Market Rather Calmly Awaits More Details on Tariffs

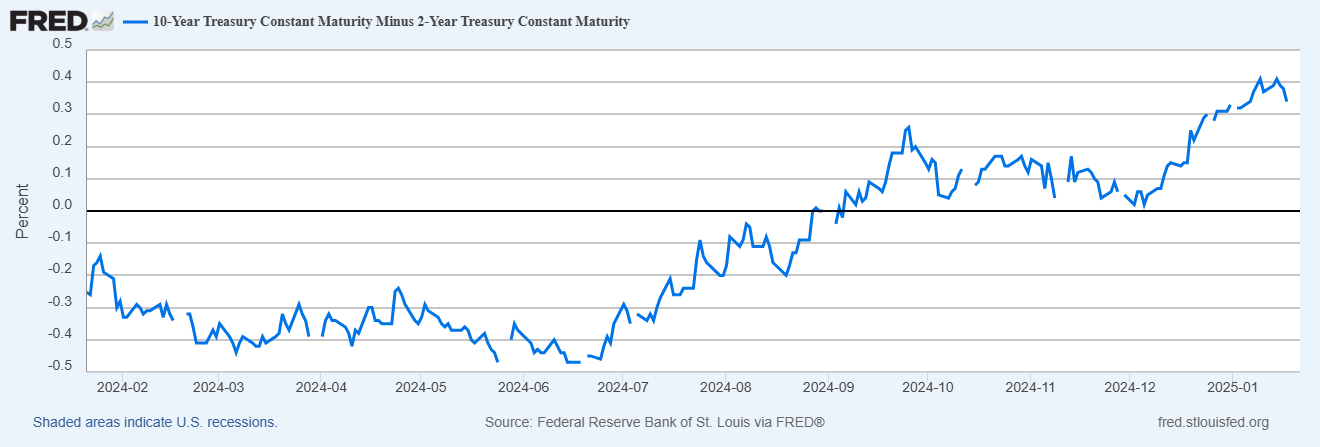

- Treasury yields are a tad lower this morning as the market continues to buy the fact on tariffs perhaps not being as onerous as threatened after the election. With Trump talking about 10% tariffs on China, and not 60%, along with the possibility that some may be rolled out in increments, the market is taking off some of the steepener trades that prevailed prior to the inauguration. Today is new day, however, and anything can happen with a new administration in charge. Currently, the 10yr Treasury is yielding 4.57%, down 1bp on the day, while the 2yr is yielding 4.27% down 1bp on the day.

- The news flow from the new Trump administration hasn’t slowed, nor did we expect it to, but the market, for the time being, is taking the onslaught of executive orders and comments on tariffs rather calmly. Given that we’re not staring at immediate double-digit tariffs against China and other trading partners the worst scenario from the lead up to inauguration has been avoided, and a bit of a relief rally has continued in Treasuries.

- Still, Trump has threatened Canada and Mexico with 25% tariffs starting on Feb. 1, while he also set an April 1 deadline to “review current trading practices.” So, some uncertainty remains over when tariffs may begin. He also mentioned yesterday a possible 10% tariff on China, which is far below the 60% floated during the post-election period. He also mentioned the EU for good measure as an abuser of its trading position with the US. So, the market is taking it all with a grain of salt at the moment and tending to side with the view that tariff talk will be a negotiating posture rather than an absolute declaration. Thus, yields remain well off their recent highs and the trading rather calm. That obviously won’t always be the case but take it while you can get it.

