Markets Rethinking Recession Risk

Markets Rethinking Recession Risk

- Treasury yields are edging lower this morning after they popped yesterday in the wake of better-than-expected initial jobless claims reducing some of the recession angst. Equity futures are lower into the open and that modest risk-off tone before a weekend, and after a big runup yesterday, is not surprising. There’s no data on offer today but next week brings plenty of inflation news headlined by CPI on Wednesday then Retail Sales on Thursday so that will be the focus for investors. Currently, the 10yr note is yielding 3.93%, down 7bps on the day while the 2yr is yielding 4.02%, down 3bps on the day.

- The Weekly Jobless Claims report is sometimes given limited attention, especially when the labor market is humming along, but with investors and markets focused on any new clues regarding the state of the labor market, this week’s report achieved first-tier status. After the prior week’s pop to 250 thousand claims, just shy of the cycle high of 258 thousand last August, this week’s number retreated to 233 thousand, short of the 243 thousand expected. By way of comparison, this series peaked at 665 thousand in March 2009 in the wake of the Great Financial Crisis (GFC) recession.

- With the claims number receding slightly, the recession angst also receded after ramping up in the wake of the prior week’s YTD high claims number followed by the weak jobs report. So, the risk of a dramatic weakening in the labor market was taken off the table, at least for this week. That led to an upward move in yields, especially the 2yr, as risks of intermeeting cuts, or large multiple cuts before year-end ebbed.

- The Continuing Claims series remained nearly unchanged at 1.875 million, and while that is near a three-year high, the stabilization brought calm to the market as well. By way of comparison, and excluding the pandemic/lockdown period, continuing claims peaked at 6.6 million in May 2009 during the fallout from the GFC recession. So, while it’s climbed some in the past year, we’re still a long way from the depths of the housing-related recession.

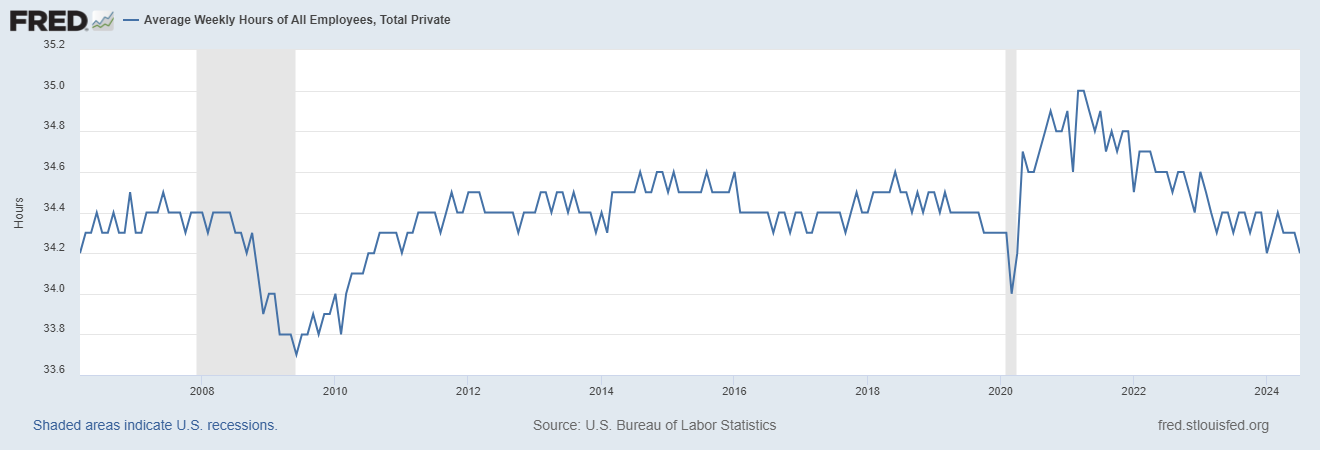

- These two series are especially important now as we look for signs of any further weakening in the labor market. So far, we’ve seen in the last four jobs reports a reduction in temporary help service employment, and in July the weekly hours worked ticked down to 34.2 hours from 34.4 at the start of the year. Again, comparing to the GFC recession, hours worked bottomed then at 33.7 hours. So, employers are shedding positions from temp help and cutting hours, but they are resisting the urge to layoff full-time employees. When/if we see that develop, we’ll know labor market weakness has taken another leg lower and odds of a recession will certainly increase. Until then, this is just more easing in the labor market but well short of a dramatic recession-inducing slide.

- Next week is Inflation Week headlined by July CPI on Wednesday. Expectations are for decent numbers that if they come in-line will keep a September rate cut firmly on the table. In fact, we’ll go so far as to say CPI would really have to come in hot (say 0.4% or higher MoM) for it to challenge odds of a rate cut. Even then we wouldn’t rule out a cut. To us, the question of a 25 or 50bps cut comes down to the August jobs report. If it’s as weak as July, and revisions don’t offset some of the weakness, then odds of a 50bps cut will increase tremendously. If it shows a modest bounce, or at least not further deterioration, then it’s probably a 25bps cut. That report is due September 6th.

Average Weekly Hours Worked Continues to Dip as Employers Resist Layoffs for Now

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.