Labor Market in September: Don’t Count Me Out Yet!

- The September jobs report surprised to the upside across most measures and seems to argue for a 25bps rate cut in November, at most, but the October jobs report will have the final say on that as it drops just before the November FOMC meeting. September nonfarm payrolls rose 254 thousand vs. 150 thousand expected and 159 thousand in August (revised up from an initial 142 thousand). July was also revised higher by 55 thousand jobs, and that halts, at least for a month, a year-long trend of downward revisions. Meanwhile, private sector jobs increased 223 thousand vs. 125 thousand expected and 114 thousand in August (revised down from an initial 118 thousand). Recall, ADP reported 143 thousand private sector jobs earlier this week. ·

- For a third month in a row, the Household Survey (which generates the unemployment rate, labor force participation, etc.) reported a similar picture as the Establishment Survey. For September, the Household Survey reported an increase of 430 thousand jobs and a decrease of 281 thousand unemployed workers. With both surveys posting similarly strong results, it does increase the comfort level in the validity of the numbers.

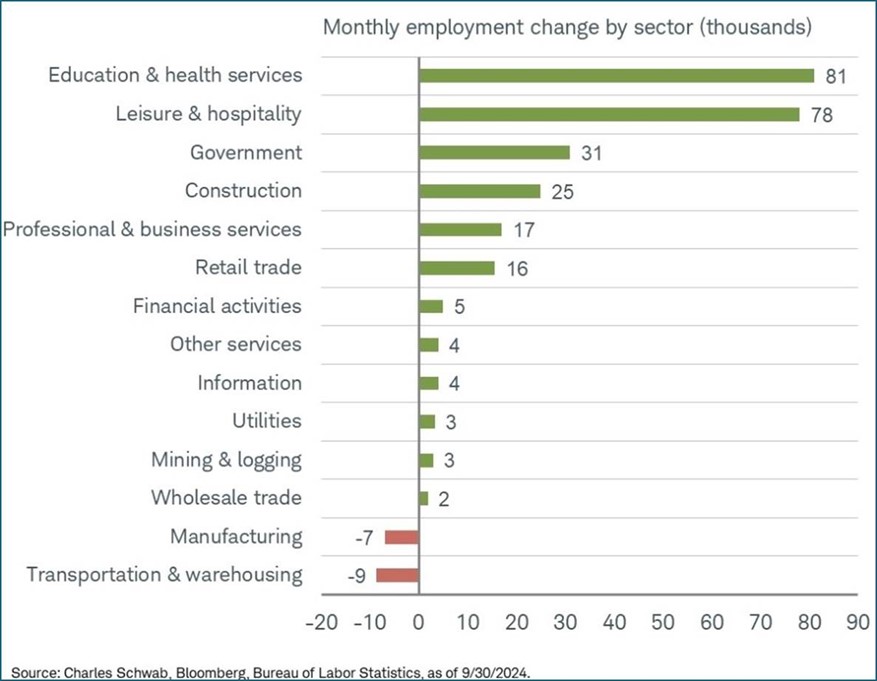

- Job gains were strongest in the usual suspects: leisure/hospitality (78k), healthcare/social assistance (72k), construction (34k), government (31k), and construction (25k). Job losses occurred in transportation/warehousing (-9k), manufacturing (-7k), and for a sixth straight month temporary help services shed jobs, this time 14 thousand. The job loss categories highlight the weakness in the manufacturing side vs. the services side of the economy which in total added 202 thousand jobs in September.

- The unemployment rate surprised by dipping a tenth to 4.1% (4.051% unrounded). The Household Survey reported a decrease of 281 thousand in the ranks of the unemployed but also an increase of 150 thousand in the labor force. Over the past year the labor force has grown by 802 thousand workers. The decrease in the unemployed and the increasing labor force both worked to move the unemployment rate lower. Despite the improvement in September, the number of unemployed persons increased 487 thousand over the last year, but much of that is probably from the increasing labor force with new potential workers still in search of jobs.

