Latest Data Shows Economy/Consumer Still Doing Good

- Treasury yields are lower and equities rallying as the week draws to a close and markets make final preparations for a second Trump Administration. Second-tier data greets investors today so the combination of cooler inflation numbers and solid retail sales from earlier this week are combining to close the week in an upbeat tone, at least at the open. Currently, the 10yr Treasury is yielding 4.58%, down 3bps on the day, while the 2yr is yielding 4.23% down 1bp on the day.

- While the Fed waits for improvement on inflation before continuing rate cuts, they’re keeping the other eye out for the economy and yesterday’s retail sales numbers for December continue to point to a strong showing by the consumer. Retail sales overall increased 0.4% and while that missed the 0.6% expectation and 0.8% from the prior month it was still a solid result. November sales were aided by strong car sales which were not likely to repeat. In addition, sales ex-autos and gas rose 0.3% vs. 0.2% in November and the Control Group – which feeds into GDP- rose a solid 0.7% vs. 0.4% in November. That boosted fourth quarter GDP forecasts with the Atlanta Fed GDPNow increasing its estimate from 2.7% to 3.0%. If that comes to pass that will be the third straight quarter of 3% growth or better.

- The gains were broad-based as well with 10 of 13 categories showing growth during the month. In addition, this report is mostly goods-based, and we know the economy has been driven more by the services-side so that adds to the positives from the report. The more comprehensive spending numbers will come on January 31 with the Personal Income and Spending report which encompasses more of the service-side spending.

