Market Awaits PCE Inflation Numbers Tomorrow

Market Awaits PCE Inflation Numbers Tomorrow

- Treasury yields are mostly unchanged as investors await the latest inflation readings tomorrow and a trio of Fed speakers this afternoon, (more on that below). Presently, the 10yr Treasury is yielding 4.30%, unchanged on the day, while the 2yr Treasury is yielding 4.68%, up 1/32nd in price.

- In a week full of data, today is probably the one day to mark time until the January PCE inflation numbers tomorrow. The releases today are not first-tier so investors will be waiting for later in the afternoon when a trio of Fed speakers go at it, but they probably won’t depart from the patient pause refrain, so we’re back to waiting on PCE again.

- One release we did get today was the second estimate of fourth quarter GDP and it was revised lower from 3.3% to 3.2%. The dip came despite consumer consumption increasing from 2.8% to 3.0%. The offset to that pickup in spending was a slight increase in the inflation estimate with core PCE increasing from 2.0% to 2.1% quarterly annualized. Also, inventory build was less than previously estimated, and imports were higher which acts to lower GDP. Recall, third quarter GDP was a surprising 4.9% so a moderate, and mostly expected, slowing in the fourth quarter, but it still contributed to a decent full-year GDP of 2.5%. The current Bloomberg consensus for 2024 GDP is 2.0%. Yet, the Atlanta Fed’s GDPNow model is looking for first quarter GDP at 3.25%. If that comes to pass, some material slowing will have to happen in subsequent quarters to pull the full year pace closer to the current estimate.

- Just after 12pm ET, three Fed speakers will offer up their latest thoughts on the economy and policy, but frankly, we’re likely to hear more of what we heard last week and that is they are in no rush to cut. Bostic and Collins participate in a fireside chat in Georgia with both taking questions. A little later NY Fed President John Williams will deliver a keynote address at the Long Island Association Regional Economic Briefing. This will come with questions too, so maybe some new remarks come from the questions. We shall see.

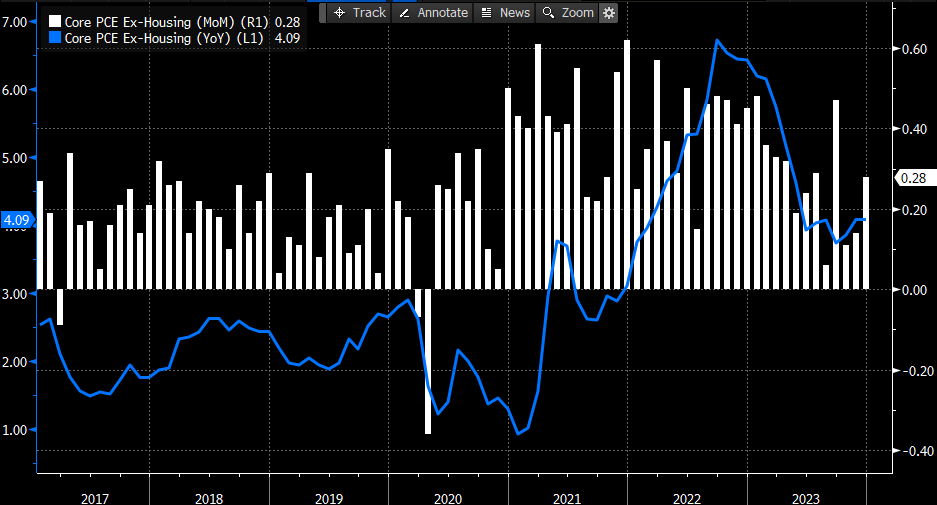

- The core PCE estimate for tomorrow remains at 0.4% MoM, but with the YoY pace easing to 2.8% from 2.9%. That would be the lowest YoY rate since March 2021. But the Fed will drill down to the pace of core services as that has been the sticky piece of the price puzzle lately. After a period of consistent improvement in early to mid-2023, core services started rising again in the third and fourth quarters, and with those pesky seasonal adjustment issues, it could surprise to the upside in January, which would only deepen the Fed’s resolve to stand pat with policy. Looking ahead to February’s CPI report due on March 12, early estimates for core CPI are at 0.3%, a slight improvement over January’s hot 0.4% print.

Core Services Ex-Housing: After Improving in Early 2023, “Stickiness” has Returned

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.