May Jobs Report Headlines Busy Week of Data

May Jobs Report Headlines Busy Week of Data

- Treasuries are rallying in sympathy to lower bond yields in Europe as the ECB readies an expected 25bp rate cut this week, despite the latest inflation numbers that were a bit hotter-than-expected. The lack of new supply this week is probably helping bids as well, but the week is chock-a-block with first-tier data that will add more insight into potential rate-cuts later this year (more on that below). Currently, the 10yr note is yielding 4.46%, down 5bp on the day while the 2yr is yielding 4.86%, down 1 bp on the day.

- The first week of a month brings plenty of data to chew on and this week is no different, and particularly more so coming just before the June 12 FOMC meeting. The May employment report on Friday will be the headline event but there will be plenty of first-tier data points on offer between now and then. Will they portray an economy that is continuing to slow after first quarter softness, or will it reveal a bounce in activity and jobs?

- The first of these reports will be this morning’s ISM Manufacturing Index with expectations for the headline number to improve slightly to 49.5 vs. 49.2 in April. So, still in contractionary territory but slightly less so. It is possible more attention will be paid to the prices paid component which popped to 60.9 in April, and May is not expected to be much improved at 59.0. That metric ran in the 40-50 range in the second half of last year, so the move to a cycle high in April speaks to the tougher inflation environment in 2024. The expectation sees that pricing pressure continuing. The new orders and employment components are expected to be close to April at 48-49ish levels for both.

- The job market has several reports due this week with the JOLTS Job Openings for April due tomorrow. Expectations are for openings to dip once again to 8.360 million vs. 8.488 million the prior month. So, the ongoing drop in this metric is expected to continue but it’s still above the 7 million level that dominated pre-pandemic. The Quits Rate will garner attention as well as it dipped to 2.1 from 2.2 in the last month which is a new cycle low and just below the 2.2% rate that prevailed pre-pandemic. This indicates declining worker confidence in finding a new, better paying, job. It joins some other recent employment metrics that are starting to point to a slowing labor market.

- Wednesday brings the ADP Employment Change report with 175 thousand new private sector jobs expected vs. 192 thousand in April. Recall the April BLS report had private sector growth at a lower 167 thousand, but expectations are for that to improve slightly to 170 thousand in May. Anyway, it will provide us with a first look at actual employment numbers for May.

- Before the Friday jobs report, the ISM Services Index will post on Wednesday with improvement from a disappointing April expected with 51.0 expected vs. 49.4 the prior month. This huge part of the economy had been running consistently above 50 (indicating an expanding sector) so the April dip below 50 was a surprise. If another sub-50 print happens it will certainly add to signals that economic activity is slowing. The prices paid component will get a gander as well. Recall, it popped to 59.2 in April. The year-to-date high is January’s 64.0, but it will get attention given its inflation indications. The services-side of the economy has been where the real stickiness in inflation has been residing and expectations are that that continued in May.

- Finally, Friday’s employment report is expected to show improvement after April’s softer numbers. Headline job gains of 190 thousand are expected vs. 175 thousand the prior month with the unemployment rate unchanged at 3.9%. Average hourly earnings are expected to improve to a 0.3% MoM gain vs. 0.2% in April, with the YoY pace unchanged at 3.9%. The Fed would like to see this YoY number edge lower into the low to mid 3% range. Expectations, however, are for modest improvement in the employment and wage picture from April and that will give the Fed comfort in their higher-for-longer messaging if expectations are met.

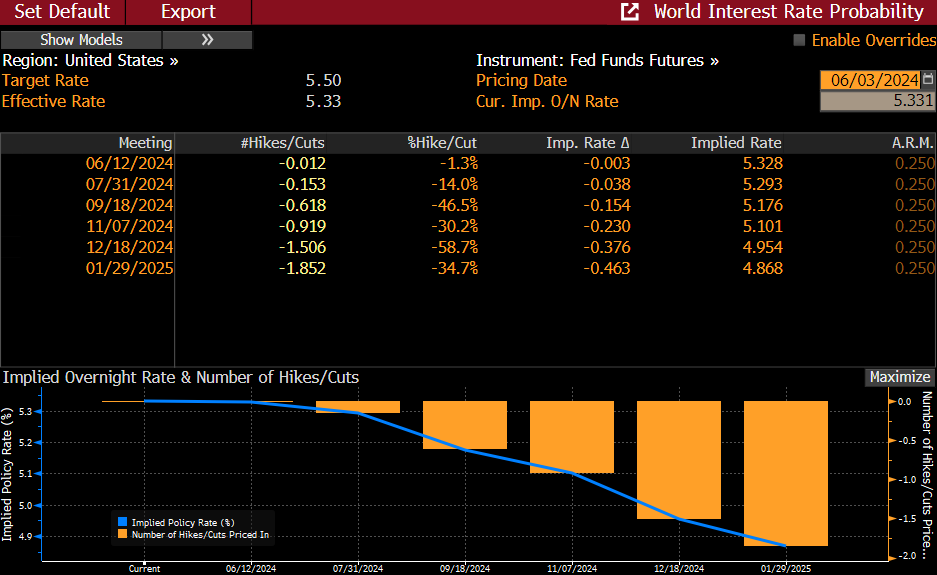

Rate-Cutting Odds Still Focused in Fourth Quarter – This Week’s Data Could Shift These Odds

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.