Market Looking for News on Treasury Secretary Pick

- Treasury yields are mixed this morning with the short end trading in the green while longer durations are seeing slightly higher yields. With new economic data on the light side this week, trading will be dominated by news from the incoming Administration, and we also get market bell weather Nvidia reporting after the close on Wednesday which could inject some volatility into equities with some spilling into the fixed income sector. Currently, the 10yr Treasury is yielding 4.46%, up 2bps on the day, while the 2yr is yielding 4.31%, unchanged from Friday’s close.

- The week is light on first-tier data with housing getting most of the reporting. That will leave trading centered more on news from the incoming Administration and any further picks to key posts. While most of the picks to date have been, let’s just say eyebrow-raising, the Treasury Secretary slot remains unfilled with several names being thrown around. Howard Lutnick, Scott Bessant, Robert Lightheiser and former Fed Governor Kevin Warsh are some of the names, and while the early picks for other slots may be somewhat unorthodox the betting is that the Treasury Secretary position may hue to a more traditional pick. We shall see.

- Housing Starts and Permits for October will be released tomorrow. Starts are expected dip -1.4% while permits are expected to increase 1.0% from September. After an early pop early in the year, starts have ranged in the 1.3 million to 1.35 million, annualized as the trend has been towards slowing starts as high mortgage rates continue to be a headwind to the residential real estate market.

- Initial Jobless Claims on Thursday will carry a little more weight this week as it coincides with the survey week for the November jobs report. Claims have been docile with little to indicate that layoffs are accelerating. This buttresses the view from Powell last week that they believe that the economy as a whole and the jobs market continue to be on solid footing which gives the Fed time to be patient about future rate cuts.

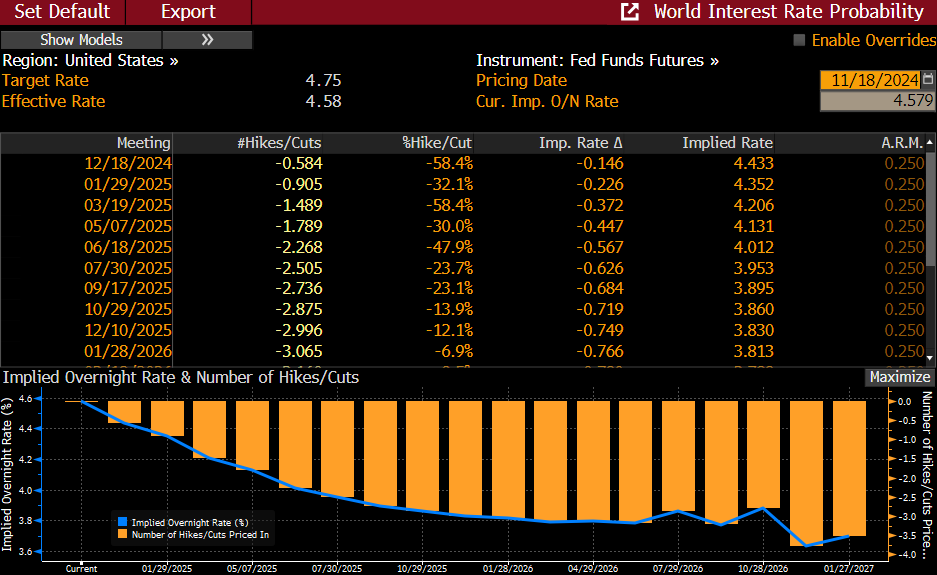

- While noting the Fed’s patient stance, we still believe they will cut another 25bps at the December 18th FOMC meeting, as policy remains firmly in restrictive territory. And next year’s first quarter could see the seasonal effects of higher inflation just like we experienced this year which would seem to be an ideal place to pause for a meeting or two. The futures market is not so sure about a December cut, with odds at 58%, certainly lower than what they were just when the month began (see futures market odds below).

- October Existing home sales will also be released on Thursday with sales expected to increase 2.9% to 3.95 million annualized. Keep in mind this series is based on closings so many of the sales were done with mortgage rates in the 6.6% to 7.0% range vs. the 7.30% rates currently on offer. By way of comparison, sales were in the 6.0 to 6.5 million range prior to the Fed’s hiking cycle. So, sales have been nearly cut in half which speaks to the reversal of momentum that has occurred in the last couple years (see sales graph below).

- The final bit of data worth talking about this week will be Friday’s S&P Global preliminary PMI numbers for November. Manufacturing is expected to remain in contractionary territory but with some slight improvement from 48.5 to 48.9. The Services Index is expected show healthy expansion at 55.1 vs. 55.0 in October. So, same old story: struggles in manufacturing while services remain the star of the economy.

Odds for a December Rate Cut Down to 58% from 85% on November 1st

Existing Home Sales Slowed Dramatically as Fed Rate Hikes Took Hold

Source: Bloomberg

Bankrate Average 30yr Mortgage Rate – Uptick in October and November Likely to Slow Upcoming Activity

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.