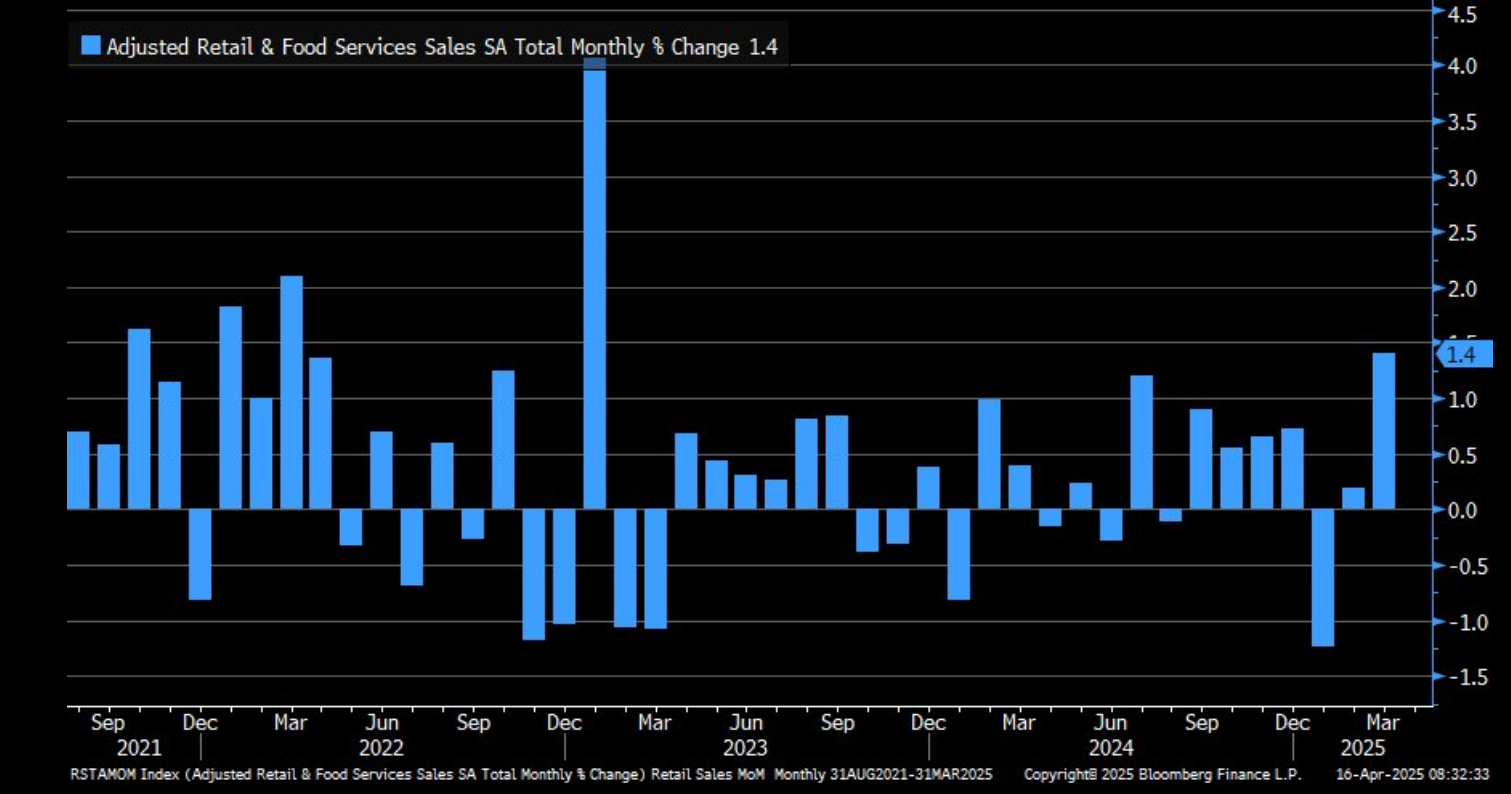

March Retail Sales Solid, But How Much Is Tariff Front-Running?

