Late Financial Commentary Revives Hopes for a 50bp Cut

Late Financial Commentary Revives Hopes for a 50bp Cut

- Treasury yields are lower this morning as the last of the week’s inflation numbers hit with August import/export prices cooler than expected, and late-breaking financial commentary that said the 25 or 50bp decision will, in fact, be a close call. So, the uncertainty is likely to carry into next Wednesday’s decision which should keep Treasury bids alive and well until we hear from Powell and Co.. Currently, the 10yr is yielding 3.65% down 3bp on the day, while the 2yr is yielding 3.57%, down 8bp on the day.

- The reports this week all seemed to point towards a 25bp rate cut next week. Then former NY Fed President Bill Dudley, in a speech in Singapore, said there is a strong case to cut 50bp which would help to stabilize labor markets more quickly than an initial 25 bps cut would do. That was followed by a Wall Street Journal article where former Kansas City Fed President Esther George told reporter Nick Timiraos (and noted Fed whisperer) that a larger cut early in the process is easier than later. The impact of those comments was to boost odds of a 50bp cut back to near 50% when they were languishing in the teens yesterday. Timiraos was quick to add that other Fed officials are still leaning towards a 25bp cut as a larger one would condition the market to expect them at future meetings. Of course, the Fed could provide a larger cut but temper expectations that each rate decision is a stand-alone exercise based on the data at the time. In any event, it does add a bit more uncertainty to the decision than was the case yesterday.

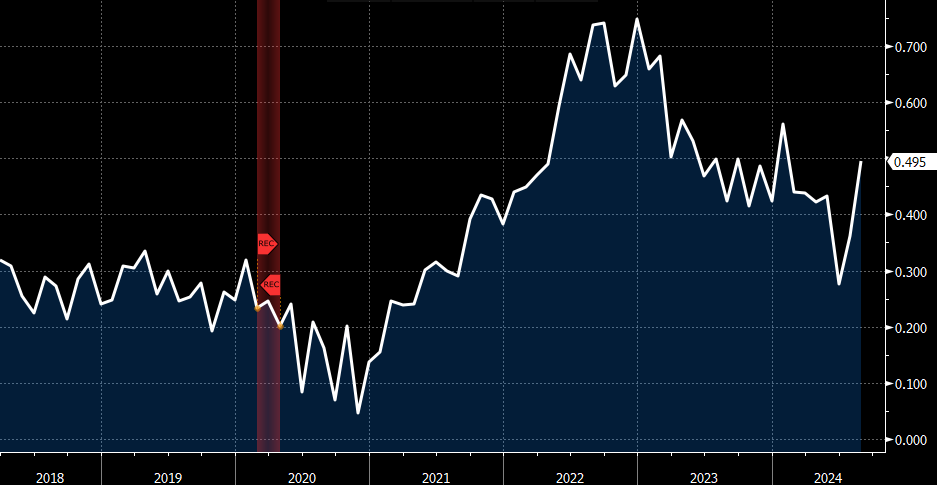

- Coming into this week, it was clear that while the jobs report didn’t settle the 25bp or 50bp rate cut debate, the inflation data this week confirmed a hard lean in the 25bp direction. First, core CPI came in a tenth higher than expected with the usual sore spots: housing and core services ex-housing contributing mightily to the upside miss. The housing miss, however, was baffling. The 0.5% OER print was the highest since January when it looked like the long-awaited rollover was gathering momentum (see graph below). Even after stripping out housing, core services ex-housing was the highest since April. Cue the “more work to be done’ chorus at the Fed.

- Coming on the heels of CPI, August PPI didn’t provide much hopeful news for the 50bps crowd either. While the monthly prints were generally a tenth higher than expected, some downward revisions for July offset that a bit. In fact, Final Demand YoY dipped from 2.1% to 1.7% which was driven by a decline in energy costs. Removing the volatile areas of food, energy, and trade, the YoY print was higher at 3.3%, unchanged from July. But like CPI, the sore spot in PPI was in the services side which increased 0.4% for the month vs. 0.0% for goods. So, while the deflationary story in goods remains intact, the stickiness in services is both a lingering problem at the retail and wholesale level.

- While inflation numbers were thick this week, with the Fed’s renewed focus on its labor mandate weekly jobless claims remained stuck in the low 200 thousand range (230k vs. 228k in July). Claims have been running between 230 thousand and 250 thousand for months now (see graph below) and that was the case again for this week’s claims. Layoffs remain muted as employers remember the struggle in hiring enough staff to handle the post-lockdown demand spike and they don’t want to be left short again should the Fed cut enough to spur a rebound in growth. In fact, recall the jobs report saw an increase in hours worked, and a dip in temporary help layoffs, the two areas employers reach to before firing full-time workers. That implies labor demand isn’t cratering. That’s why we found Dudley’s concerns over the labor market to be a bit overdone.

- Later this morning, we’ll get the preliminary University of Michigan Consumer Sentiment Survey for September and while sentiment is expected to tick up slightly, the Fed will be more interested in the inflation expectations. The 1yr expectation is expected to tick lower from 2.8% to 2.7% while the 5-10yr outlook is expected to be unchanged at 3.0%. The Fed is big on keeping inflation expectations “well anchored” so the stable expectations here will be good and just another reason to cut only 25 bp vs. 50bp.

- The futures market still has 100bp of rate cuts priced in by December and with three meetings remaining that means one would have to be a 50bp cut. We’ll get more clarity next Wednesday with the updated dot plot and Summary of Economic Projections as to whether the Fed is opting for an every-meeting cadence to rate cuts, or the more patient quarter-end pace. We tend to think they would like to stick to 25bp cuts and move to an every-meeting cadence should labor market conditions worsen, then follow that with 50bp cuts if the situation deteriorated further. Again, we’ll get a clearer view of Fed expectations not only for this year-end but next year as well with the updated forecasts, along with Powell’s post-meeting comments.

- The futures market has the funds rate hitting 2.80% by year-end 2025 which would imply 250bp in cuts by then which is considerably more than the Fed’s June dot plot median of 4.125%. Something will obviously have to give between those two outlooks. The first step will be next Wednesday’s Fed update, which is likely to close the gap some but not go all the way to the aggressive futures market pricing. That could leave short-end Treasuries susceptible to some pullback depending on how forceful the Fed pushes back on the market’s forecast.

Initial Jobless Claims Stuck Around 230 Thousand as Employers Resist Laying off Full-Time Workers

Source: Bloomberg

The Rollover in Owner’s Equivalent Rent Reversed in August

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.