Making Do Without the Jobs Report

- With the government shutdown entering its third day, the data blackout continues with the absence of the BLS Nonfarm Payrolls Report for September. We have managed, however, to round up some alternative data on the matter and discuss the findings below. Suffice it to say, labor market momentum continues to slow, but it’s in no hurry, apparently, to do so. Meanwhile, yields continue to leak lower which is the custom in government shutdowns. Currently, the 10yr Treasury is yielding 4.09%, unchanged on the day but down 3bps since the shutdown, while the 2yr note yields 3.55%, also unchanged in early trading, but down 7bps since the shutdown.

- It’s jobs Friday and here we are with nothing to look at thanks to the ongoing government shutdown. “Nothing to look at” may be a little harsh because we do have some privately issued reports to look at in the meantime. For instance, we did get the Challenger Job Cuts Release yesterday and it was one of the few labor reports of recent vintage that wasn’t all gloom and doom. Planned cuts in September totaled 54 thousand vs. 86 thousand in August. That’s a decrease of 37% vs. an increase of 13% in August. Furthermore, the monthly average so far in 2025 is 112 thousand and in the three-year period of 2022 -2024 the average was 51 thousand. So, not a bad number for September given what we’ve been seeing in other reports lately.

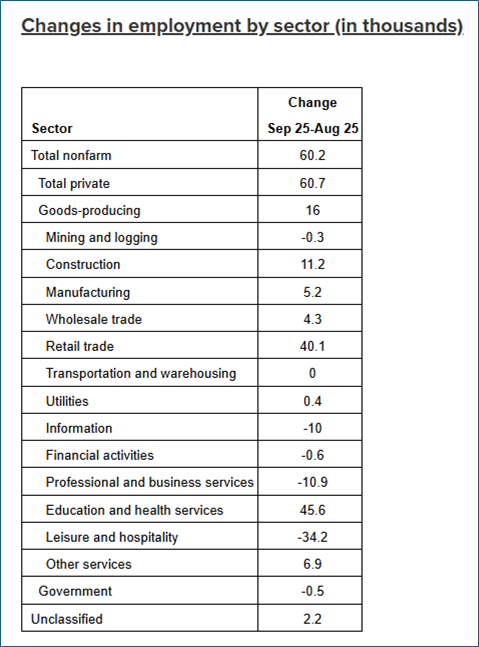

- Revelio Labs yesterday released its September edition of Revelio Public Labor Statistics (RPLS). Their numbers show employment gains of 60 thousand for September, a reading that came in just above expectations but continues to reflect a broad slowdown in the labor market. In terms of leading indicators, active job postings declined by 0.6% month-over-month, while salaries from new job postings decreased by 0.3%. Both hiring and attrition rates fell by 0.1 percentage points, pointing to continued weakening in labor market momentum. Revelio Labs uses regression modeling built on historical correlations with both RPLS and ADP data, Revelio Labs estimates that the BLS would have reported approximately 38 thousand jobs gained in September. That compares to the Bloomberg consensus expectation of 51 thousand new jobs (65 thousand private sector) with the unemployment rate stable at 4.3%.

- Also, digging around for alternative statistics, we found the Chicago Fed Labor Market Indicator Series. This series per the website, “combines real-time private sector data with official labor statistics to provide a timely and comprehensive view of labor market conditions. Updated twice monthly ahead of the BLS report, the Chicago Fed Labor Market Indicators include a layoffs and other separations (discharges and quits) rate, a hiring rate for unemployed workers, and a forecast of the monthly BLS unemployment rate.” For September, it reported that the Unemployment Rate Forecast for September was 4.34% vs. 4.32% August BLS actual. The Layoffs and Other Separations Rate was 2.10% vs. 2.09% in August and 2.06% a year ago. The Hiring Rate for Unemployed Workers was 45.22% vs. 45.61% in August and 46.96% a year ago. In summary, some weakening in labor market momentum but nothing dramatic at this point, that seems to be a theme at the present time.

