Light Data Week Meets With Light Staffing

- Treasury yields are edging higher with new supply coming this week. With Christmas on Wednesday, staffing levels are skeletal at best so don’t read too much into any movements due to the expected light volumes. That said, the Treasury will be auctioning 2yr notes today, 5yr notes tomorrow, and 7yr notes on Thursday so that new supply should keep pressure on prices, especially with the expected light staffing. Currently, the 10yr Treasury is yielding 4.54%, up 2bp on the day, while the 2yr is yielding 4.32%, up 1bp from Friday’s close.

- Despite the Fed’s hawkish cut last week, Friday’s release of November PCE inflation data came in cooler than expected, while consumer spending continued to impress with plenty of savings to allow for it to continue through December and into the New Year. Solid growth with modest inflation is the Fed’s goal, and while just one report, Friday’s Personal Income and Spending numbers pointed squarely in that direction.

- As you would expect with Christmas falling on Wednesday, this week is limited on new data, and the information we do receive the question is how many people will be around to even work with it? Such is the case with the last week or two of the year.

- In that regard, the preliminary Durable Goods Orders for November were released this morning and were mixed given soft aircraft orders but decent demand elsewhere. Overall orders were down -1.1% vs. -0.3% expected and an upwardly revised gain of 0.8% in October. Ex the volatile transportation sector (think aircraft), orders were barely negative at -0.1% vs. 0.3% expected and 0.2% in the prior month. However, Capital Goods Orders (Non-Defense, Ex-Air) rose 0.7% vs. 0.1% and -0.1% in October. This measure is a proxy for business equipment investment with the November pace the highest in over a year. Capital Goods Shipped (Non-Defense, Ex-Air) rose 0.5% vs. 0.2% expected and 0.4% the prior month. So, on net, Boeing is still struggling with aircraft orders, but business equipment investment seems to be ramping up.

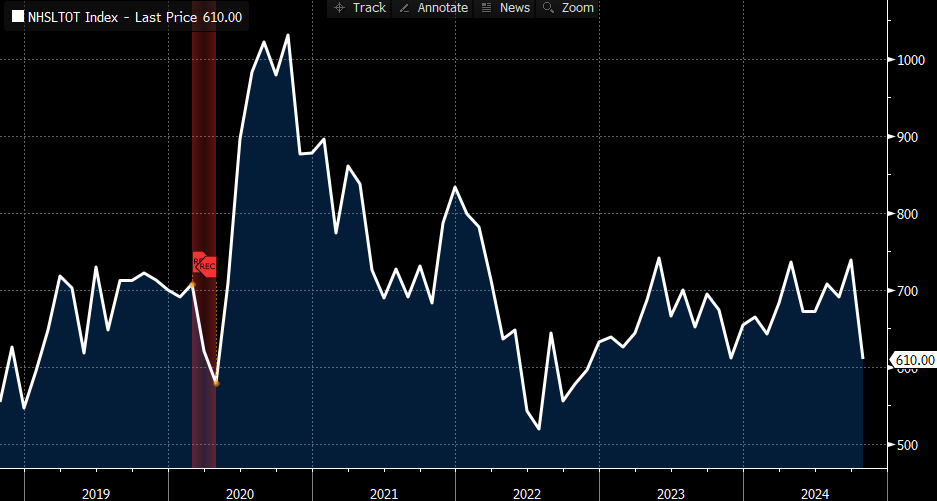

- Later this morning we’ll get New Home Sales for November with 670 thousand annualized expected vs. 610 thousand in October. That uptick in sales would represent a 9.8% increase and rather impressive given 30yr mortgage rates spent most of the month above 7%. Of course, October sales were negatively impacted by the dual hurricanes so the expected rebound seems reasonable, and builders can buy down mortgage rates to help sales which is something the existing home sales market can’t provide.

