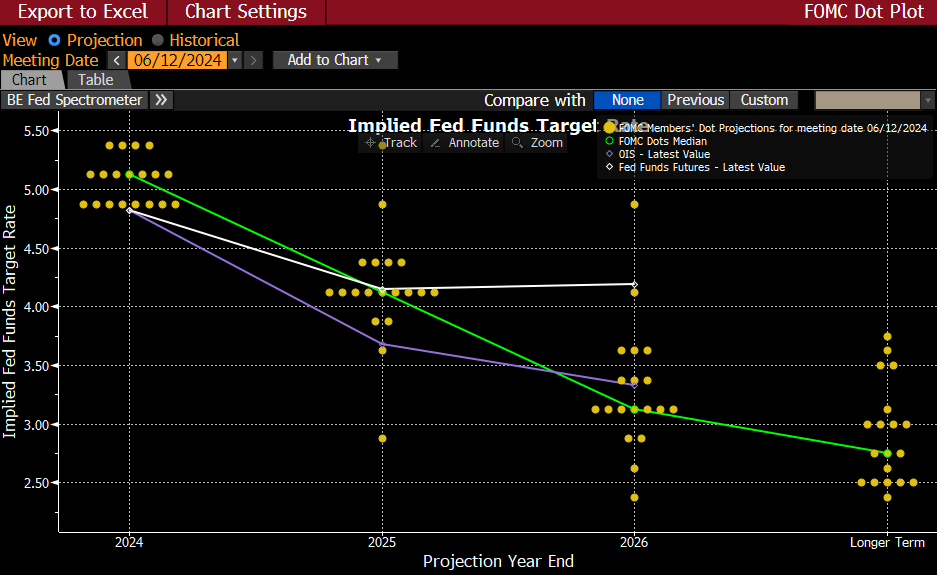

- That leads us to the admission by Powell that most members didn’t update their forecasts after the CPI release, so the projections, both on rates and economic metrics, was perhaps outdated before it was even published. And given the increase in continuing claims yesterday to the highest level since January, and before that the highest since November 2021, so it adds more questions to how strong the labor market really is. That could make the year-end 4.0% unemployment rate forecast a bit questionable as well. Finally, while the headlines from the meeting highlighted the one cut call for this year, eight members forecast two rate cuts while seven forecast one. The four curmudgeons forecasting no rate cuts pushed the median to one cut even though a plurality of members see two.

- The reality is, given a full acknowledgement of the Goldilocks CPI, cooler PPI, and increasing continuing claims, two rate cuts are probably where the Fed would come down today. That’s why the futures market is still pricing decent odds for that to happen despite the Fed’s latest forecast.

- We’re not done yet with inflation readings this week. This morning, we received the May Import and Export Price report. Import prices fell -0.4% vs. -0.1% expected and less than the 0.9% gain in April. That kept the YoY rate at 1.1%. It was the first monthly drop in import prices this year. Imports less petroleum fell -0.3% vs. 0.2% expected and 0.7% in April. That’s the first monthly drop since October 2023. Export prices decreased -0.6% vs. 0.1% expected and 0.6% the prior month. That’s the first drop in export prices this year. YoY export prices increased 0.6% vs. -1.0% in April. While May’s numbers are decidedly cooler than April, the deflationary trend for much of last year is over which is leading to higher YoY rates, albeit to very modest levels. In any event, a month-over-month downtick in import and export prices is another cooler May read vs. April.

- Later this morning, we’ll get the preliminary June University of Michigan Consumer Sentiment read. The focus will be on the inflation outlook and given that it is driven a lot from gas price direction, and gas prices were lower of late, the expectation is for the 1yr inflation read to tick down from 3.3% to 3.2%. The longer-term 5-10yr inflation call is expected to remain unchanged at 3.0%. Stable to lower inflation expectations are what the Fed is after so an as expected report will be greeted favorably.

2024 Rate Cut Forecast Reduced from 3 to 1 but it was a Close Call – 2 Cuts are Still a Possibility

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.