Market Awaits Fed’s Updated Rate & Economic Outlook

- With no reports on offer this morning, the market will try to remain awake until the 2pm ET FOMC announcement and subsequent press conference. The risk-off tone in equities resumed once more yesterday, and that allowed Treasuries to rally a bit, but the moves were limited with the Fed meeting looming. Treasury yields are near unchanged on the day as one would expect with the afternoon Fed news on deck. Currently, the 10yr Treasury is yielding 4.29%, up 1bp on the day, while the 2yr is yielding 4.05%, also up 1bp on the day.

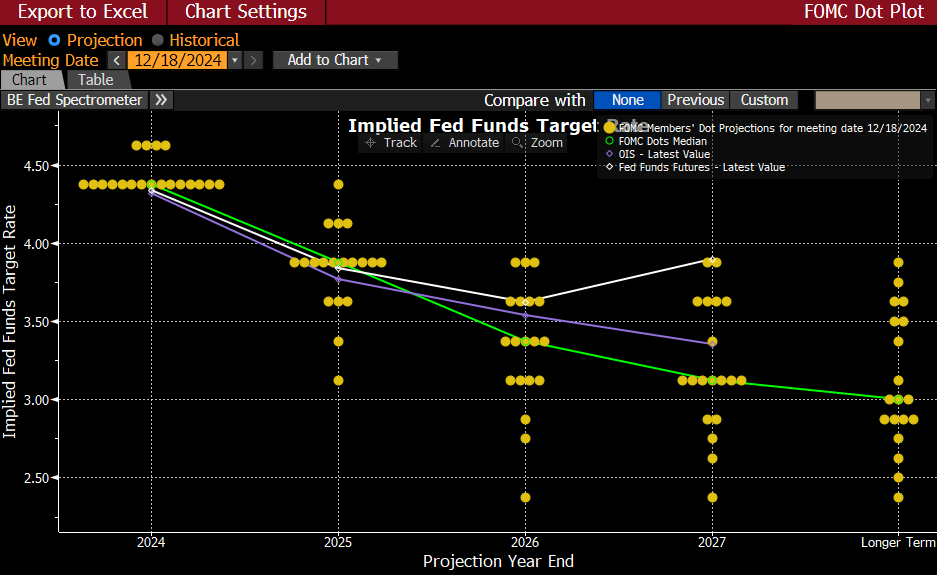

- While there won’t be a rate cut today the Fed will reveal their latest rate and economic outlook, but there remains plenty of unknowns such that any forecast is fraught with uncertainty. The Fed will offer up a refreshed dot plot of fed funds rate expectations and also an updated look at the economy, particularly GDP, inflation, and unemployment.