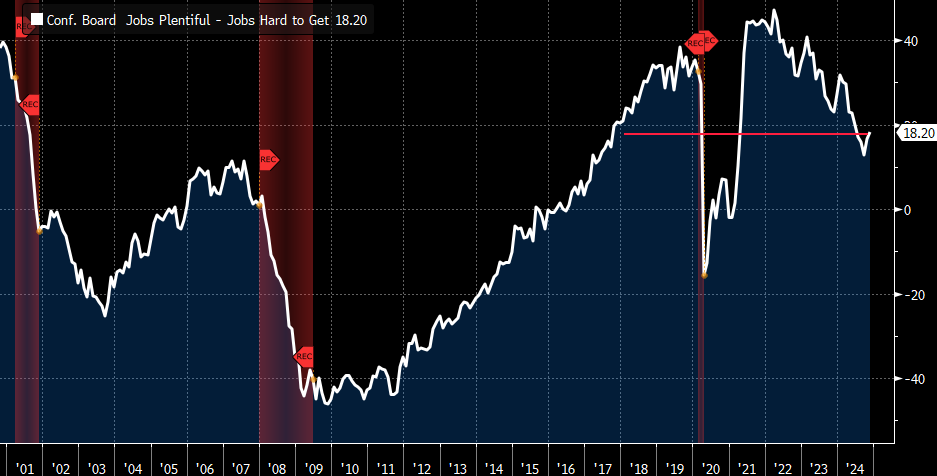

- Also, at 10am ET, the Conference Board will issue the Consumer Confidence Report for December. Expectations are for confidence to increase from 111.7 to 113.2, that would be the highest reading since July 2023. The present situation and expectations sub-indices will garner some attention as will the jobs plentiful minus jobs hard to get will be a focus for the Fed. It was trending lower for months (indicating less job openings) but the prior two months saw a bounce in openings, so we’ll be looking to see if that trend continues. If it does, it buttresses the Fed’s expected pause next quarter.

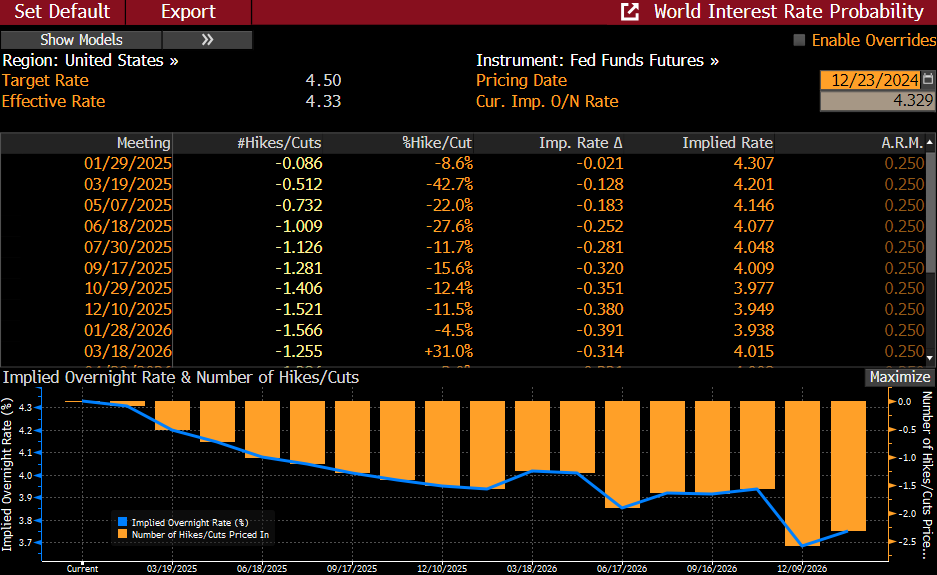

Fed Funds Futures: Next Rate Cut Not Priced Until June 2025 & Only 38bps in Rate Cuts for all of 2025 – Seems Too Pessimistic to Us Source: Bloomberg

Source: Bloomberg

Conference Board’s Jobs Plentiful minus Jobs Hard to Get – Has Improved Last Two Months Source: Bloomberg

Source: Bloomberg

New Home Sales Expected to Rebound After Storm-Affected October Source: Bloomberg

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.