- Treasury yields are mixed and quiet this morning after digesting a solid Retail Sales report but with nagging questions over how much is tariff front-running vs. organic buying? We characterize the report as solid and broad-based (more than just autos contributed), and it gives the Fed another solid hard data number to point to when they speak of keeping policy status quo. In any event, it’s the last major monthly report before the holiday-shortened week closes tomorrow, leaving the field open for more DC tape bombs on trade and tariffs. Currently, the 10yr Treasury is yielding 4.34%, up 2bps on the day, while the 2yr is yielding 3.82%, down 1bp on the day.

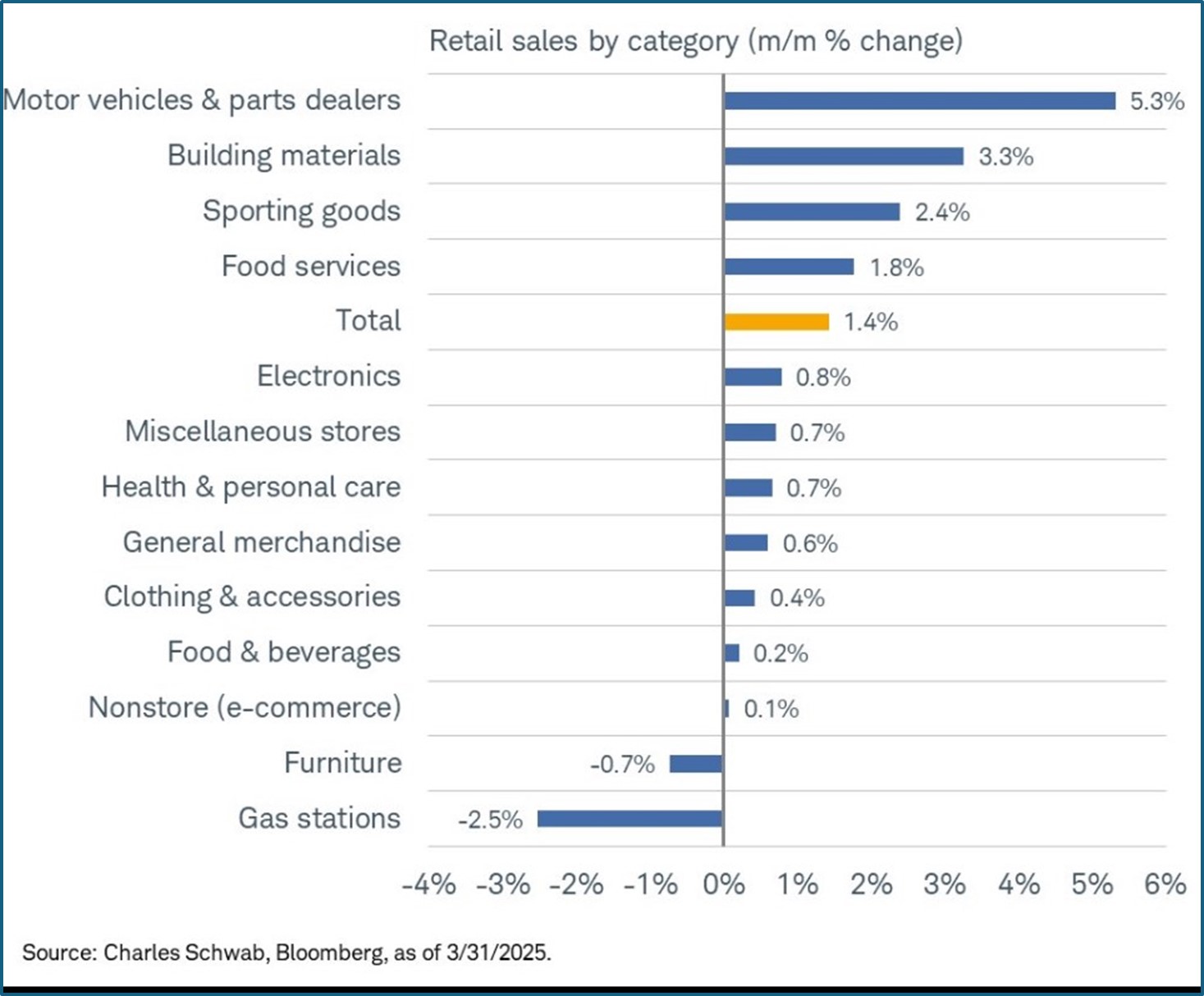

- Retail sales for March were expected to rebound from February, in a pre-tariff buying surge, and they did. Advance retail sales were up 1.4%, matching expectations and easily beating the 0.2% increase in February. Sales ex the volatile auto and gas categories were up 0.8% vs. 0.5% expected and an upwardly revised 0.8% in February. The direct feed into GDP, the so-called Control Group, rose 0.4% vs 0.6% expected and 1.3% the prior month, upwardly revised from 1.0%. 11 of the 13 categories were up, led by autos at 5.3% MoM. The issue investors will have with this report is how much was tariff front-running and how much was organic run-of-the-mill purchases? Obviously auto sales were goosed but ex-auto and gas was still a healthy gain at 0.8%. But again, was some of that tariff front-running? The answer is probably some, but for now the Fed has another solid hard data number that will not advance the case for rate cuts anytime soon.

- While the numbers represent something of a rebound from February’s mediocre performance, the results still beg the question that while the consumer may still be spending, it’s not at the pace of last year, and with tariff machinations acting near-term as sand in the gears of the economy, where will the assist to the economy come from? That determination will be critical for the Fed that has relied on a strong economy to confidently express patience with getting inflation to 2%. With two-thirds of our economy tied to the consumer, any signs of that consumer stepping back, even modestly, will force some downgrading of expected economic performance and perhaps eat at some of the Fed’s confidence in waiting out inflation.