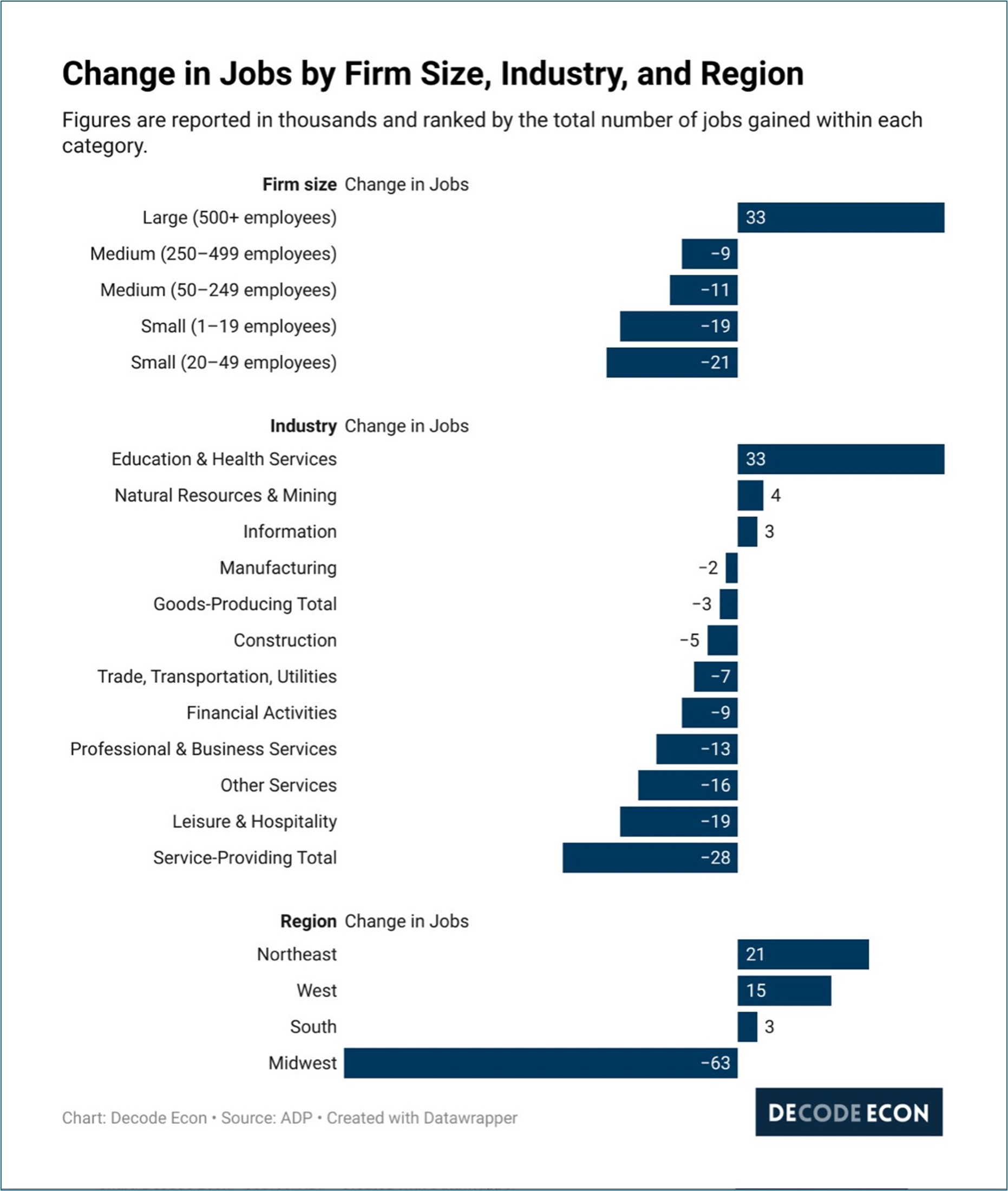

- When one looks across the spectrum of labor reporting that we have seen, from ADP, Conference Board’s Labor Differential, JOLTS Job Openings to Jobless Rate, the Quits Rate, and Hiring Rate they all point to a loss in momentum but not excessive at the moment. If we’re on the hunt for further labor market slippage away from the BLS, we’ll see these same indicators continue to head south along with an eventual pick-up in layoffs. A pick-up in layoffs is so far not evident in the weekly jobless claims data (the latest week being held up with the shutdown), and the JOLTS Layoff Rate which was steady at 1.1% in the latest August report.