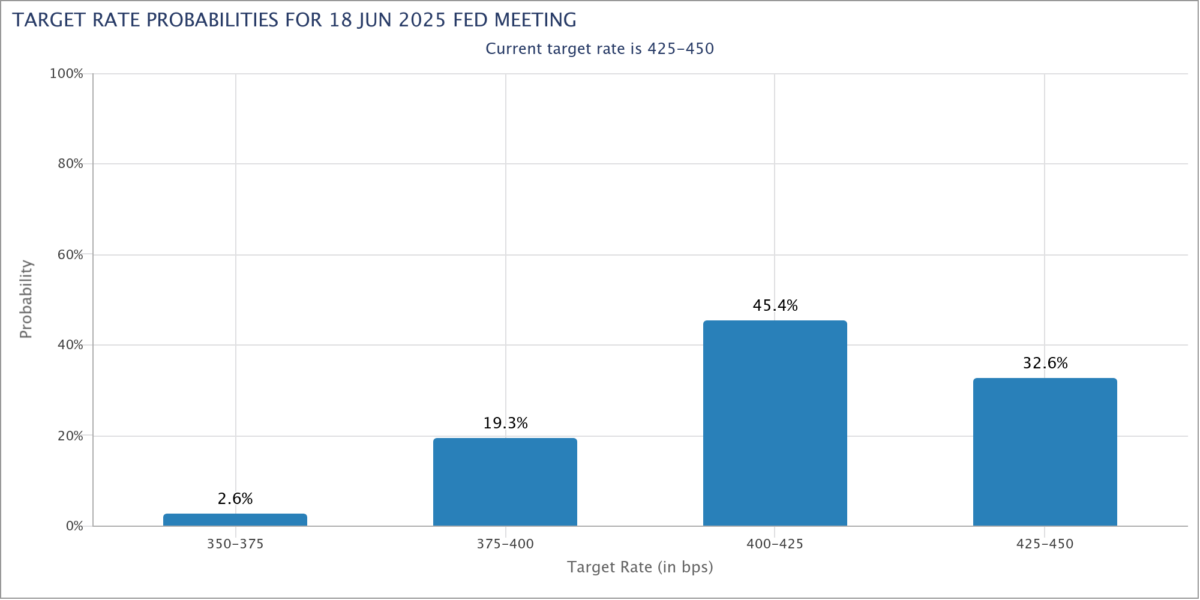

- The Fed remains in radio silence before for next week’s FOMC meeting where they will pause, and with all the unknowns surrounding issues like tariffs, deportations, and inflation measures, we don’t know what certainty the Fed can provide, if any, about future monetary policy. The futures market still sees a cut more likely in the June/July timeframe and we find no reason to disagree with that notion.

- There’s an important distinction to make in that the last several years have been all about Fed policy. First hikes, then a pause, then cuts. This year the focus is clearly shifting from the monetary side to the fiscal side as the Trump administration begins to set out its policy markers and plans. It’s quite the change from the sedate, measured, telegraphed nature of the Fed to the more mercurial behavior expected to come from the White House. The calmness in Treasuries that we see so far is probably going to be short-lived.

- The data on offer for the remainder of this week is certainly second-tier which will only put more emphasis on White House announcements. Tomorrow, the weekly jobless claims numbers will be released but the action there, or lack thereof, has been similar to watching grass grow lately. On Friday, the preliminary S&P Global PMI series will be released for January. While not the first-string like ISM, it will still provide an early look at January activity both from the manufacturing and services side. The familiar refrain of strong services and weak manufacturing is expected to persist in the first month of 2025. Existing home sales for January will round out the data for the week with sales expected to be slightly better than December, but no major shift in activity is anticipated.

Futures Still Signal June/July Rate Cut

10yr – 2yr Spread Having Tough Time Breaking Above 40bps

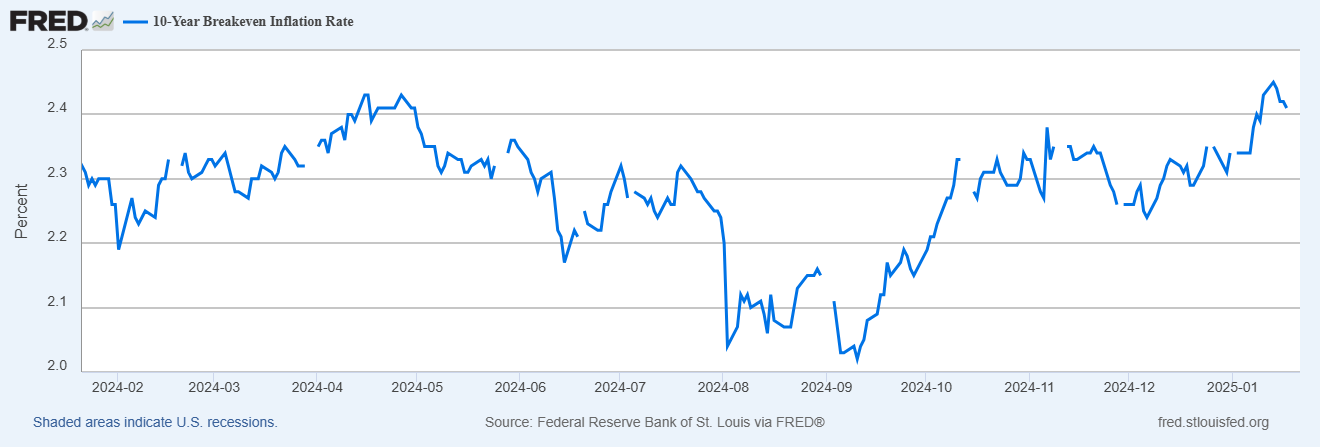

Meanwhile, TIPS Inflation Breakeven Rates Starting to Dip as Inflation Fears Ebb

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.