Market Waiting on Friday’s PCE Inflation and Spending Numbers

Market Waiting on Friday’s PCE Inflation and Spending Numbers

- An upside surprise in Australian CPI (4.0% vs. 3.6% prior) has global sovereign yields higher and Treasuries are no exception, but some of the upward move is also consolidation of the recent rally. A 5yr note auction this afternoon ($70bn) will also weigh on the market, but the 2yr auction yesterday was well received and this morning’s higher yields should provide the conditions for another decent auction. Currently, the 10yr note is yielding 4.30%, up 5bp on the day, and the 2yr is yielding 4.73%, up 3bp on the day.

- Halfway into the week, the market remains largely in waiting mode for the May PCE inflation and spending numbers on Friday. Expectations have core PCE at 0.1% MoM with the yearly rate dipping to 2.6% from 2.8%. Recall, the Fed’s latest forecast has year-end core CPI at 2.8%. With CPI and PPI already in hand, the ability to forecast PCE is easier than CPI estimates, so the market may have already priced in a “good” report whereas a miss higher would bring on a bigger does of volatility (read: selling) and a reduction in September rate cut odds (currently at 60%).

- Personal spending will get its share of attention given the weakness in the Retail Sales report for the second straight month. Expectations are for spending to increase 0.3% vs. 0.2% in April and real spending (net of inflation) is expected to also increase 0.3% vs. -0.1% in April. The Personal Spending series incorporates more items than the retail sales series, especially on the service-side of the economy which is where the consumer has been focused of late. For example, Carnival Cruise Lines reported record earnings and record bookings into 2025 this week, and TSA airline boarding levels continue to run ahead of last year, with a record July 4th weekend expected. It seems service-side spending is continuing to be solid.

- Fed speak this week has started to reveal subtle differences of opinion between members. Before this week, FOMC members had largely been singing from the same higher-for-longer hymnal. Now, there is a split beginning to show. The week opened with San Francisco Fed President Mary Daly reminding everyone that the Fed also has a full employment mandate and that we may be nearing an “inflection point” where further dips in job openings could elicit a larger uptick in unemployment, and the Fed should be mindful of that in their quest for 2% inflation. Chicago Fed President Austin Goolsbee picked up on that theme in a Monday CNBC interview.

- Yesterday, we heard from two Fed governors with Michelle Bowman burnishing her hawkish reputation by saying she wouldn’t hesitate to hike rates if the data indicated such a move. Recall, she was one of the last FOMC members to buy into the current fed funds level as the terminal rate, so it’s not surprising that she hasn’t totally given up on the rate hike story. Meanwhile, Fed Governor Lisa Cook seemed more amenable to a rate cut but with the timing remaining unclear. We imagine that if PCE comes as expected, and June and July CPI don’t upset the apple cart, she could be a yes vote for a September cut. No Fed speak is expected today.

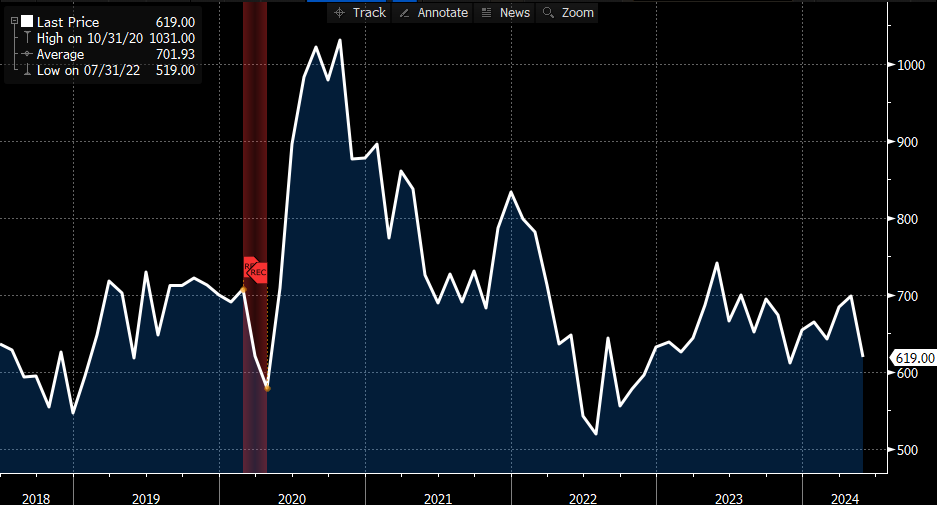

- Later this morning, we’ll get New Home Sales for May with 633k annualized sales expected vs. 634k in April. That level of activity has been consistent for the past year. The advantage this report has over some other housing reports is that it’s based on contract signings and not closings so it’s a more real-time look at housing than existing sales. The stability in sales activity shows that buyers aren’t flooding to the new home market even though builders can generally buydown mortgage rates, making affordability a little easier. Thus, housing activity continues to be constrained by high prices and 7% mortgage rates.

New Home Sales – Lowest Since November 2023

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.