- Keep in mind too that with reduced immigration numbers, the current equilibrium rate to keep the unemployment rate steady is estimated at around 50 thousand new jobs per month. That’s a much lower bar than the low six-figure level when immigration (both legal and illegal) was much higher which stimulated labor force growth. We’ll offer the caveat, however, that with government possibly shedding jobs into the shutdown that the unemployed totals could begin to mount quickly in the months ahead.

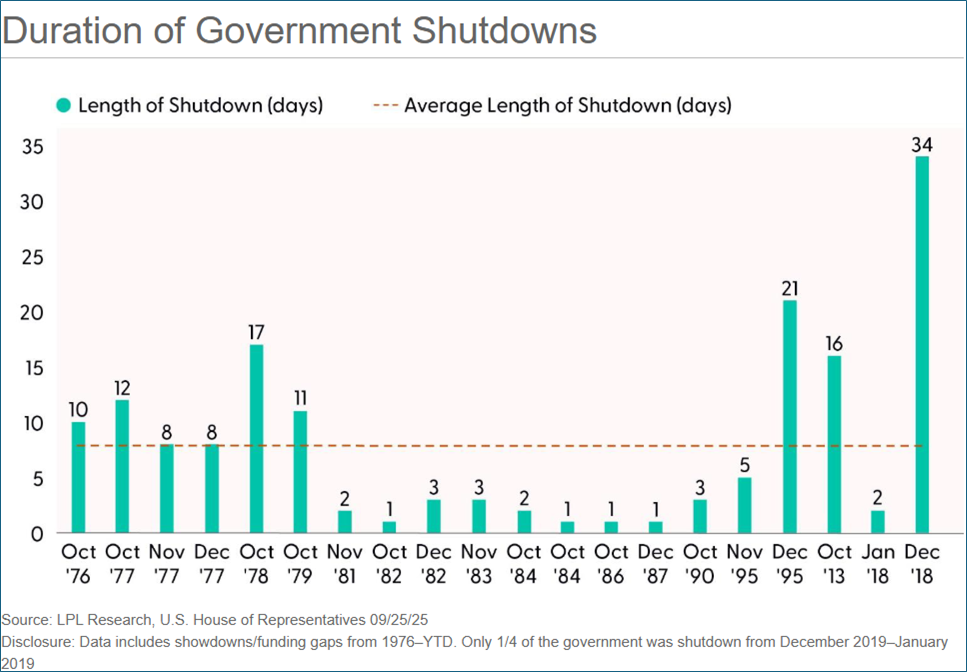

- Turning back to the shutdown, past experience says that if the shutdown is not resolved in less than a week (1 – 5 days) the risk greatly increases for the shutdown to last several weeks. Also, this shutdown doesn’t involve a possible credit event as is the case in a debt ceiling situation. Thus, the potential to drag on is enhanced, not to mention the obvious wider divisions evident between both political parties at present.

- History suggests too that shutdowns are typically bond bullish events. To wit, in the four shutdowns that lasted longer than 5 days, 10yr Treasuries rallied 3 of the 4 times by an average of 9bps. The last shutdown in 2018-2019 was the longest at 34 days and saw 10yr Treasuries rally 5bps. This market is quicker as 10’s rallied 7bps in the first day. We’ll see where they go when it’s all over with.

- But that’s not all folks. Later this morning we’ll get ISM Services for September with the headline measure expected to tick lower from 52.0 to 51.7. So, softer growth in the services sector but still above 50, indicating an expansion continues, albeit at a slower pace. The Prices Paid Index (68.0 expected vs. 69.2 Aug), and the Employment Index (46.8 expected vs. 46.5 Aug), will get plenty of attention as the dual Fed mandates of price stability and full employment get an airing. The Fed speak of late has shown a clear cleavage in the FOMC between those most concerned about inflation and the others more worried about the labor market. There should be plenty for both groups to point to in this report.

Revelio Labs Estimate of September Job Growth

Source: Revelio Labs, Inc.

Breakout of ADP Private Sector Job Growth/Loss in September

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.