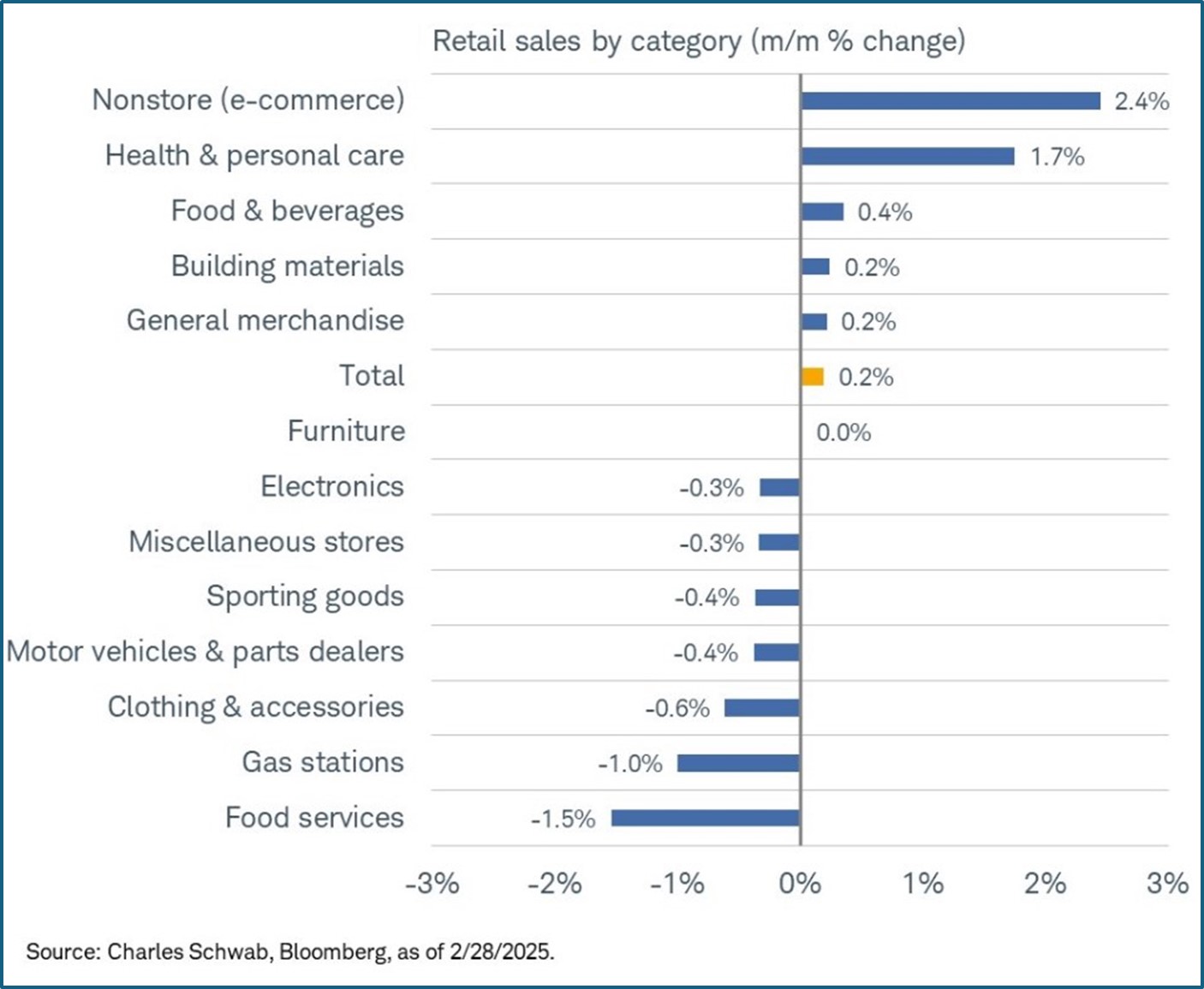

- The new data this week didn’t make the Fed’s job any easier. First, retail sales for February were better than January’s weak showing, but that weakness was revised even lower, and while there was a modest rebound in sales, it remained well below the levels we were accustomed to last year. Also, yesterday’s import/export price report was the penultimate inflation release for February with import prices hotter-than-expected, particularly foreign air travel prices rebounded 3.4% after declining 12.8% in January. That particular piece of pricing feeds into the foreign travel component in PCE, the only inflation report remaining for February and the Fed’s preferred measure. Import prices for February continued a theme begun last week with CPI/PPI. Components within those respective reports that are also part of PCE were on the hotter side. That has analysts expecting core PCE to print a “high” 0.3% MoM or even 0.4% for February. Thus, the potential is there to come in hotter than the 0.2% core CPI for February and possibly repeat January’s 0.3% core PCE result.

- Thus, the Fed could soon be confronted with a slowing economy, stubborn inflation, mixed with an uncertain fiscal policy picture that is tilted in the direction of exacerbating both trends. In December, some Fed members included rough estimates of future Trump policy into their forecasts. We suspect those that did probably relied on Trump 1.0 as a guide. It seems clearer now that tariff policy will be bigger and more substantial than what we experienced the first go-around. Plus, this time, all FOMC members will be adding estimates of fiscal policy changes into their updated rate and economic projections, albeit with much uncertainty. That means downward adjustments to growth and upward adjustments to inflation are likely. The December forecast had core PCE for year-end 2025 at 2.5% and GDP at 2.1%. It’s likely in today’s update we’ll see a couple tenths added to inflation and a couple tenths subtracted from growth, if not more.

- As for rates, we expect the Fed to stick with their December forecast of two rate cuts this year, but we could see the neutral rate estimate increased again from the current 3.00% to perhaps 3.125% or 3.25%. The 2026 forecast from December had two 25bps cuts and that could be trimmed to one as well, especially if the neutral rate estimate is raised, which we think it will.

- One item that the market will be looking for is a discussion of curtailing or ending Quantitative Tightening (QT). While recent Fed speak has mentioned that reserve levels remain plentiful, which signals no intent to curb QT, if the debt ceiling is lifted, it will allow the Treasury to replenish its operating account which is being drawn down under the current “extraordinary measures” regime. That process will drain reserves. We’re not sure if a definite plan will be unveiled today to curb QT, but some discussion around the issue is likely with more definitive moves perhaps happening at the May or June meetings. If it’s not discussed in the post-meeting statement, it will be something Powell will be asked about at the press conference.

