May Jobs Report Beats Expectations, but With Conflicting Signals

May Jobs Report Beats Expectations, but With Conflicting Signals

- Nonfarm payroll gains for May were 272 thousand vs. 185 thousand expected and 165 thousand in April (revised down from an initial 175 thousand). March was revised lower by 5 thousand jobs, and that continues a year-long trend of downward revisions. The gain in May jobs easily exceeded the 12-month average of 232 thousand. Private sector jobs increased 229 thousand vs. 165 thousand expected and 158 thousand in April (revised down from an initial 167 thousand).

- Yet again, the Household Survey (which generates the unemployment rate, etc.) reported a much different picture. For May, the survey reported a decline of 408 thousand jobs and saw only 25 thousand new jobs in April. As we’ve said before, combined with the usual downward revisions in the Establishment Survey, and the conflicting message in the Household Survey, it does give one pause as to how much to conclude definitively from these BLS reports, at least with the initial releases.

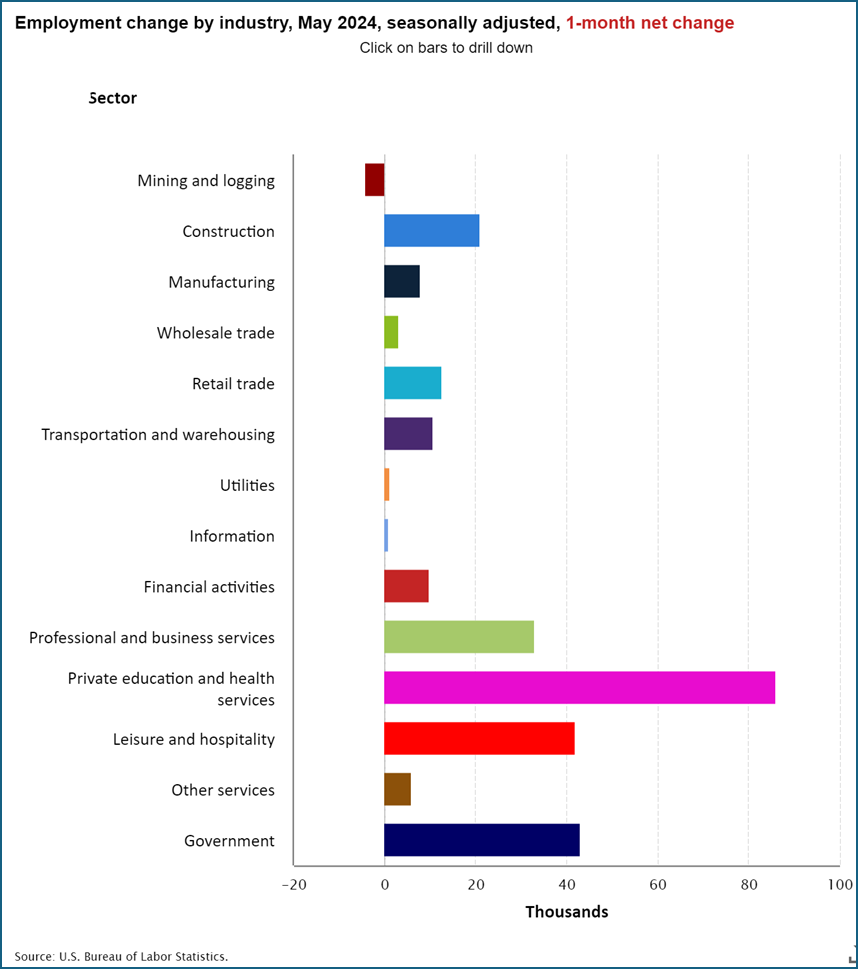

- Job gains were notable in healthcare/social assistance (84k), government (43k), leisure/hospitality (42k), and professional/business services (33k). Increased hiring in government, leisure/hospitality, and construction accounted for most of the pop in jobs from April. Job losses for the second straight month were concentrated in temporary help services at 14 thousand. This is a gathering trend and could signal some softening with firms reducing temp help as demand slows before moving to cut full-time workers. This is just another of the conflicting signals coming from the data.

- After dipping from back-to-back 0.3% MoM gains to 0.2% in April, Average Hourly Earnings popped in May to 0.4% vs. 0.3% expected. The year-over-year pace increased to 4.1% vs. 3.9% expected and 3.9% in April. Average weekly hours worked was unchanged at 34.3 hours, matching expectations. Weekly hours peaked at 35.0 a year ago, and it seems it is settling in the low 34-hour range, certainly not a sign of increasing labor demand.

- The pop in wage gains is not what the Fed wants to see as it keeps the potential for a wage-price spiral intact. Ideally, the Fed wants that YoY number to drift to 3.5%, or less, just above the 2% inflation benchmark. Monthly prints in the 0.2% – 0.3% range will do the trick while May’s 0.4% will be deemed too hot where inflation risk is concerned.

- The unemployment rate rose one-tenth to 4.0%, above the expected 3.9%, as the Household Survey reported an increase of 157 thousand in the ranks of the unemployed and a decrease of 250 thousand in the labor force (the denominator in the unemployment rate calculation). The labor force drop follows a small gain in April which is another conflicting sign. If job gains are so impressive it would seem more people would be encouraged to leave the sideline and head into the labor market pool, instead they’re heading in the other direction, at least per the Household Survey.

- The increase in the ranks of the unemployed dropped the Labor Force Participation Rate to 62.5% missing the 62.7% expectation. The participation rate a decade prior to the pandemic averaged 63.3% while the average over the past year has been 62.6%. We seem to be at a near-term plateau in the size of the labor force.

- After a bond friendly report in April, and after several softish labor-related reports already in for May, today’s BLS report was clearly an unexpected curveball. The headline beat and increased wage gains will dash hopes for any change in the higher-for-longer mantra at the Fed. That said, the continuing divergence between the two surveys may give Fed officials some pause as to how much to rely on today’s report. As mentioned, the Household Survey paints a decidedly weaker picture, but it is more in line with other recent labor-related reports that indicate some softening. However, that survey is much smaller in size, so deference is paid to the Establishment Survey when they conflict.

- There is, however, increasing discussion that the Establishment Survey’s Birth/Death Business Adjustment is off and has been off for some time dating well back into 2023, overstating business starts and understating business closures. Revisions/benchmarking will be made in August, with some estimates at 700 thousand overstated jobs. Thus, don’t write-off a September rate cut just yet, but next week’s CPI report will be a bigger piece of that puzzle.

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.