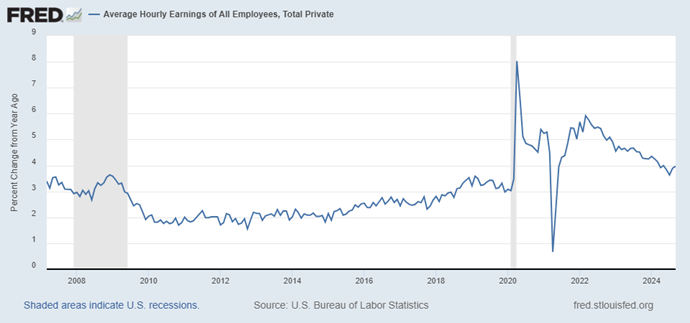

- Average Hourly Earnings rose 0.4% MoM, beating the 0.3% expectation and matching the August gain. The year-over-year pace rose to 4.0%, beating the 3.8% expectation which was the August rate as well. Average weekly hours, however, dipped to 34.2, a tenth lower than expectations and August’s 34.3 hours. Weekly hours peaked at 35.0 a year ago and seem to be settling in the low 34-hour range, which is a sign of moderating labor demand despite the headline beat.

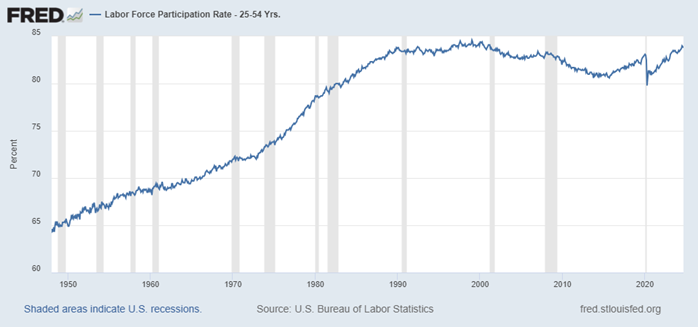

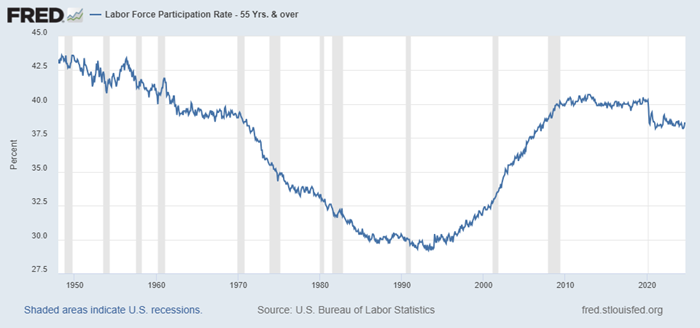

- Despite the increase in the labor force, the Labor Force Participation Rate remained at 62.7%, for a third straight month, and matching expectations. The participation rate a decade prior to the pandemic ranged between 62.5% and 63.0% while the average over the past year has been 62.6%. The prime age (25-54yr old) group saw the participation rate remain the highest at 83.8% vs. 83.9% in August. The participation rate of this cohort remains near the highest in 24 years (see graph below). The somewhat stalled nature of the overall participation rate is more a function of the older cohort (>55yrs) leaving the labor force in increasingly larger numbers and to a lesser degree the 16 – 24yr cohort with many returning to schools and colleges.

- September’s report certainly puts to rest talk of any dramatic slowing in the labor market, although we still see the Fed cutting 25bps in November as the funds rate remains well into restrictive territory. You want some things to pick at? Ok, wage gains improved but hours worked ticked a tenth lower so call that a push. In addition, temporary help losses continued for a sixth straight month, indicating employers are reducing temp help and hours worked before increasing layoffs. The memories of labor shortfalls coming out of the lockdowns remain vivid. While we think a 25bps cut remains the base case, the October employment report will have the last word, as long as inflation offers no surprises in the interim.

- In another sign of reluctance to laying off fulltime workers, initial jobless claims from yesterday remained muted. Claims for the week ended September 28 were 225 thousand, just above the 222 thousand forecast and 219 thousand the prior week. Continuing claims fell too from 1.834 million to 1.826 million, below the 1.830 million forecasts. The next step in labor market weakness will be increasing layoffs, particularly in the services sector, and we’re just not seeing that in claims figures yet.

- Finally, the September ISM Services Index was released yesterday, and while the headline sentiment measure printed at the highest since February 2023, it did see a downturn in employment. The largest, and healthiest, part of the economy remained so in September as the headline reading was 54.9 vs. 51.7 expected and 51.5 in August. However, the employment metric softened from 50.2 to 48.1, the lowest in three months (see graph below). So, it bears watching if the softening employment gathers momentum in coming months. Meanwhile, the new orders metric rose from August’s 53.0 to 59.4, certainly a healthy gain which softens some of the concern over the employment dip. So, while the manufacturing sector remains in the doldrums, the much larger services sector continues to be doing ok, and that too argues for 25bps vs. 50bps.

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.