Market Awaits FOMC Minutes and Nvidia’s Earnings

Market Awaits FOMC Minutes and Nvidia’s Earnings

- With precious little new fundamental information on offer today Treasuries are finding an early bid, but it certainly lacks conviction. One highlight today will be the FOMC minutes dur at 2pm ET (more on that below). The other big event will be Nvidia’s quarterly earnings after the close. Given you could call the last year the Nvidia rally, its results are likely to set the market tone on Thursday. Presently, the 10yr Treasury is yielding 4.26%, up 3/32nds in price while the 2yr Treasury is yielding 4.59% up 1/32nd in price.

- In a holiday-shortened week devoid of first-tier releases, investors will have to make do with this afternoon’s FOMC minutes from the January 31 meeting. But with the meeting occurring before the hotter-than-expected CPI and PPI releases the word stale is being used to describe whatever is contained within the minutes.

- In fact, the minutes probably represent one-sided risk. If they are more dovish than expected that will likely be waved off given the subsequent inflation numbers. If it comes out in a hawkish tone, then the short end could be susceptible to more selling as those pesky inflation numbers only feed the hawkishness and rate cuts get pushed further out.

- The other item of interest in the minutes will be any discussion of how and when to begin winding down Quantitative Tightening (QT). Recall the December meeting did have discussions around beginning the planning process. So, there was expectation we would hear more in the January meeting, but the statement was quiet in that regard, as was Powell in the press conference. There was speculation that the winding down process would begin with the May meeting. If that appears not to be the case it could pressure longer-term Treasuries as a size-buyer like the Fed remains on the sidelines longer than anticipated.

- In addition to minutes there is still a solid contingent of Fed speakers with a total of six set to go today and tomorrow. The highlight of that bunch will be Vice Chair Christopher Waller speaking on the economy. Recall he had been one of the more hawkish members through much of 2023 but softened his tone prior to the December meeting. It will be informative to see how that tone has changed, if at all, given the updated inflation reports. The bad news is that the speech takes place in the evening so any reaction will have to be a Friday affair.

- Speaking of inflation, the latest PPI report has been incorporated into the outlook for January PCE due on Feb. 29 and it pushed the expectation for core PCE to 0.4% MoM. That would be the highest monthly print in a year, so the discussion will commence once again as to whether this is reflective of a true uptick in inflation, general January volatility, or faulty seasonal adjustments. The earliest answer to that won’t come until February CPI due on March 12. In any event, even with a hot monthly print, YoY core PCE is expected to tick down to 2.8% vs. 2.9% due to favorable base effects. Those base effects become much more challenging in June and beyond so any improvement in the YoY rate needs to happen between now and then.

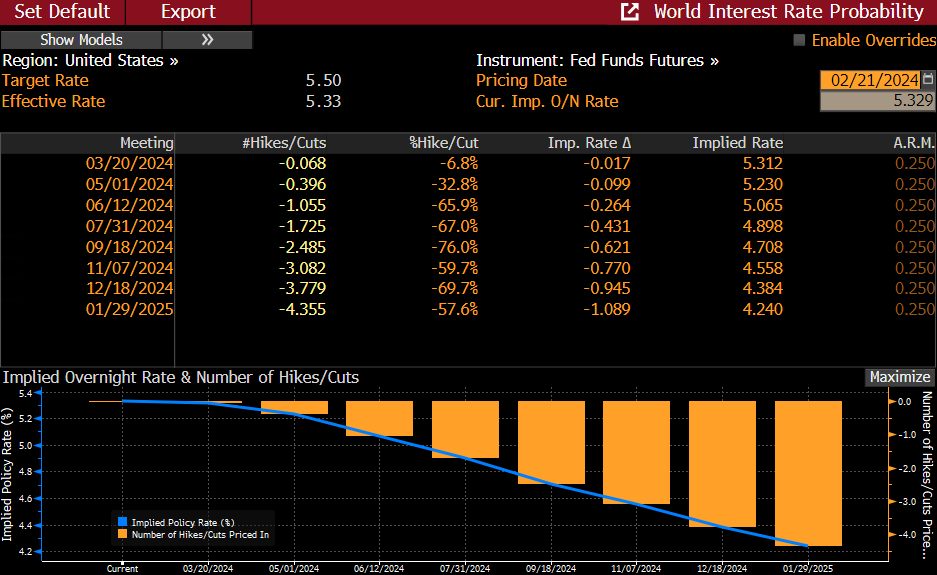

First Rate Cut Odds Pushed to June – Will the FOMC Minutes Push Them Further Out?

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.