Labor Market Data Will Dominate This Week

- Treasury yields have been volatile this morning with overnight seeing higher yields, but a bid was found in early US trading and those gains are now back near unchanged as equities ready to open at 9:30am ET. The data calendar is chock full, with the jobs report on Friday headlining the December releases. Meanwhile, the Treasury will be busy auctioning $119 billion in 3yr, 10yr, and 30yr bonds which should keep prices under some pressure as those are put away between now and Wednesday. Currently, the 10yr Treasury is yielding 4.61%, up 1bp on the day, while the 2yr is yielding 4.27%, down 1bp from Friday’s close.

- With the holidays in the rearview mirror, the data deluge of December is now upon us. We got a brief taste last Friday with the ISM Manufacturing Report. it was better than expected but still in contractionary territory. Tomorrow, the ISM Services Report is expected to show continued strength in the services side of the economy (53.5 expected vs. 52.1 in in November). The prices paid, employment, and new orders sub-indices will get attention as well for what they say about inflation, jobs, and activity with new orders.

- Tomorrow, the first of the labor reports will hit with the November Job Openings and Labor Market Turnover Survey (JOLTS). Job openings are expected to be relatively slightly lower at 7.750 million vs. 7.7744 million in October. The job openings to unemployed ratio is one that Powell speaks of often when assessing labor market strength, and with it trending back to near pre-pandemic levels has been one of the early indicators in calling the softening in prior labor market strength. The Quits Rate (% of all workers voluntarily quitting a job), ticked up in the last report from 1.9% to 2.1% so that will get some attention as well. The pre-pandemic level was 2.3% and is a measure of worker confidence (or lack thereof) in voluntarily leaving one position for another. It rose as high as 3.0% in 2021 when the labor market was rebounding off Covid lockdowns and labor shortages abounded. It’s another important measure for the Fed in assessing the direction of the labor market.

- The December FOMC minutes will be released on Wednesday and given there was a dissent in the vote to cut 25bps the discussion about that decision should make for some interesting reading. No doubt there was increased concern about inflation improvement stalling, and with some members building in higher inflation estimates stemming from Trump’s proposed policies, that discussion too should be of interest in refining estimates for future policy decisions.

- The big report, or course, will be Friday’s December jobs numbers. Expectations are for a solid report with 158 thousand new jobs and the unemployment rate remaining unchanged at 4.2%, and average hourly earnings slipping from 0.4% to 0.3% MoM and unchanged at 4.0% YoY. If those results come to pass it will provide more cover for the Fed to pause in January as they are widely expected to do.

- Finally, with longer-end yields approaching highs from 2024 and 2023, the Treasury will be auctioning a trio of coupon issues this week. $119 billion in total issuance will be sold between now and Wednesday with 3yr notes today, 10yr notes tomorrow, and 30yr bonds on Wednesday. That supply should keep pressure on yields, but with the 30yr yield approaching the highest levels since 2023, buyers should find the current yield levels attractive.

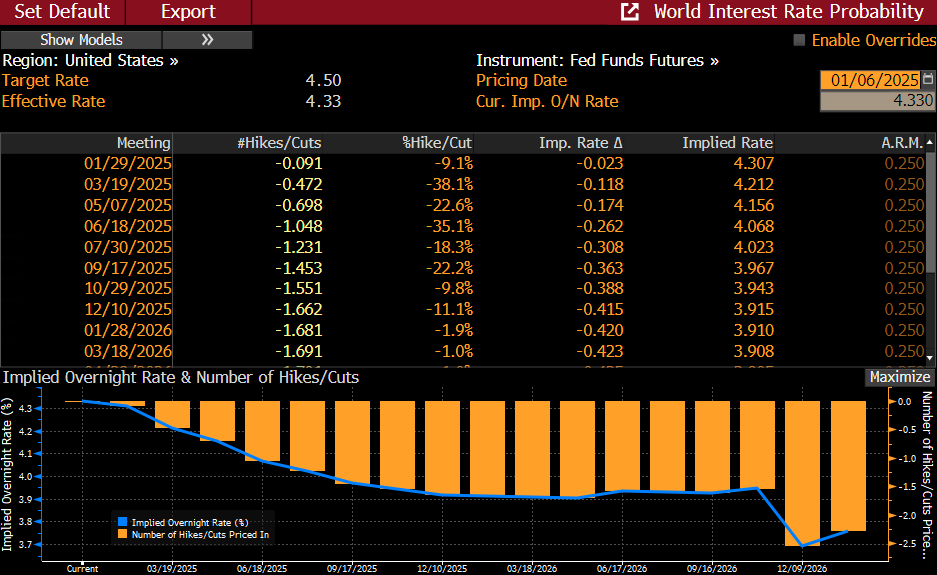

Futures Continue to See First Rate Cut in June but now Only 42bps in Cuts for all of 2025

Source: Bloomberg

Job Openings Per Unemployed Persons Back to Pre-Pandemic Levels Signaling Labor Market Cooling

Source: Bloomberg

30Yr Treasury Yield – Highest Since October 2023

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.