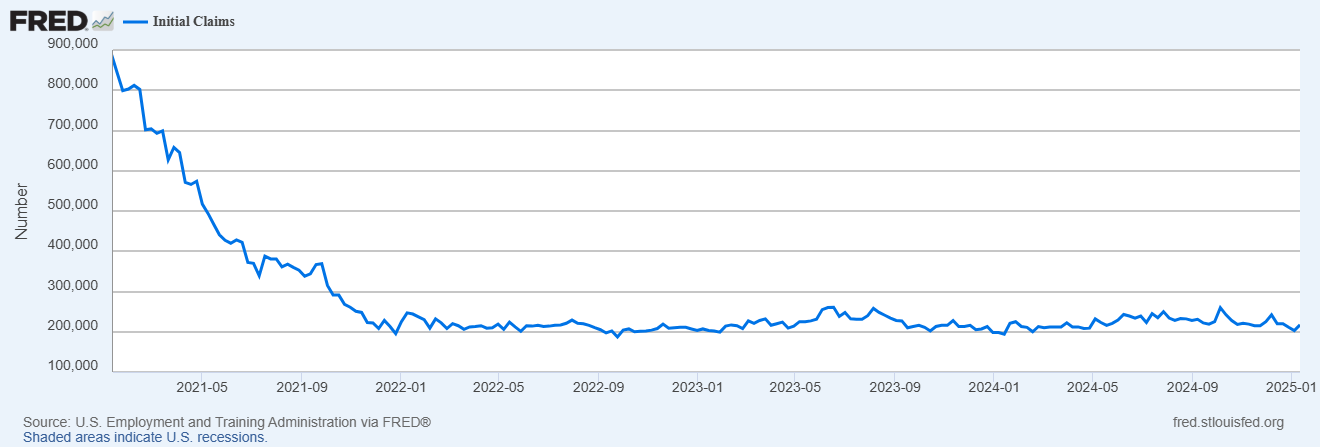

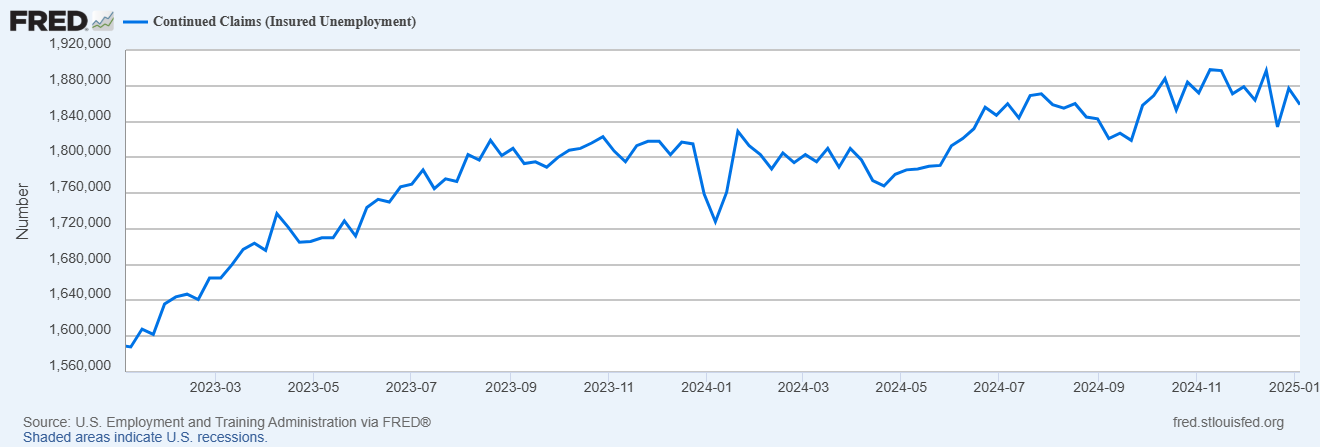

- Other numbers from yesterday were initial jobless claims and continuing claims which continued recent trends indicating low levels of layoffs while continuing claims edged lower indicating re-hiring was picking up from a slightly slower pace over the past few months. Weekly claims for January 11th came in at 217 thousand vs. 203 thousand the prior week, while continuing claims edged lower from 1.867 million to 1.859 million. As long as layoffs remain low, the Fed will feel comfortable taking time to wait for lower inflation numbers.

- Arguing against an improving inflation picture were the December Import/Export prices which both rose more than expected but not by large margins. Import prices rose 0.1% when a decline of 0.1% was expected. Export prices rose 0.3% vs. 0.1% expected. While not as important to the inflation picture as CPI/PPI it will add a bit of a headwind to the improving inflation picture, and this is before any changes in tariff policies happen.

- With the inflation information in hand, estimates for the Fed’s preferred inflation gauge, core PCE, are estimated at 0.18% or a “low” 0.2%. That would be a friendly number to the market and the Fed, but the improvement is likely to be grudging, at least early in the year as seasonality usually tends towards hotter inflation prints in the first quarter. That was the case last year when we had three straight months of core CPI at 0.4%. If we can print 0.3% or lower that will allow the YoY rate to probably drift into 2-handle territory.

- While we expect seasonality to be at play again this quarter, OER and core services-ex housing are lower than this time a year ago and that should provide the basis for some marginal improvement in the typically challenging first quarter. So, we remain guardedly optimistic that a mid-year rate cut remains a distinct possibility, and that with more favorable inflation seasonals in the second half of the year, a second cut could come late in the third quarter, or in the fourth quarter.

- Trump’s nominee for Treasury Secretary, Scott Bessent, handled his Senate confirmation hearing yesterday without too many hiccups. It’s expected he will pass through the entire Senate by a wide margin. He did mention that not extending the 2017 tax cuts would lead to “economic calamity” which seems a bit hyperbolic to me, but who am I to question a Treasury Secretary-Nominee?

- Housing starts and permits finish the data for this week with December starts coming in at 1.499 million annualized vs. 1.327 million expected. That’s a whopping 15.8% improvement from November’s results but 4.4% below December 2023 starts. Meanwhile, permits totaled 1.483 million vs. 1.460 million expected and a 10k decrease from the 1.493 million in November.

- Last but not least, I sat down this past week with Joe Keating in our Wealth Management Group to discuss his outlook for 2025. Joe has been our go-to economist for years, especially back in the legacy CenterState Bank days. I’m sure you’ll find the discussion interesting and informative. You can listen here.

Retail Sales YoY Shows No Signs of Slowing

Initial Jobless Claims Remain Muted

Continuing Claims Edging Lower Indicating Re-Hiring Time is Stabilizing

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.