- We’ll be back in the afternoon with a recap of the meeting and the updated rate and economic outlook.

Fed Dot Plot from December – Will be Updated Today, but We Still See 2 Cuts for This Year

Source: Bloomberg

Broad-based Moderation by the Consumer as 7 of 13 Spending Categories Declined in February

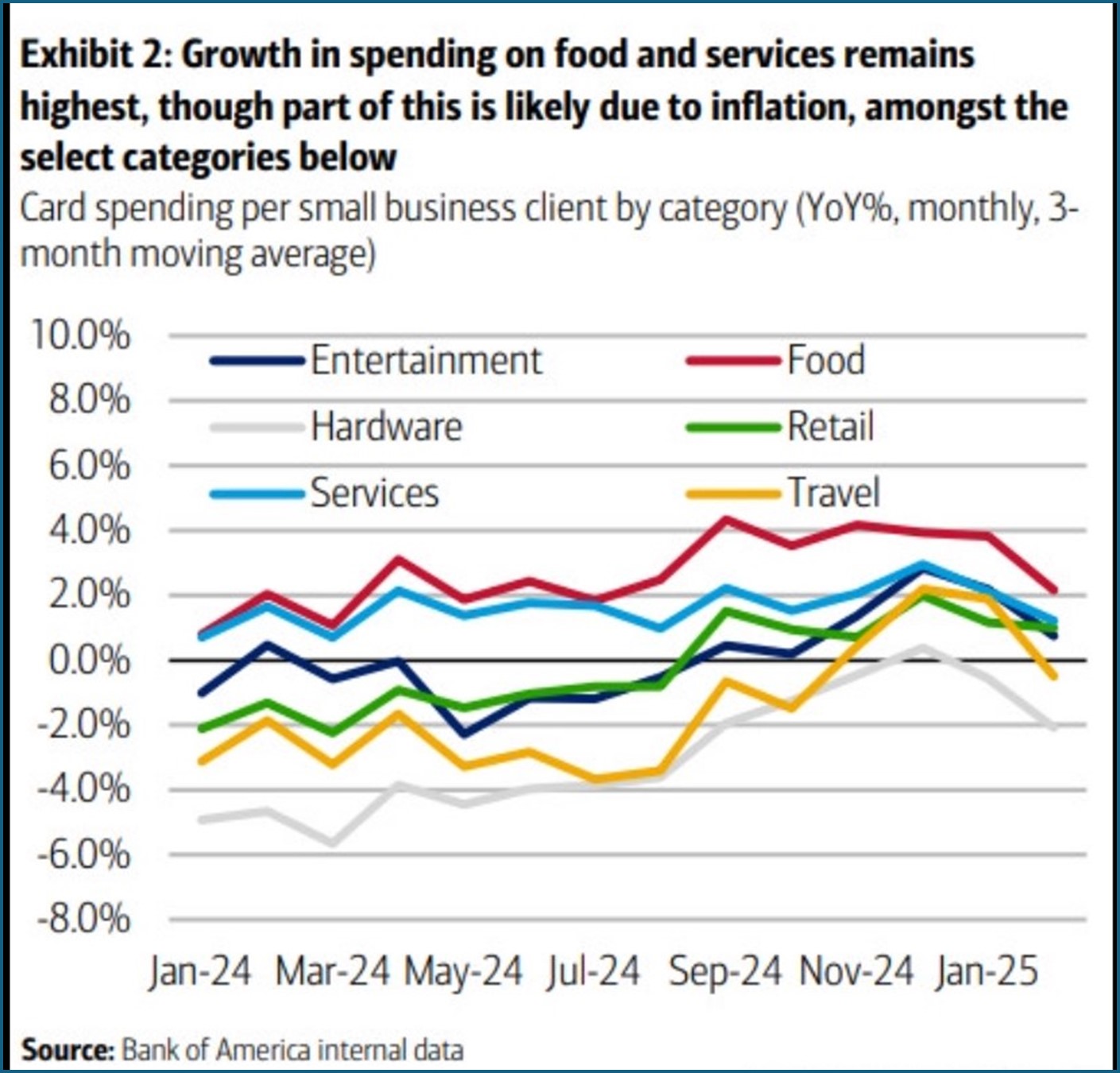

Per Bank of America, Credit Card Spending is Slowing, Especially in Discretionary Categories

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.