Market Rethinks Friday’s Reaction to the Jobs Report

Market Rethinks Friday’s Reaction to the Jobs Report

- Treasury yields are grinding higher this morning as the fears Friday that a slowing jobs market may prompt a recession are given a more sober look today. A rebound in equities is occurring across the globe and stocks are opening higher here as the selling from Friday is partially reversed. There was a little for everyone in Friday’s employment numbers but translating that into imminent recession was probably a bridge too far. Currently, the 10yr is yielding 3.73% up 2bps on the day, while the 2yr is yielding 3.68%, up 3bps on the day.

- Friday’s release of the August jobs report was like one of those blockbuster movies, with plenty of advance billing and hype, that instead of meeting expectations left viewers unfulfilled. The clarity that the report was supposed to provide vis a vis 25 or 50bps in cuts instead provided a little for both camps with the picture as muddied as it was going into the report.

- Yes, the headline job gains missed expectations, but they were still above July’s disappointing totals, and the unemployment rate ticked down a tenth to 4.2%. And while revisions, which have consistently been to the downside, could knock the modest gain lower, average hourly earnings ticked higher along with hours worked, not exactly a signal of a collapsing jobs market. In addition, the participation rate of the prime age cohort (25yrs – 54yrs) remained near a 24-year high. Again, not a sign of collapsing labor demand.

- If one wanted to build a case for a 50bps cut they would point to the slowing in job gains, especially after downward revisions, and the three-month average is decidedly moving precariously below six figures. Yes, labor market momentum is slowing but that was the point of the rate hikes. The 25bps crowd will point to the improved unemployment rate along with wage gains, not to mention the gains in real wages as inflation continues to cool. We find ourselves in the 25bps camp, for now, especially after Fed Governor Waller’s post-jobs report speech.

- In that speech, Waller, who is regarded as one of the thought leaders FOMC, said a cut is coming in September, but the case for anything larger than 25bps remains to be seen. The money quote from his speech was this, “If the data supports cuts at consecutive meetings, then I believe it will be appropriate to cut at consecutive meetings. If the data suggests the need for larger cuts, then I will support that as well. I was a big advocate of front-loading rate hikes when inflation accelerated in 2022, and I will be an advocate of front-loading rate cuts if that is appropriate. Those decisions will be determined by new data and how it adds to the totality of the data and shapes my understanding of economic conditions.”

- So, it seems he sees the need for more data beyond the jobs numbers to convince him of a 50bps cut. For those so inclined the speech did provide some interesting comments on how the Fed views the current state of their dual mandates. You can find the full text here. The comments also calmed the futures market that bumped odds of a 50bps rate hike higher in the knee-jerk reaction to the topline miss in jobs. Those odds sit at a 32bps rate cut next week which implies 100% odds for a 25bps cut and 25% odds that it will be 50bps (see table below). That’s a touch lower than the odds that prevailed pre-jobs report.

- Away from the labor market, this week provides August inflation data with CPI on Wednesday and PPI on Thursday. However, while inflation reports have had top billing since the hiking cycle began, they have now moved to a supporting role as the labor market takes centerstage. Expectations are for 0.2% MoM gains in both the overall and core numbers with the overall YoY rate moving down from 2.9% to 2.6% while core remains stuck at 3.2% as the challenging base effects from last year continue to deny much YoY improvement as long as 0.2% MoM prints remain in place.

- While the inflation results won’t alter a 25bps rate cut next week, a particularly weak print could reignite the hopes of the 50bps crowd. What is likely to happen is that attention will be paid to the unrounded results, that is, is it a “high” 0.2% or “low” 0.2%, and how the stickier pieces of the inflation basket, like core services ex-housing and OER, behaved during the month. PPI follows on Thursday with modest cooling expected from July. With those two reports in hand, analysts will get to work in providing estimates for the month-end PCE numbers, which is the Fed’s preferred inflation series.

Futures Still See Greater Likelihood of a 25bp Cut Next Week

Source: Bloomberg

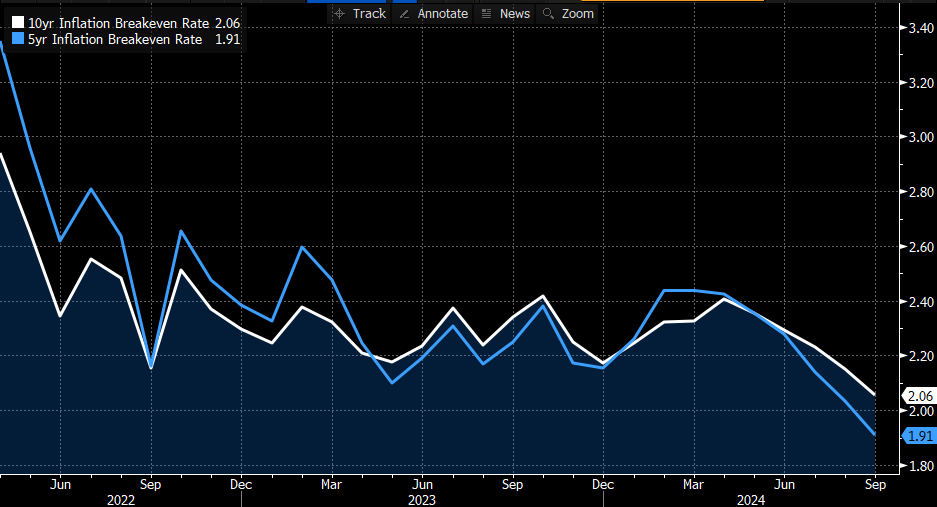

TIPS Inflation Breakeven Rates Continue to Drift Lower as Inflation Concerns Ebb

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.