March Rate Cut Odds Rising Again

March Rate Cut Odds Rising Again

- Treasury prices are higher this morning as a series of bond-friendly reports have boosted odds for a March rate cut. From ADP’s downside miss on private sector job growth, to the Employment Cost Index pointing to slowing wage gains, to Treasury’s mostly as-expected auction announcement it has provided a potent backdrop before the Fed rate decision later this afternoon. Presently, the 10yr Treasury is yielding 3.94%, up 23/32nds in price while the 2yr Treasury is yielding 4.19%, up 9/32nd in price.

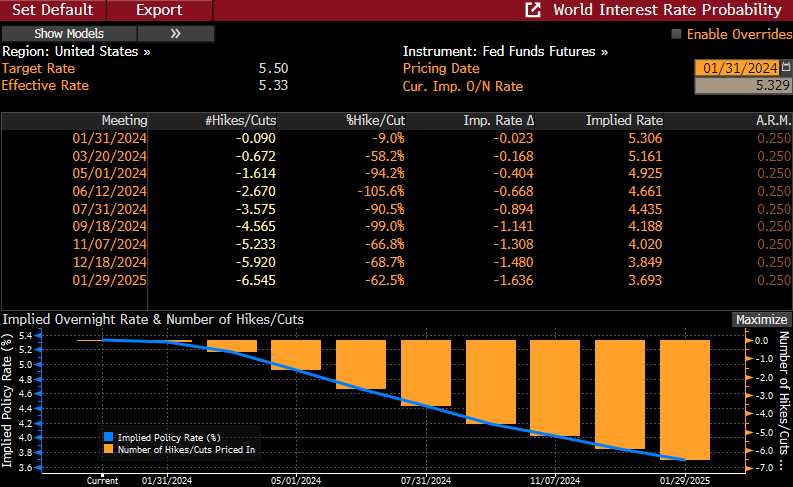

- The FOMC rate decision is due at 2pm ET. We see the expected pause continuing but with little new clarity on when the first cut will occur. The next meeting is in mid-March which gives the Fed two more CPI and employment reports and another PCE inflation print, so the “data-dependent” phrase is likely to be heard today. It’s also expected that the tightening bias in the statement will be recalibrated to a more neutral stance, which is step 1 in getting to a rate cut sometime before mid-year.

- There is also speculation they will begin to provide some initial guidance on when and how quickly to wind down QT. We have surmised earlier that we get an announcement today that the issue is being studied, then a more detailed announcement in March, with the first reduction in run-off set for the May 1 meeting. That would then set up the June meeting for the first rate cut. That’s probably how the Fed sketches it out now absent any Wiley Coyote moment in the labor market. We’ll be back later this afternoon with a review on what we learned today.

- Away from the Fed, this morning’s ADP Employment Change Report came in short of expectations with 107 thousand private sector jobs vs. 150 thousand expected and off the 158 thousand in December. While ADP has a history being more erratic compared to BLS it did nail it in December, but is that a case of a stopped clock being right twice a day? For now, the market is treating with more respect given the December hit so it does add more intrigue for Friday’s jobs report where the expectation is for 165 thousand private sector jobs. If job growth hangs in the mid-100k level, we think the Fed will continue with their patient pause approach. If it drops to the low 100k level, or less, then a March rate cut remains a possibility and that’s how the market is trading it today.

- Another bond-friendly read from ADP is that annual wage gains continue to drift lower. The annual increase for job-stayers dipped from 5.4% to 5.2% and for job-changers the annual wage gains dropped from 8.0% to 7.2%. Wage gains for job-stayers peaked at 7.8% in September 2022 and 16.4% in June 2022 for job-changers. While the current rate is still above what the Fed wants, it is trending in the right direction, at least from the Fed’s perspective.

- On Monday, the Treasury updated their expected funding needs for the quarter, and it came in lower at $760 billion which is below the previous estimate of $816 billion. That sent yields lower and this morning the Treasury updated auction amounts for the coupon-bearing securities this quarter and that came in close to expectations. Auction sizes will increase marginally during the quarter much like last quarter, but the Treasury added that these increases “leave the Treasury well positioned to address potential changes to the fiscal outlook and to the pace and duration of future SOMA redemptions” (i.e., QT). They’re pretty much saying absent some tail risk coming to fruition the Treasury should be well supplied after this quarter. Next week, the Treasury will auction $42 billion in 10yr notes and $25 billion in 30yr bonds.

- The Fed’s favorite gauge of wage growth is out this morning with the Employment Cost Index posting a quarterly increase in compensation of 0.9% which is below the 1.0% estimate and 1.1% in the prior quarter. It’s the lowest quarterly growth in compensation since June 2021. The annual rate for 2023 was 4.2% vs. 5.1% in 2022. So, yet another report that points to slowing wage gains which will comfort the Fed’s concerns over wage-push cost increases. Ideally, they would like the gains to continue to moderate into the 3-handle range, so the latest quarter annualized certainly indicates that is slowly happening.

Some Bond-Friendly Reports Have March Rate Cut Odds Back Above 50%

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.