- Speaking of the Fed we had two Fed speakers on Monday deliver their thoughts on future policy decisions. First, Fed Governor Christopher Waller was his recently dovish self, claiming that he feels any tariff price increase will be transitory, (yes, he did go there), and would be inclined to cut rates in the event the economy stumbles as the soft data are indicating it will. Meanwhile, Atlanta Fed President Raphael Bostic was his typically more cautious self about the inflation question and the potential impact of fiscal policy changes. He advocated waiting until more clarity is known on all fronts: inflation, fiscal policy, and the economy. His views are probably more the norm at present at the Fed, but Waller is more influential. In any event, it’s pretty clear the Fed will want to see a downturn in hard economic numbers, and not just survey data, to move towards rate cuts, and that’s not what we received today.

- The futures market is calling for more than three cuts by year-end so they are clearly betting on a slowdown in the economy that will force the Fed into action, not just once but multiple times. The risk to the Fed is that with their “show me” attitude on the economy once the signs are evident will it be too late to prevent a severe downturn?

- That determination is probably in the hands of the consumer and the policy decisions coming from the White House. The March New York Fed Survey of Consumer Expectations noted increased 1yr inflation expectations (3.1% to 3.6%), but middle to longer-term expectations remained “well anchored” (in Fed parlance) vs. the upward spike we saw in the University of Michigan survey. The downside of the Fed’s survey is the consumer is turning more pessimistic in their earning and spending plans, along with increased employment uncertainty. That’s not a good combination when hoping the consumer will step back up to the plate and carry the economy like they did last year.

Retail Sales Up 1.4% MoM with Auto Sales Leading the Way

Auto Sales Clearly Led the Buying Activity in March

Retail Sales YoY – Still Solid but How Much is Tariff Front-Running?

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.