June PCE Comes as Expected Keeping Hopes for a September Rate Cut Alive and Well

June PCE Comes as Expected Keeping Hopes for a September Rate Cut Alive and Well

- Treasury yields are lower this morning on the back of another positive read on inflation, this time it was the Fed’s preferred PCE inflation series. While coming in mostly as expected, it continues the theme of cooler inflation readings since May and will keep alive hopes for a September rate cut. Currently, the 10yr note is yielding 4.21%, down 5bp on the day while the 2yr is yielding 4.39%, down 6bp on the day, and the lowest since early February as a September rate cut continues to get baked into yields.

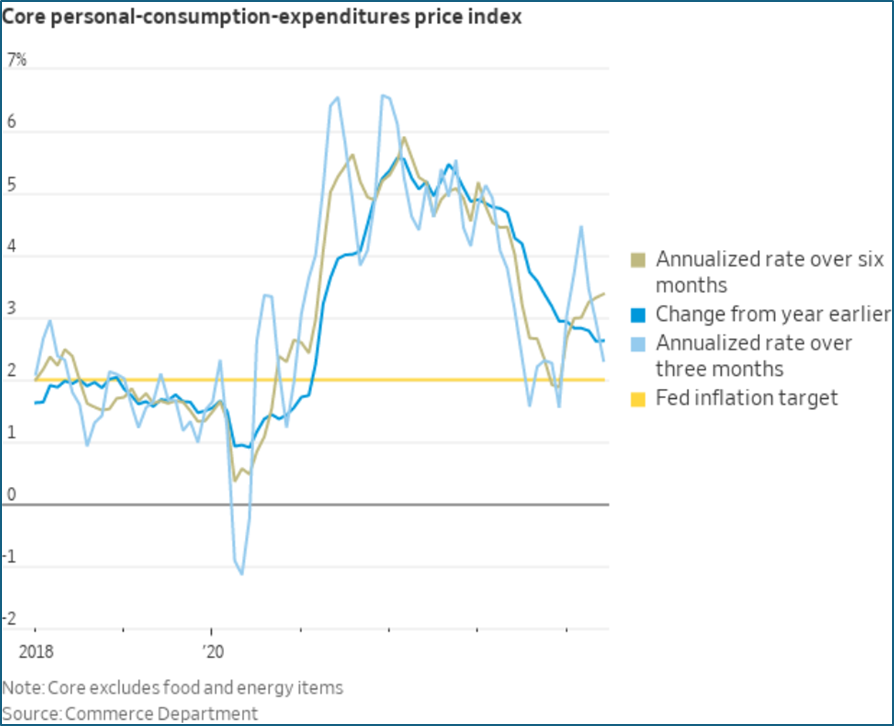

- The highly anticipated core PCE inflation reading for June came in at 0.2% (0.18% unrounded), matching expectations, but the YoY rate held at 2.6%, tying it for the lowest reading in three years. We’ve been mentioning for a while the second half of 2024 will get more challenging for improving YoY rates and we’re seeing that here. Meanwhile, the 3-month annualized rate slowed to 2.3%, the lowest this year. Also, the so-called Super Core reading (core services ex-housing) rose just 0.19% vs. 0.18% in May keeping it near the lowest reading since August 2023. The cool inflation read follows similar reports from June CPI and PPI and will keep the high odds for a September rate cut firmly in place. Overall PCE rose 0.2% (0.18% unrounded) vs. -0.1% in May (which was revised lower from an initial 0.0% unchanged reading). That dropped the YoY rate from 2.7% to 2.5%, just above the 2.4% expectation.

- Personal spending for June came in at 0.3% MoM, matching expectations while May was revised up from 0.2% to 0.4%. Real spending (net of inflation) rose 0.2%, missing the 0.3% expectation, and below the 0.4% pace in May which was revised up from 0.3%. Recall, the retail sales series for June was better-than-expected and the solid results here, which are more comprehensive, confirm a consumer who continues to come through month after month with just a bit of a breather in June.

- Personal income for June rose 0.2% MoM, missing the 0.4% expectation, and May was revised lower from 0.5% to 0.4%. After a pop of 1.1% in January, income gains have oscillated between 0.2% and 0.4% which works out to a YoY rate just under the 3.9% Average Hourly Earnings gain from the June jobs report. That implies wage gains continue to moderate and are approaching the 3.5% or so target at the Fed. That moderation in wage gains will also play well with an expected September rate cut.

- In addition, we did receive the first look at second quarter GDP yesterday, which all of today’s numbers are a part of, and the report generally beat expectations. Second quarter GDP came in at 2.8% vs. 2.0% expected and well above the first quarter’s 1.4% growth rate. The pick-up in GDP was driven by personal consumption which bumped up to 2.3% vs. 1.5% in the first quarter. Growth was also helped by inventory build which added 0.8% to GDP. Backing out the more volatile inventory, international trade, and government categories, final sales to private domestic purchasers increased 2.6%, same as the first quarter and a solid result to be sure. The softer income, however, did drop the savings rate to 3.4% the lowest since December 2022. That could signal some slowing in consumption in the months ahead, but the consumer has shown quite the resilience in finding ways to fund their spending habits.

- Also from yesterday’s report, the quarterly inflation series was a tad hotter-than-expected with core PCE coming in at 2.9% annualized vs. 2.7% expected but that was much improved from the first quarter’s 3.7% annualized rate. It looks like the slight upside miss came from May which was revised higher in today’s PCE figures from 0.13% to 0.18%.

- In all, the Personal Income and Spending report for June was close to expectations and should do nothing to dissuade the Fed from targeting a September rate cut. The miss on income and the downward adjustment in May led to the decrease in the savings rate to the lowest in 2.5 years, which may weigh on the consumer’s ability to continue spending at their recent pace, but as we’ve said before calling for the demise of the consumer has been a losing trade for a year or more.

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.