Market Awaits, GDP, PCE, and Record 5-Year Auction

Market Awaits, GDP, PCE, and Record 5-Year Auction

- Treasuries are trading weak today as the market awaits more consequential reports tomorrow and Friday in the form of first quarter GDP and March PCE. Also, the Treasury will be auctioning a record $70 billion in five-year notes today, which should keep Treasuries on the back foot until the record supply is put away. Currently, the 10yr note is yielding 4.64%, down 10/32nds in price, while the 2yr is yielding 4.94%, down 2/32nds in price.

- As we await the initial look at first quarter GDP tomorrow, and then PCE inflation numbers on Friday, we did get preliminary durable goods numbers for March, and they were a bit of a mixed bag. New orders rose 2.6% but February was revised down from 1.3% to 0.7%. Orders ex-transportation rose 0.2%, as expected, but again the prior month was revised down from 0.3% to 0.1%. Core orders, which is a proxy for business investment, rose an as expected 0.2% but February was revised down from 0.7% to 0.4%. Finally, shipments, which is an input into GDP, rose 0.2% matching expectations and improved from a -0.6% drop in the prior month. Given the improved shipment numbers for March it may provide a slight boost to the Atlanta Fed’s GDPNow first quarter estimate which currently stands at 2.9%.

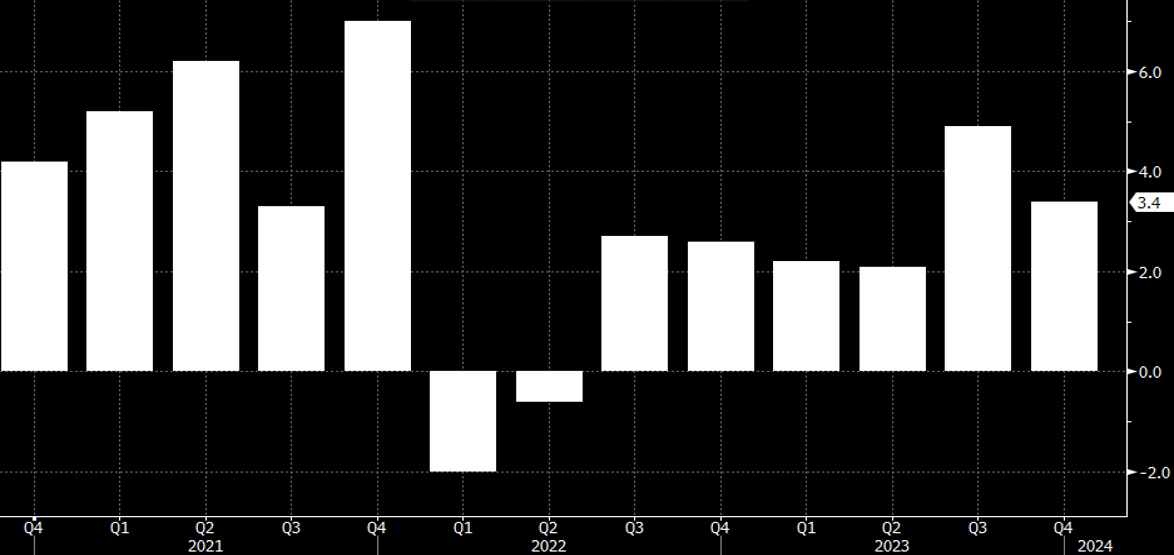

- As for first quarter GDP, Bloomberg consensus is at 2.5%, and as we mentioned the Atlanta Fed’s GDPNow estimate stands at 2.9%, subject to any revision following today’s durable goods numbers. In addition to the growth rate, investors will be looking at the inflation indicators in the report. The GDP Price Index is expected to increase 3.0% annualized which compares to the much cooler 1.6% rate in the fourth quarter. The Core PCE Price Index is expected to increase from 2.0% in the fourth quarter to 3.4%. Given the hotter-than-expected inflation reports so far this year these expected quarterly inflation reads are not surprising, but if they come as expected, or higher, it will provide more fodder for the Fed’s higher-for-longer rhetoric.

- We mentioned last week the Fed’s Beige Book on economic conditions wasn’t nearly as upbeat as the recent hard data reports and remarked whether this was an early warning sign or just a false signal. Well, yesterday S&P released their preliminary look at April PMI numbers, and it noted some weakness as well. The manufacturing PMI fell from 51.9 to 49.9, missing the 52.0 forecast and the first sub-50 print since December. The services PMI also slipped from March’s 51.7 to 50.9, missing the 52.0 expectation, and the lowest in five months. In the commentary, the S&P’s chief economist noted that further economic momentum “may be lost in the coming months, as April inflows of new business fell for the first time in six months and firms’ future output expectations slipped to a five-month low amid heightened concern about the outlook.” So, we now have two anecdotal reads that point to some economic slowing. We’ll make note of that as we squint our eyes looking for any weakening signs in the upcoming hard data reports.

- As mentioned, first quarter GDP is expected to be solid, so we’ll look to Friday’s Personal Income and Spending for March for any weakening signs. While the PCE inflation series will get most of the attention, and core PCE is expected to be up 0.3% MoM with the YoY ticking down to 2.7%, the spending numbers will be of interest too. Recall that March retail sales surprised to the upside and the more comprehensive spending numbers on Friday are expected to be up 0.6% vs. 0.8% in February, certainly respectable by any measure. While the slowing noted in the survey readings occurred during April, the March data to date hasn’t hinted at any softening signs, but we’ll keep looking for it.

Post-Covid Quarterly GDP – Another Strong Quarter is Expected

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.